This story was originally published on February 17, 2019 and has since been updated.

THE SOONER YOU START CRAFTING A FINANCIAL PLAN, THE BETTER YOUR CHANCES OF HAVING A LIFETIME OF FINANCIAL SUCCESS.

Have a 401k? Are you putting your dollars into an IRA? Do you know the 50-30-20 rule? You want to set out on your own, buy a house, plan for retirement? There's no time like the present to give yourself the present of a future. So let's talk money, honey.

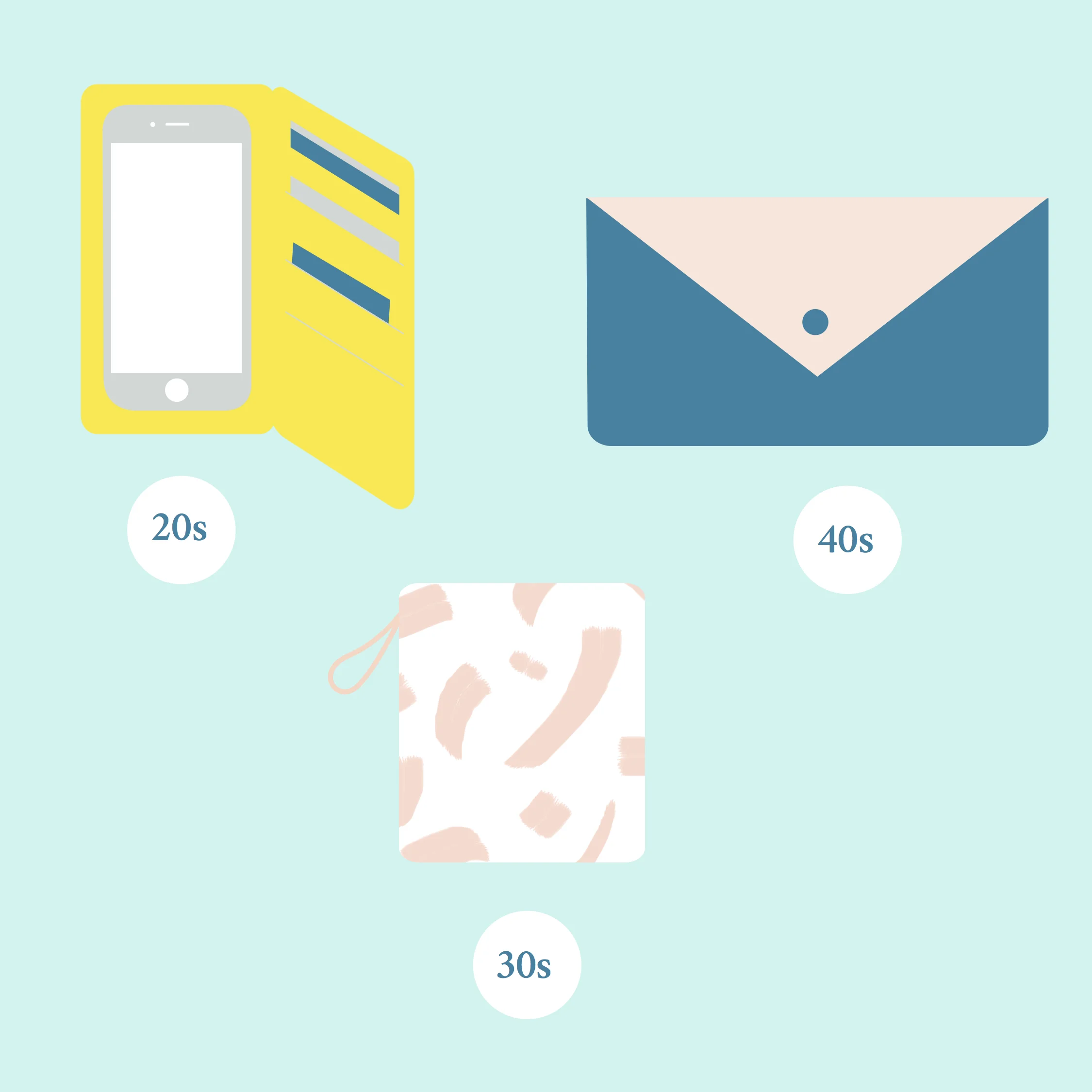

YOU'RE TWENTY? WELCOME TO ADULTING.

No longer a teen, no longer relying on your parents to bail you out of tricky financial situations, and perhaps paying for your own health insurance. Your twenties are when you first really start to understand the inner-workings of earning, saving, and planning for your future. Especially since you're facing down an overcrowded job market and some oh-so-painful student loans. The Class of 2015 is the most indebted in history, the average student owing $35k, and many others taking out second loans for grad school.

In order you prep for a secure future, in your twenties you should focus on saving-- and that means living below your means. You might be tempted to blow that first big(ish) paycheck, or YOLO it for a bit, but if you're dropping dollars you don't have and racking up hefty credit card debt, you're screwing yourself. Forget FOMO, you should be more concerned with FOMRO (fear of money running out.)

Forget FOMO, you should be more concerned with FOMRO (fear of money running out.)

Tweet this.

1. PAY YOURSELF FIRST. You've heard of treat yo'self. This is pay yo'self. This catchy tagline is intended to encourage saving. Even if it's a small amount every week, you need to start putting money away. Here's a tip: If you're using cash and you break the bill, deposit the rest of the amount into savings.

2. YOU NEED AN EMERGENCY FUND. If you lose your job, get sick, or are unable to work, financial planners suggest having an emergency fund that can cover a month's expenses. That way you're not dragging yourself into debt when you're already down.

3. LEARN THE 50-30-20 Rule.50 percent of your income should cover needs like rent, food, and transportation costs. 30 percent should cover things you want like night's out with friends, the occasional trip, maybe a new pair of shoes. 20 percent should be put away. This doesn't always work out every month, expenses pop-up, but you should be tracking your finances too see how close you're hitting the goal.

4. STOP GETTING PARKING TICKETS. You need to be financially responsible now and stop wasting money. If you have a pile of unpaid parking tickets in your glove box, it's time to take a good hard look in the mirror and at those parking signs.

5. START SAVING FOR RETIREMENT NOW. If it sounds crazy, it's not. LearnVest, a financial program that is accessible to everyone, released a study finding that a planner who starts putting $600 a year away at the age of 25 will have $72k by 65.

6. TAKE ADVANTAGE OF 401(k) EMPLOYER MATCHING PROGRAMS. It's hard to think about the "future" when it feels like a distant nebulous blob. And you're first thought at putting money into a 401(k) or similar program might be: I want this money now. However, if you're lucky enough to land a job where your employer offers a contribution-matching 401(k) do not overlook this opportunity. It might mean a slightly smaller paycheck, but it's free money for your future. You'll barely even notice it, but you will notice the chunk of savings you've accumulated by the end of the year.

ALRIGHT, YOU'VE HIT YOUR STRIDE IN YOUR THIRTIES

If you learned how to save and plan in your twenties, in your thirties:

1. ALL OF THE ABOVE RULES STILL APPLY. You need to consistently practice saving-- both for short-term and long-term goals. Want a house? That down payment doesn't come cheap, and to get a bank loan you need to have proven steady income, and cash in the bank.

2. CREATE A DEBT-FREE-BY-40 SCHEDULE. You should also aim to be completely debt-free by the time you hit forty. That way you enter the big 4-0 able to focus on your nest egg instead of those student loans.

Beyond that many of us typically make some very significant financial decisions in our thirties, like buying the aforementioned starter home, or starting a family. You might have more money in your thirties, which means it's prime time to be even more careful about how you spend. It's called lifestyle inflation-- don't get caught in it. When we have money in the bank we feel a little freer to spend on "unnecessaries," which can be dangerous. Treat yourself, sure, but don't treat yourself right out of a comfortable future. Short term pain, long term gain.

"Don't get caught in lifestyle inflation in your '30s. Live within your means."

Tweet this.

3. PAY YOUR BILLS ON TIME. If you're looking into home ownership, you can be sure the bank is looking into you-- and every bill you pay, or haven't. From checking if you've paid your car payments on time and haven't lagged on other bills, to seeing what you spend monthly. If you have creditors chasing you down, you can bet your bottom dollar that those bigger life purchases are going to be impossible to acquire. Good credit is a must if you want a good rate from auto loans to mortgages.

4. START INVESTING. You need mix up your investments by starting a stock portfolio which sets you up for greater financial security in the long run.

5. BUY A COOKBOOK. All that money you spend out eating out in your twenties? It's time to meal-plan in order to financial plan. Americans spend more money on eating out than on groceries. And with apps like Postmates making food delivery a cinch, we're tossing away dollars.

6. STOP BLIND SPENDING. We tend to work longer hours with every passing decade. And the app economy has made convenience very appealing-- but it's at a high cost. Apps like the aforementioned Postmates make it easy to spend without seeing. What the tech banks on is that you're not registering how much you're actually spending. A five dollar delivery here, six dollars there-- in the immediate it seems small, until you realize you've spend 300 the last month of delivery fees. That's 300 dollars you could be putting in savings or an emergency fund.

WELCOME TO FORTY & THE REST OF YOUR LIFE

1. OUT OF DEBT? YOU SHOULD BE, OR CLOSE TO IT. Wild to think about it, but in your forties you're closer to retirement than you've ever been before.

In 2013 data showed that the average female worker in the U.S. retires at 61. You should be as close to out of debt-- especially with those student loans, than ever before.

You shouldn't be paying off your student loans while paying for your kids to go to school.

2. INCREASE YOUR SAVINGS. From your emergency fund to how much you're putting away for retirement. Since the aim for your forties is to be out of debt, you should be able to reallocate those fund into savings. Your life is probably a little more expensive than it was in your thirties and the stakes are a bit higher. So even if you're making more money, that mortgage, cost of kids, and that nicer car don't pay for themselves.

3. MAXIMIZE YOUR CONTRIBUTIONS. Currently, for 2016, the 401(k) and IRA contribution limits are $18k and $5,500, respectively. In your forties you should be maximizing these contributions, especially if your employer matches your donations.

4. START A COLLEGE FUND, IF YOU HAVEN'T ALREADY. If you're planning to send your kids to college, it won't come free or easy. Higher education comes at high costs. According to the College Board, the average cost of tuition and fees for the 2015–2016 school year was $32,405 at private colleges, $9,410 for state residents at public colleges, and $23,893 for out-of-state residents attending public universities. That doesn't include: housing, meals, personal transportation, or books.

MORE FROM OUR BLOG