5 Black Financial Educators Who Are Empowering Us to Take Control of Our Finances

Teaching us how to budget, pay off debt, and more.

Photo: Courtesy of Tonya Rapley

Welcome to 5 for 5, where we spotlight 5 women in 5 minutes or less.

It’s no secret that Black women are not paid fairly. On average, Black women are paid 37% less than white men and 20% less than white women for doing the same work, according to LeanIn.org. But despite the stats, Black women *can* build wealth. Ahead are five financial educators who are advocating for change, empowering women to take control of their finances, and pushing these stats in the right direction.

1. Dasha Kennedy

Dasha Kennedy, a.k.a. @thebrokeblackgirl, doesn’t hold back when it comes to sharing tips for assessing personal debt, reaching a big financial goal, and implementing a financial wellness self-care routine.

2. Tonya Rapley

The “Millennial Money Expert” and founder of My Fab Finance, Tonya Rapley, is on a mission to help 100,000 people make at least one money decision they’re proud of, whether it’s buying a home or saving money on a trip.

3. Tiffany Aliche

Known as @thebudgetnista on Instagram, Tiffany Aliche breaks down big goals like building wealth, paying off a mortgage, and buying a home while paying off student debt into achievable (dare we say simple) steps.

4. Marsha Barnes

The brains behind @thefinancebar, Marsha Barnes is a must-follow for friendly reminders to engage with your finances, adjust your budgeting plan, and start an emergency fund, as well as tips on how to follow through.

5. Jamila Souffrant

The founder of @journeytolaunch, Jamila Souffrant, is all about helping people grow their savings, get out of debt, and gain financial freedom and independence. (Psst… her podcast, Journey to Launch, is a must-listen!)

MORE ON THE BLOG

Making a Comeback: How Perseverance Can Help You Pivot to New Possibilities

This week, on WorkParty.

Listen to the full episode here.

It’s no secret that COVID-19 has challenged small businesses everywhere to rethink the brick-and-mortar business model. With physical retail locations closing and e-commerce on the rise, it's been crucial for small businesses to pivot to digital to weather the pandemic.

By the numbers: Online sales grew by nearly 50% at the peak of the pandemic, and experts are predicting the shift may be permanent. According to a recent survey, 41% of consumers are currently shopping via social media and 51% say they’ll continue to use in-app shopping post-COVID.

Bank of America recently released their yearly survey of small business owners in the 2021 Small Business Owner Report. Their research found that business owners have started to regain their footing as economic confidence, business revenue expectations, and hiring plans bounce back significantly from levels seen in the fall. For example, 50% of SBOs are confident the national economy will improve – up significantly from 37% last fall, and 60% expect their revenue to increase – up even more from 34% last fall.

To address the impact of the pandemic, business owners tapped into various funding sources to stay afloat and made operational changes that they anticipate will continue going forward. More than half of SBOs tapped into funding sources such as personal savings, business credit cards and PPP loans. A majority of SBOs anticipate that the operational changes they made in response to the coronavirus will continue beyond the pandemic – specifically enhancing their sanitation practices and further building a digital sales strategy.

Regardless, entrepreneurship is on the rise—and it doesn’t show any signs of slowing down. Today, nearly 40% of the workforce is made up of freelancers, temps, independent contractors, and solopreneurs, and a growing number of millennials and Gen-Zers are becoming solopreneurs—61% of independent millennials are planning to stay independent as solopreneurs.

So, how do you successfully lead your business through COVID-19? How do you turn a seemingly insurmountable challenge into an opportunity? And how do you start planning for the “new normal” when the future is still unwritten?

On this episode of WorkParty, Jaclyn sits down with Ellen Marie Bennett, the founder and CEO of Hedley & Bennett, the leading Los Angeles based culinary workwear brand, to answer these questions and discover what it takes to weather the storm, and outfit hundreds of thousands of home cooks all over the world. Join the party on social @workparty and stay in the know at workparty.com.

Subscribe to WorkParty

and never miss an episode.

MORE ON THE BLOG

Attention, Self-Employed Bosses! Here Are 4 Tips for Budgeting on a Variable Income

Money mindset is everything.

Photo: ColorJoy Stock

During my first month as an entrepreneur back in December of 2018, I made $226 as an administrative assistant. Fifteen months later, I would go on to quit my day job and make upwards of $5,000 a month as a freelance writer and content creator for Rosetta Stone.

While I had excitedly waited to get to this point, it was still hard for me to give up the financial security of my day job. Without corporate perks like PTO, health insurance, and automatically deducted taxes, I suddenly had to make sure I had enough to get through the expected—and unexpected—costs each month without the help of a regular paycheck.

As an entrepreneur or freelancer, it is completely normal to have an irregular income, but it can definitely make budgeting your money a little trickier. Luckily, after a lot of trial and error and some helpful advice from a top-notch financial coach, I can finally say I’ve figured out how to budget with a variable income. Since this is something I wish I had known years ago, I decided it was time to share with my fellow business owners!

1. Calculate Your Monthly Needs

Before taking control of my budget, I had no clue how much I really spent per month. Like most young business owners, in my first two years of business, I was pretty much taking whatever job I could get—mostly because I just needed to get my bills paid. Never really knowing how much to expect from month-to-month, I ignored my bank account completely.

Every month I would just cross my fingers and hope I wouldn’t get an “insufficient funds” notice from my bank. But, this method led to a lot of extra stress and negative emotions around money.

So, one day, I sat down and went through my last three months of bank and credit card statements and looked at how much I had been spending on necessities. This helped me figure out how much I really needed to be making each month to get by. Some common needs within a personal budget include things like:

Rent

Utilities

Groceries

Gas (only for required outings)

Debt repayments (minimum required payment)

Phone

Personal care (toiletries, medicine, etc.)

Insurance (car, life, etc.)

Essential family expenses (childcare, clothing, etc.)

I also included the needs I had for my business. Some common business needs within a budget include things like:

Employee/contractual worker wages

Website hosting

Email hosting

Insurance (health, business, etc.)

Public relations

Marketing/advertising

Business-related debt repayment

Travel

Taxes

Business-related software (accounting, email management, website building, social media marketing, SEO, project management, CRM, communication/messaging, etc.)

Business-related hardware (computers, phones, printers, etc.)

And this isn’t just what I learned from personal experience. When I sat down with financial coach Yvonne Tran for one of my podcast episodes, she echoed this sentiment as well. “If you have variable income my biggest tip would be to know how much you need to pay every month for expenses or bills and make that a goal to bring in every month in your business,” Yvonne shared.

2. Reset Your Money Mindset

Like it or not, we all have certain ideas about money. Whether you grew up hearing “money is the root of all evil,” “a penny saved is a penny earned,” or any other common money-related beliefs, our society has a lot of positive and negative associations with money.

Having grown up in a family of entrepreneurs, money struggles—and the negative money mindset that comes with them—were no stranger to me. For a long time, money was something that I considered stressful and even dirty. It wasn’t until I learned to see money as a tool and something to be grateful for that the money really started flowing.

“Money mindset is definitely really important because if you view money as so stressful, super complicated, and intimidating then I can show you all the ways that you can fix your financial situation, but if your mindset is telling you ‘no’ then it’s not going to work out in the end,” Yvonne told me.

A few ways you can reset your money mindset are:

Using positive affirmations around money (and putting them everywhere!)

Learning to give money away without fear

Evaluating your beliefs around money

Actively fighting off any negative thoughts about money

Fostering gratitude in every transaction

3. Cultivate Healthy Money Habits

Creating a strong budget and resetting your mindset creates a strong foundation for making good financial decisions, but keeping up with those good financial decisions means you have to cultivate healthy money habits too. Some healthy money habits that could help keep your budget on track are:

Downloading a money-tracking app like Mint

Spending with gratitude, not fear by using affirmations like, “I am grateful for all that money brings me,” or “I am grateful that I can contribute my money to the economy/this cause/this person,” when spending money

Setting financial goals each quarter

Waiting 24 hours before buying “wants” to avoid impulse purchases

Saving 20% of your income for the unexpected

Yvonne is a big proponent of saving, especially when you have a variable income. “If you happen to have a short month one month and not bring in as much as you need then hopefully you’ll have that extra savings already set aside,” she shared. “That way, that can come in to fill the gap for that month, and then you’ll just work harder next month to bring in more money.”

4. Re-Evaluate Your Budget Each Month

If you have a variable income it is best to evaluate your budget pretty frequently. By re-evaluating your budget more often, you’ll have a better handle on your money as your income changes.

Since I can usually predict my income for the next few months, I tend to re-evaluate my budget each quarter, but monthly works great too. Here’s the method I use: first, I calculate how much I’ll be making over the next three months. Then, I divide that up to give myself a general monthly budget. Finally, I calculate all of those personal and business needs we talked about earlier.

Next, I subtract my needs from my income and I use that final number as my budget for the month. I’ll usually take out a percentage for savings, but the rest I let myself spend freely. Some people prefer to take their savings directly out of their income, but it makes me feel better knowing everything else is taken care of first. This works well for me because on good months I can splurge on certain items, whereas on not-so-good months I have to reign myself in a little bit. But either way, it gives me a concrete number to focus on each month.

There are hundreds of ways to budget your money, but the best budget is the budget that works best for you. I tried a lot of budgeting methods before I found one that really worked for me, so don’t get discouraged if you struggle a little bit. For me, once I changed my mindset around money everything changed, so I would definitely suggest digging into your own stories around money before getting started. Happy money-making!

“There are hundreds of ways to budget your money, but the best budget is the budget that works best for you.”

—Calli Zarpas, Founder of the Do Well Department

About the Author: Calli Zarpas is the founder of the Do Well Department, a holistic business program created to help overwhelmed business owners cultivate a business and life they love. When Calli isn’t running her community, she’s writing her weekly newsletter and hosting her podcast called Unstrictly Business, all about how successful business owners foster success in both their business and personal lives (Yvonne’s episode is an awesome place to start!).

Love this story? Pin the below graphic to your Pinterest board.

MORE ON THE BLOG

The Entire Beauty World Is Watching This Zero-Waste Haircare Brand Started by Two Industry Veterans

And these co-founders are just getting started.

We know how daunting it can be to start a new business, especially if you’re disrupting an industry or creating an entirely new one. When there is no path to follow, the biggest question is, where do I start? There is so much to do, but before you get ahead of yourself, let’s start at the beginning. To kick-start the process, and ease some of those first-time founder nerves, we’re asking successful entrepreneurs to share their stories in our series From Scratch. But this isn’t your typical day in the life profile. We’re getting into the nitty-gritty details—from writing a business plan (or not) to sourcing manufacturers and how much they pay themselves—we’re not holding back.

Photo: Courtesy of Everist

As alums of major beauty brands including Revlon and L’Oreal, Jessica Stevenson and Jayme Jenkins saw from the inside that the beauty industry has a major plastic waste problem. “Before we even had a business plan or a product idea, we were committed to finding an innovative way to solve that problem,” Jenkins tells Create & Cultivate. “We had multiple aha moments or pivots along the way including, Why are we shipping large, heavy beauty products full of water and excess packaging around the world? Why do we need water in haircare when we’re already showering in water? We just knew there had to be a better way.”

And, as the co-founders of Everist, a zero-waste haircare brand, it’s safe to say Stevenson and Jenkins have indeed found a better way. The brand’s inaugural products, a Waterless Shampoo Concentrate and a Waterless Conditioner Concentrate, boast silicone-, sulfate-, and preservative-free formulas made without any water and 99.7% pure aluminum recyclable packaging. The brand also uses recycled packaging for shipping, opting out of any plastic packaging and shipping materials, and has partnered with Climate Neutral to offset carbon emissions.

Ahead, the co-founders tell Create & Cultivate how they launched an industry-disrupting haircare brand, including the mistakes they’ve learned from along the way.

Can you tell us a bit about your background and what you were doing professionally before launching Everist?

JESSICA & JAYME: We’ve both spent over a decade in the beauty industry in various roles and categories, most recently as a general manager (Jessica) and a VP of marketing (Jayme) for the beauty brands Nude by Nature and The Body Shop, respectively. Prior to that we both led marketing for some of the top brands from L’Oreal to Revlon and learned from some of the brightest minds in their fields.

Did you write a business plan? If so, was it helpful, and if not, what did you use to guide your business instead and why did you take that approach?

JESSICA: We did eventually when we had narrowed down the idea, but in the beginning, we cycled through dozens of different concepts and did an exploration to see if they made sense. Was it profitable? Scalable? Was it even possible to bring to market? Was it a product or service that we would personally use? It took us a while to zero in on the right idea. Once we had our winning concept we did write a thorough business plan to give our early investors confidence in our idea and approach. It served as a great starting point, but things are constantly changing in startup-land and you need to stay flexible throughout the whole process. We view our models as live working tools to strategize vs a one-time exercise.

Photo: Courtesy of Everist

How did you come up with the name Everist? What are some of the things you considered during the naming process?

JAYME: We wanted a brand that would be named after our customers; they are the Everist. They are the ones making small eco-conscious choices in their daily lives that together add up to a big impact. We exist to help them by making eco easier and without compromise. We also wanted a name that didn’t sound too “crunchy” but had the connotation of mindful consumption; an Everist thinks about their forever impact on their two homes: their body and our planet.

What were the immediate things you had to take care of to set up the business?

JESSICA: We had to have a chemist and a manufacturing partner to help us create the product first (which ended up being a very long process since we had such a “blue-sky” brief). We also needed to find a sustainable packaging partner. Once we made some headway on that, we got started on our incorporation, trademark, domains, social handles, and in our case, patent process.

What research did you do for the brand beforehand, and would you recommend it to other founders?

JESSICA: Coming from the industry, we did bring with us a great deal of knowledge to set a solid foundation. Although not essential, starting in a space where you already have some expertise, will give you a good head start. From there we did do a thorough competitive analysis and whitespace mapping, followed by continuous formula experimentation and business model profitability analysis to ensure our idea was viable to scale. In the end, the most important advice we can give is to always start with a large enough customer need and quickly test a bunch of solutions to find the one that best meets that need for market fit versus developing a product and trying to force-fit it to a customer.

How did you find and identify the manufacturers that you work with? What was important to you during this process, and are there any mistakes you made and learned from along the way?

JAYME: We wanted a manufacturer that was local for environmental reasons and also so we could be very involved in the process. We wanted a partner that believed in our ideas and was committed for the long run to help us bring them to life. It’s not always easy, but a strong partnership can help you move mountains.

How did you fund Everist? What were the challenges and what would you change? Would you recommend your route to other entrepreneurs?

JESSICA: We started self-funded, like many entrepreneurs, as we were solidifying our idea, but we soon realized we would need more investment for inventory, brand building and to scale quickly. We attended events and casually met as many people as we could to learn and develop relationships. During one of those events, we were lucky enough to find the right strategic partner to lead our pre-seed raise and bring on other like-minded investors who could add value and believed in our long-term vision. To us, the right strategic fit was everything, especially early on as you need to have people on board who believe in you and support all the twists and turns that will inevitably come.

Do you pay yourself, and if so, how did you know what to pay yourself?

JESSICA: We don’t currently pay ourselves, but we plan to after launch. This is a personal decision based on both the founders’ and the company’s financial position and equity growth prospects. Cash flow is the company’s lifeline, so we will definitely not be taking our past corporate salaries, but enough to cover some living expenses. However, as the company grows, we do believe in founders taking a reasonable salary for their position.

How big is your team now, and what has the hiring process been like?

JESSICA: We are currently a small team of two who have embraced the gig economy and have brought on amazing freelance and vendor partners to help us scale while remaining flexible at this early stage. Most of our partners have been brought on through research and referrals. That said, we are both seasoned people managers coming from big beauty and believe in developing diverse talent for long-term success. Therefore, we look forward to growing our team soon!

Did you hire an accountant? Who helped you with the financial decisions and setup, and are there any tools or programs you recommend for bookkeeping?

JESSICA: Since we are both business grads, we had a baseline of knowledge to build our own financial models and were able to handle our own expense reporting through QuickBooks pre-revenue. However, as we were preparing to launch, we knew we needed to bring on experts to set up a solid foundation for growth. Therefore, we hired an outsourced accounting firm that specializes in bookkeeping and controller services that scale with the needs of the business. Other systems we explored were FreshBooks, as well as inventory management through a system such as SOS Inventory or QuickBooks Commerce. Once you have sufficient scale, a fully integrated ERP platform such as Oracle NetSuite could be useful.

Photo: Courtesy of Everist

What has been the biggest learning curve during the process of establishing your business?

JAYME: Everything? That’s really what’s made this experience so exciting (and at times overwhelming). We have been hands-on in every area of the business where previously we were more specialized or leading a team of specialists. Learning clean chemistry, web platforms, fundraising terms, IP law. It’s been a wild ride.

How did you promote your company? How did you get people to know who you are and create buzz?

JAYME: Our first marketing investment was bringing on a great PR team. We knew that part of our uniqueness was that we had an innovative product with a great story to tell and we wanted to make sure we had help getting it out there. We’re also believers in creating a strong social community, encouraging reviews, partnering with like-minded influencers and brands, developing valuable educational content, and A/B testing digital media campaigns.

Do you have a business coach or mentor, and if so, would you recommend one to fellow entrepreneurs?

JESSICA: We don’t have a formal coach or mentor but have been fortunate to be surrounded by great industry experts, inspiring entrepreneurs, and investors who have also become valuable advisors. It is definitely helpful to have a strong support network around you for your entrepreneurial journey. If that doesn’t happen organically then there are many organizations or accelerators that you can join to connect you with a relevant mentor. However, it can take several tries to find the right mentor-mentee fit, but when you do it can add tremendous value.

What is one thing you didn’t do during the setup process that ended up being crucial to the business and would advise others to do asap?

JESSICA: Register your business name and international trademark early. It’s not necessarily one we didn’t do, but it’s something we hear as a stumbling block all the time. Especially for brands, you don’t want to be forced to change your name after you’ve built up awareness once you find out there is someone else already using the same name in your local market or another important international market.

For those who haven’t started a business (or are about to), what advice do you have?

JAYME: There are a million problems and to-do’s vying for your attention every day, so be laser-focused on what your priorities are and keep moving forward.

What is your number one piece of financial advice for any new business owner and why?

JESSICA: Managing your cash flow is critical. In a past side hustle, I’ve been in the situation that I had to personally finance a retailer PO when I was already deep in student debt. It quickly teaches you how real a cash flow problem can be versus numbers on a financial statement in business school. Make sure you know your burn rate and have a plan A, B, and C to extend whether through self-funding, an equity raise, or a loan. It can also be a good idea to have a working capital line of credit ready as a safety net to cover inventory costs before revenues can be collected.

If you could go back to the beginning with the knowledge you have now, what advice would you give yourself and why?

JESSICA: It will take longer than you expected, so enjoy the process. When a problem arises, get the right people in a room (or virtual room) and keep asking clarifying questions to uncover the root of the problem that needs to be fixed. Then, focus all your attention on the solution as people can be very creative when they are open to new possibilities and stay positive. The end result might look different, but often better if you’re open to it.

Anything else to add?

JESSICA: There are always going to be reasons and risks that can feel like now’s not the right time, but if you’re passionate about your idea—you just have to jump in. Best to ensure you have a solid support system around you and then be as flexible as possible to learn and pivot as you go.

MORE ON THE BLOG

Old Navy's Head of Creative Marketing Says Believing in Your Talent is Key to Success

“Believe in your talent.”

We often look to the iconic leaders of our time for motivation and wisdom, but for many of us, this is purely inspirational and not as applicable to our everyday lives. We truly believe there is more benefit in looking to your left and seeking out a peer-to-peer mentorship with a colleague or friend you admire. Why? Firstly, they will likely have the time to be your mentor, and secondly, their advice will be relatable and allow you to see your path clearly while keeping your mind open to new ideas, identifying new opportunities, and helping you self-advocate. We call them Everyday Superheroes. In this new series, we talk to the people who are paying it forward, lifting others up and paving a smoother path for the next generation to come.

For Dana Marinovich, getting laid off was a fundamental part of her career arc, and a challenge that eventually led to her dream job as the Head of Creative Marketing for Old Navy.

After being let go, she took the summer off to reset and think about what she wanted next. “I gave myself permission to hold space for the change, to really evaluate what I wanted and recalibrate my intentions for the future,” Marinovich tells Create & Cultivate. “After a few months, I was reenergized, refocused and was able to set clear goals for myself that were true to who I am and what I want in my life, instead of being swept away with what was expected next.”

Now, as the Head of Creative Marketing at Old Navy, Marinovich leads a team of creative directors, writers, art directors, graphic designers, stylists, and photographers to help bring the brand’s vision to life through the creative in all channels. And with millions of people engaging with Old Navy each day, it’s safe to say that Marinovich’s work touches a lot of people.

Read on to hear how she went from agency world to in-house at Old Navy, how she finds the inspiration to create killer brand campaigns, and why believing in your talent is key to your success.

What did you study in school? And what did you want to be when you grew up?

I did not ever think that I would be in a creative industry when I was young. I grew up with a focus on math, science and literature. The closest thing to being creative that I could imagine, was to grow up to be an architect. So for a long time I thought that’s what I wanted to be.

While in college, I majored in Art and Design, with a focus on graphic design. I also studied Painting and Photography at Chelsea College of Art and Design and Central St. Martin’s. Through those programs I fell in love with art, with critical thinking and this truly changed and solidified my focus.

What are some of the earlier jobs that helped to shape your career path?

After college, I moved to NYC and one of my first jobs was working for a (then) small agency, YARD. What I learned there was invaluable in how to approach a creative project for a brand. At that time, most of the agencies were either branding or advertising focused. But YARD was doing something different - they were a creative agency that bridged the two and built the work with a solid strategic ground. It was all the things, intertwined - and I was inspired by this approach. So early on in my career, I realized how much I loved to build brands holistically… and to build a thriving brand you need great creative strategy, a killer voice, and image and branding that elevates it. This period of time was like bootcamp in creative thinking, iterating and pushing limits. It was really really hard, and I will forever be grateful for it.

“Do one thing at a time. Put space between things. Develop Rituals. Think about what is necessary.”

What challenges have you faced along the way? What did you learn from them? How did they prepare you for your job now?

The biggest challenge I have ever faced is being laid off. I don’t think people talk about this enough transparently, like it should be a secret. Like there is stigma around losing your job. I have worked in retail or for retailers for a long time now, and the business is just volatile. There will be really high highs and really low lows. Some businesses can withstand the test and others are not so lucky. You have to ride the wave - and know that it will fluctuate.

When I was let go, I took the summer off to reset and think about what I wanted next. I travelled and spent a month abroad in Croatia with my family. I gave myself permission to hold space for the change, to really evaluate what I wanted and recalibrate my intentions for the future. It was honestly the hardest and best time for me in my career building. After a few months, I was reenergized, refocused and was able to set clear goals for myself that were true to who I am and what I want in my life instead of being swept away with what was expected next. It was a relief, like I finally took back control of what my days were.

Tell us about your role. What does it entail? Did you work your way up? What were the positions along the way?

As the Head of Creative Marketing at Old Navy, I lead and get to work with a diverse creative team. My role is to develop a clear creative vision of the brand that people can relate to and want to connect with. Old Navy is a brand for everyone, for families, for your friend family, for your community. It’s inclusive by nature. And we bring the brand to life through a lens of fun, fashion and making the most of life together.

To get to this position, I both worked my way up and worked sideways. As I mentioned, I started my career in advertising in NY, but when I moved to CA , I came in-house at Gap. This was years ago, and I moved my way up at that brand - starting as a Global Art Director (which meant I would translate the North America creative for Europe, Japan and franchise partners), but quickly after starting, some of the leadership team left, and I was promoted to lead the internal creative team. I worked on many things during this time - and wound up pitching against our agencies and took back in-house the kids, baby and body advertising work. It was fun, we even pitched against agency work for the Diane von Furstenburg x GapKids campaign work - and won the pitch. At the time, it felt like a big deal, the internal team was so motivated and we were so happy to be doing the work that we were doing. We had a lot of fun.

After a few years I moved on to be the Vice President of Creative at a small kids and baby clothing company called Tea Collection. I was there for about five years and helped solidify the creative look/feel and voice for the brand. And then I came back to Old Navy and was just promoted this past Spring to the Head of Creative Marketing role.

What do you love most about your job and why? Does the reality of your career match up to your expectations? Why/why not?

I love the people I work with, the team is very talented. As the Head of Creative Marketing, I get to work closely with a lot of different voices and I am energized by people’s unique point of views and helping the team grow and the work to push forward.

I love working in-house and getting to actually craft and dream and think about how this brand shows up to the world. The reach of Old Navy is quite breathtaking - millions of people get an email from us everyday, millions hear and see and feel and touch the work that my team puts out there. I love getting to work for a brand that touches so many people. With that comes a big responsibility, and I take that very seriously.

I honestly never would have thought when I started my career that I would get to the place that I am now. Of course, I had drive but where I am today truly came out of determination to always grow as a human. I wanted to do more, and I set my sights on the next and the next and the next. At the level I am at now, more of my responsibilities are in building talent, protecting the creative and pushing to the next. It’s a dream job honestly. Is it exactly what I would have expected in every moment? No -- it’s a hard job! But it is all worth it.

What can you tell us about the company culture? What has encouraged you to stay?

I love working for an organization that champions inclusivity, diversity and fashion for everyone. This year we are pushing this even more. At the end of the summer, there is a big moment for the brand, and women in particular. It’s incredibly rewarding and impactful.

The people and the team at Old Navy is also what keeps me excited every day. I truly care for each of the individuals I work with and together we champion the work we do.

Talk us through your daily tasks and what a day in the office looks like for you. What’s the most rewarding part of your day?

Most of my day is spent discussing creative strategy, reviewing work and concepts and connecting with the creative team. The most rewarding part of the creative process is when the work is hard, when you’ve hit a wall over and over again, but you keep pushing – and then all of a sudden, the light goes on. That breakthrough moment is what it’s all about. It’s so rewarding to personally go through that process, but to also help a team through it – that’s what gets me.

What does your morning pre-work routine look like? What rituals set you up for success?

Well, each day is a bit different. Two days a week, I wake early and work out - this clears my head of stress. I find clarity and a good personal space is so necessary in this line of work. And the other three days, I focus on my other big role - I’m a mom of two small kids. And I love spending the mornings giving them my attention, sitting and having breakfast with them, talking Legos and unicorns, getting them ready and doing school drop off. It’s important for our connection that I show up at school, see and greet other parents and their teachers. It’s a balance and is so important.

For work, I also like to take one morning a week for an hour and plan my priorities. This helps me keep on track and not get swept away with the work.

Your role requires you to be across so many facets of the business—how do you manage your time effectively? What is your greatest productivity hack? How do you get it done?

I’ve recently read an article about the 12 Essential Rules to Live more like a Zen Monk, and found this very inspirational. A few of the rules are: Do one thing at a time. Put space between things. Develop Rituals. Think about what is necessary.

These are things to remind myself, to practice and get better at. Again, I’m always learning and growing. I’m very thoughtful and deliberate in my approach to projects.

Do you ever reach inbox zero? Do you believe in that? What is your inbox philosophy?

I had a dream once I got my inbox to zero. I believe in the power of search.

What is one of the biggest misconceptions about your job?

Being a leader of a creative team is not actually being creative or creating all the time. Often I am researching, reading, reviewing, discussing; I’m thinking strategically, I’m analyzing, editing and then I’m creating.

If someone wanted your role specifically, what advice would you give them on how to land their dream job/your current job?

Stay hungry. Love what you do. Be a team player. Understand you are only as good as the sum of your parts. Learn from your failures.

“Stay hungry. Love what you do. Be a team player. Understand you are only as good as the sum of your parts. Learn from your failures. ”

Have you seen a consistent standout quality or personality trait of successful people in your industry?

Confidence, transparency, honesty, and straightforward in nature, and people who like to have fun.

What’s the best piece of advice you’ve been given? And what’s the worst piece of advice you’ve been given?

Best: “Believe in your talent.”

Worst: “You need to diversify. So, let’s have you work on this pitch for a fast food account.”

If there was one person you admire that you could power brunch with, who would it be?

Dolly Parton!

The Best Out-of-Office Emails to Use When You Finally Take That PTO

V-A-C-A-Y!

Photo: Kindel Media for Pexels

We all know the sigh of relief we let out once we set that OOO email, but did you really get the message right? Sometimes setting our automatic responses gets confusing and we're not sure what information to include and not to include. But because we want everyone to enjoy more of themselves on vacation and less of their inboxes, we've drafted some messages to use for your next round of PTO days.

How do you set your vacation responders? Let us know in the comments section!

Option 1

Hi there,

I’m away on an island somewhere taking some much-needed me-time. Please contact [NAME] at [EMAIL] during my absence as my phone is on “do not disturb.”

Sincerely,

[NAME]

Option 2

Hi there,

I am currently out of office and will be returning on [date]. In the meantime, don’t forget to subscribe to [COMPANY NEWSLETTER] and follow us on [FACEBOOK, TWITTER, INSTAGRAM LINKS] for all things [COMPANY NAME].

Best,

[NAME]

Option 3

Hello,

I will be out of office from [date] to [DATE]. During this time I will have limited access to email, so please forgive my delay in response.

Very Best,

[NAME]

Option 4

Hi there,

I will be out of office from [DATE] to [DATE] and on vacation. If this matter is urgent, please contact [NAME] at [EMAIL]. Thank you!

Best,

[NAME]

Option 5

Hello,

I am currently out of office with limited access to email and returning on [date].

For all [SUBJECT] inquiries please contact: [NAME] at [EMAIL]

For all [SUBJECT] inquiries please contact: [NAME] at [EMAIL]

Thank you!

Best,

[NAME]

Option 6

Hello!

I’m currently on island time and not checking my phone. Let’s catch up once I’m back on a 9-to-5 schedule on [DATE]. Thanks!

Best,

[NAME]

Option 7

Hi there,

I am currently traveling and will have limited access to email. I will do my best to respond in a timely manner, but please excuse a delay in my response. If this matter is urgent, please contact [NAME] at [EMAIL].

Best,

[NAME]

Love this story? Pin the below graphic to your Pinterest board.

This story was originally published on July 13, 2018, and has since been updated.

MORE ON THE BLOG

Eunice Byun Started Material as a Side Hustle While Working 9-to-5 at Revlon—Here’s How She Did It

From beauty industry exec to cookware innovator.

You asked for more content around business finances, so we’re delivering. Welcome to Money Matters where we give you an inside look at the pocketbooks of CEOs and entrepreneurs. In this series, you’ll learn what successful women in business spend on office spaces and employee salaries, how they knew it was time to hire someone to manage their finances, and their best advice for talking about money.

Photo: Kirsten Francis

Eunice Byun launched her cookware company Material as a side hustle while she was working full-time as an exec at Revlon. But she knew she had to quit her day job when she kept waking up with new ideas for Material and couldn’t shake that feeling of “I’ll pinch myself later on if I don’t just do this now,” she tells Create & Cultivate. “It did help not having to worry about how I would financially make it by ironing out a lot of the vision for the business on nights and weekends, while still getting paid for my full-time job,” she adds about the decision of launching a business while working from 9-to-5.

Although the slow-and-steady approach was right for her, the entrepreneur admits it’s not for everyone. “If you’re the type of person who needs to jump in feet first and throw everything you’ve got at the business, then my approach might have been too cautious,” she says. “For me, I needed some assurance that what my co-founder and I were dreaming up was compelling enough that we could secure funding so that we could build the product and our brand right from the start.” And it’s safe to say that strategy has more than paid off. In fact, she had a number of investors who were interested in working with her before she even had a product (no big deal!).

Ahead, Byun explains what it took to launch a business while working full-time, how she secured funding before producing a single product, and why it’s important for founders to be compensated, regardless of the actual dollar amount printed on the paycheck.

Your résumé is so impressive. You started your career in finance as an analyst at Goldman Sachs and later served as vice president of global digital marketing at Revlon. Can you tell us about your professional background and what you were doing professionally before launching Material?

I’ve been fortunate enough to have had a pretty diverse career to date. After graduating from Northwestern University, I went into finance at Goldman Sachs. It’s a great place to start your career because you learn a lot of transferable skills—presenting information, time management, people management—at an early age. Ultimately, I knew that I couldn’t see myself in finance long-term and wanted to move into something more consumer-focused.

From there, I spent the next chapter of my professional life in the consumer and start-up worlds, soaking up as much operational knowledge as possible. I learned about forecasting, merchandising, managing a P&L, operations, PR, and communications. Although I didn’t know it at the time, I was accumulating bits and pieces of know-how that would serve me well with my own company, Material.

Right before launching Material, I was in the beauty industry, deep in digital storytelling, community building, and influencer-focused marketing, much of which has informed our current marketing strategies.

What was the “lightbulb moment” for Material? What inspired you to start your business and pursue this path? Did you always envision yourself becoming an entrepreneur?

I was that kid growing up who never knew how to answer the question, “What do you want to be when you grow up?” As I got older, I eventually realized it came down to surrounding myself with talented, driven people (who I could learn from), and building something that people cared about. That rubric served me pretty well as I navigated through a few different industries.

But it wasn’t until I had my daughter that I realized there had to be something more. I wanted a place where I didn’t have to leave parts of myself at home, especially as a new mom. When my co-founder and I started piecing together the concept of Material, we envisioned the idea of our company but also the type of place and people we wanted to spend our time in and with. We felt there was a need for our company to exist (e.g. to bring more beautiful, high-performing designs to the home cook), but we also knew we wanted to build a company with values that matter and motivate us and our team.

You had a number of investors that were interested in working with you before you even had a product. What were some of the challenges you faced in raising funding pre-product and what would you change? Would you recommend your route to other entrepreneurs?

Product is central to our business, as we aren’t a one-product-shop where we focus solely on a singular item. In our case, we launched with a collection of seven items, so raising a pre-seed round was necessary in order to deliver the quality of products we envisioned. However, we made sure not to take too much money from the beginning as we didn’t want to automatically put us on the hamster wheel of raising more and more capital as quickly as possible. We also were specific on having a diverse set of initial investors, which proved to be one of our best decisions. With a mix of venture, angel investors, and houseware industry experts, we’ve received different opinions and guidance which has allowed us to chart a growth plan for Material that feels more dimensional and sustainable.

What was your first big expense as a business owner and how should small business owners prepare for that now?

Public relations and communications. We invested right from the start in a top-notch, start-up-focused PR partner. The way we saw it was we only had one company launch moment, where we could come out and tell the world who we were and what we are about, so we wanted to make that moment count. What we’ve found is that many of those press hits quickly got our name out and generated buzz, but longer-term populated our branded search results and filled the pages with articles. These still pay off for us years later.

What are your top three largest expenses every month?

Payroll, fulfillment, and platform-related costs (e.g. processing fees and hosting). We used to spend a lot more on top-of-the-funnel marketing but have found that our lower-cost acquisition tactics are more effective and produce more loyal, long-term customers.

Do you pay yourself, and if so, how did you know what to pay yourself?

Yes. One of our early investors advised us from the start to pay ourselves what we needed to focus on the company, and not how we’d make ends meet. That being said, my co-founder and I believe in hiring the best talent we can so we allocate our funds to the team (meaning we make less than other team members).

Would you recommend other small business owners pay themselves?

Yes. It’s important to feel compensated for the work being put into the company, regardless of how much that dollar amount actually is.

Photo: Kirsten Francis

How did you know you were ready to hire and what advice can you share on preparing for this stage of your business?

An angel investor of ours broke this down for me once. He said there are two buckets of hires: superchargers and doers. You need both and you’ll eventually hire for both.

Superchargers are those that you bring in slightly earlier than needed—and might overpay for at the time—but they are meant to exponentially grow your business. They might have done it before elsewhere or they have some experience that will immediately add value.

Then there are the doers, where you hire them when you’re essentially past the breaking point. They help make processes move more efficiently or allow you to go faster, but you can afford to drop some balls here and there and not have it affect the business in a significant way. This ensures you aren’t building up a team too quickly and spending too much before it’s needed.

What are some of the tools you use to stay on top of your business financials? What do you recommend for small business owners on a budget?

Excel. My co-founder and I look at spreadsheets daily as things are shifting quite regularly. We also have an outsourced CFO who we can tap into with more specific questions or analyses, as we’re not quite at the place where we need that skillset full-time.

Do you have a financial mentor? Do you think all business owners need one?

I have different people whose opinions I seek out on various financial matters. I like speaking with other operators and founders about budgets because while investors may have a POV, I want people who are sitting with spreadsheets and making hard decisions on where you can spend your money and where you can’t. For fundraising matters, I like speaking to a number of people—not just one—because there’s more than just one path forward on how you finance your company.

What money mistakes have you made and learned from along the way?

Inventory can help and hurt you. Too much, and you’re stuck. Too little, and you can’t grow fast enough. We recently invested in an inventory management system to help us work through these growing pains, as we try to be as capital efficient as possible and not have too much tied up and sitting in a warehouse.

Where do you think is the most important area for a business owner to focus their financial energy and why?

Know your pathway to profitability. There used to be an overabundance of focus on top-line growth, no matter the costs. Nowadays, the focus has shifted towards profitability which is important because it means you have greater control over your financial future if you don’t always have to rely on bringing in funding.

Do you think women should talk about money and business more?

Yes! The number of times I’ve walked into a meeting where a potential investor focuses marketing questions to me and financial questions to my male co-founder have been absurd. The fact that my gender leads one to believe that I may not know much about my company’s financials is an antiquated perspective. ANY business owner should be well-versed in how their company will grow and what it’ll take to do so.

You’re a mom and a co-founder/CEO! How has being a mother changed your priorities and your focus in terms of your career? Do you think motherhood has made you a better business person?

It deepens my reasons for why I do what I do. Having my daughters see that they too can write their own narrative and build something of substantial value is important to me.

What is your best piece of financial advice for new entrepreneurs?

Get comfortable with it and don’t let someone else take the reins because they “know more about finances than you.” Your financial statements are simply a different way of telling your company’s growth story.

MORE ON THE BLOG

5 Marketing Mistakes Too Many Small Businesses Make (and How to Avoid Them)

Mistake #2: You ignore your competitors.

Photo: ColorJoy Stock

If you are a small business owner, you are likely juggling numerous tasks to keep the business afloat. Although the goal of many owners is to sell more products or services, very few know how to effectively do so through marketing (on top of everything else).

According to Investopedia, one of the most common reasons businesses fail can be attributed to poor marketing and internet presence. It is no longer enough to have a website or social media page. You must ensure your marketing reaches the right people at the right time with the right message.

While there is no marketing rule book that will guarantee virality or increase customer retention, there are, however, many marketing mistakes that can hinder your chances of growth. Here are the five common mistakes I have seen during my 10 years working as a marketing strategist, and how to avoid them.

Mistake #1: You don’t know your ideal customer.

The first step in any effective marketing campaign is knowing your ideal customer. While many new business owners think of their ideal customer demographically (i.e., age and gender), many do not have a deep understanding of who their customer is psychologically (i.e., interests and desires). Thus, making it challenging to find and target them through marketing.

How to Fix It

Form a detailed description of your target customer; this is also known as a buyer persona. A buyer persona is a fictional person who embodies the characteristics of your ideal customer. To help build a strong buyer person, conduct market research from your customer base through surveys and interviews.

The goal of this market research is to deeply understand how and why your customers make certain buying decisions. These findings will help you create detailed content and messaging that appeals to your target audience.

Mistake #2: You ignore your competitors.

No business can operate in a complete bubble. However, many business owners prefer not to look at their competitors in fear of losing focus or becoming a copycat.

How to Fix It

Running a competitor analysis can help you understand your competition’s strengths and weaknesses in relation to your own. Tools such as Facebook Ad Library and SpyFu allow you to view your competitors' marketing campaigns.

Analyzing your competition will help you better understand your market and how your customers are responding to it. You can use these findings to run more effective marketing campaigns online.

Mistake #3: You focus too little on brand awareness.

According to Small Business Trends, making money is listed as the top concern for many business owners. However, if your ideal customer does not know who you are, how can you make more sales? Many business owners spend too much time focusing on bottom-funnel marketing activities (i.e., purchases), that they forget to establish trust and credibility through brand awareness.

How to Fix It

Focus on building brand awareness through public relations, influencer partnerships, and social media advertisements. Use this opportunity to establish your brand voice, build relationships, and inform your target customer that you are a credible solution to their needs.

Mistake #4: You are not focused on retaining customers.

On average, it costs six times more to acquire a new customer than to retain an existing one. According to a McKinsey study, repeat e-commerce customers spend more than double what new customers spend. So, why are business owners unable to focus on customer satisfaction and retention?

How to Fix It

Ensuring customers stick with you throughout your business life cycle will not only increase profits but yield higher positive word-of-mouth referrals (hello, free marketing!).

To achieve customer loyalty, prove your customers are important to you through rewards, social media shoutouts, and personalized communication. Customers that trust companies they do business with are more likely to purchase again in the future and recommend to others.

Mistake #5: You don’t look at your analytics.

Marketing analytics helps you understand how well your marketing campaigns are working and assists you in recognizing what adjustments need to be made in order to achieve success. However, many business owners complete their marketing campaigns without ever analyzing the data.

How to Fix It

Develop key performance indicators (KPIs) before running any marketing campaign. KPIs are specific, numerical marketing metrics that businesses track to measure progress toward a defined goal. Example KPIs can be digital marketing ROI, conversion rates, and traffic. Set aside time every week to track the results of your marketing. Take note of what is working versus what is not, and use that information to inform your next marketing initiative.

“Many business owners spend too much time focusing on bottom-funnel marketing activities (i.e., purchases), that they forget to establish trust and credibility through brand awareness.”

—Allyssa Munro, Founder of Meg & Munro

About the author: Allyssa Munro is a marketer and published writer with a decade of experience building strong brands for top retailers, organizations, and business leaders, including Lord & Taylor, Dolce & Gabbana, Buxom Cosmetics, and Bare Minerals. Allyssa holds an MBA from Baruch College, Zicklin School of Business, and is certified in marketing research by The Wharton School, University of Pennsylvania. Allyssa founded Meg & Munro, a digital-first marketing and communications agency for beauty and lifestyle brands and the creators who lead them. The agency specializes in public relations, social media, and content creation. Learn more at www.megandmunro.com or follow @megandmunro.

Love this story? Pin the below graphic to your Pinterest board.

MORE ON THE BLOG

How My Experience as an Investor Prepared Me to Be a Founder

Sage advice from a former venture capitalist.

Photo: Courtesy of Naomi Shah

It’s difficult to think of anything in my life that has required a wider or more dynamic skill set than founding and running a company. Unlike the way founding is sometimes described in pop culture and media, you can’t just have great ideas for products and services. You have to be capable of building a healthy company culture, understand how markets evolve, and anticipate what consumers will want in the future. Personally, the last year and a half have honed a higher tolerance for uncertainty, an irrepressible curiosity about our market and users, and the ability to communicate exactly what the company is trying to achieve to inspire all of our people.

While there’s nothing quite like running a start-up, I’m grateful that I had an opportunity to work at a venture capital firm before taking the helm of my company Meet Cute. Because VCs work directly with founders every day, they need to be capable of seeing the world from a founder’s perspective, which means identifying gaps in the market, crafting the right narratives about promising companies and ideas, gathering a lot of information from disparate sources, and making informed decisions in the face of incredible uncertainty. Due diligence is the central task for VCs, but they also have to be willing to take risks on the companies they believe in.

Investors and founders are on the same team. The best partnerships are often described as a marriage. That analogy rings true especially because of the ups and downs of founding over the years, which requires an intense trust in the people you work with that they will be there when you need it. Aligning on the direction of the company, personnel, and emerging market opportunities is critical. Ahead, I’m sharing some of the many lessons I learned as an investor that have also served me well as a founder.

Lesson #1: It all starts with curiosity.

Successful VCs are always on the lookout for companies that capture and hold their interest and users’ trust. Founders should want to work with investors who have thoughtful questions about their products and services, understand their industry, think differently, and believe in the founding team. It isn’t just a matter of cutting a check and hoping for a quick return. In turn, VCs should add value by thinking creatively about what the market will look like in the future and advising the company. I learned from shadowing partners at USV that the best VCs were also the best listeners, and think of VC as a service industry.

This starts with genuine curiosity about what a company does and what impact it could have on the world with the right guidance and resources. The average holding period for VC investors is eight years. This is a reminder that investors need to be mission-aligned as they will work with companies over the long term and are investing in the sustainable success of their portfolio companies.

VCs and founders should establish open lines of communication right at the outset. I’ve never been afraid to ask questions or contact experts who know more than I do about a subject, and these skills served me well as an investor and a CEO.

When I was at the VC firm, the best way to learn about early-stage companies was to work directly with them on forecasting, marketing strategy, fundraising, and other issues and consult with experts outside of the company to bring new perspectives to the table. The same collaborative mentality is an essential part of the culture at Meet Cute today. If we need to talk to an expert about something specific, we are not shy about asking and learning. Time and time again, smart people in the industry who we look up to make time for those who are genuinely curious.

Lesson #2: Make the best decision possible with incomplete information.

Early-stage investing offers unique benefits, such as the ability to identify innovative companies before other investors, help steer those companies in a positive direction, and ultimately secure more growth over time for taking on a much larger risk. These are all reasons why it’s no surprise that early-stage VC investments have surged over the past decade from $14 billion in 2011 to just over $47 billion in 2019. Early-stage investing is on pace to set a record this year. The first quarter alone saw greater deal value than the entire year in 2011.

Early-stage investing also comes with quite a few obstacles, and a lack of information is one of the biggest. Early-stage investors don’t have as much data about a company’s growth, operational efficiency, etc., so many of their decisions are based on pattern recognition and intuition. The founders of early-stage companies face similar constraints. There’s no playbook for what many of these companies are doing, so we have to be comfortable making decisions with limited information. Just as investors need to accept the fact that they will sometimes make the wrong call, founders should be willing to fail. If everything is going too smoothly, you should ask yourself if you’re scaling ambitiously enough.

All of that said, founders and VCs should be as fastidious as possible in their research. Due diligence as a core focus means putting in the time to learn and develop opinions and perspectives. But due diligence always has to be placed in the context of the realistic constraints you face, especially in building something completely new, and knowing what level of risk you’re willing to tolerate.

Lesson #3: Always tell your story

A company’s story is integral to its identity, and it serves as one of the most effective ways to reach your audience and let them trust our brand, galvanize employees around a common message, and attract the best investors. As an investor, I frequently told stories about innovative companies to convince my colleagues that we should back them, often in the form of an investment memo or a short and sweet presentation in a team meeting. I also helped start-ups craft their stories when they launched fundraising rounds or needed to prepare for board updates. Storytelling is the most powerful tool we have as humans and we know that the emotions of a story are remembered far better than facts.

Moreover, I’ve realized how sharing your story internally is vital to improving morale and helping employees rally around a consistent set of values and objectives. Gallup reports that only 27 percent of employees strongly believe in their company’s values, while less than half say they strongly agree that they understand what the company stands for or what sets it apart. By telling the company story and vision often and consistently, the team can rally around what they’re working toward and why it matters.

Reflecting on the last year, there is a significant overlap between my experiences as an investor and a founder. By making a conscious effort to understand how my experiences tie into and bolster one another, I hope that I can show where founders and the VC firms that support them can build stronger relationships and thereby more unique and impactful products in the world.

Photo: Courtesy of Naomi Shah

About the author: Naomi Shah is the founder and CEO of Meet Cute, a venture-backed media company that has produced over 300 original light-hearted romantic comedies in podcast form. The company celebrates human connection and the full spectrum of love with the core mission of having every person feel like they are reflected in Meet Cute stories. Since its inception in February 2020, the podcast has had over two million listens across over 150 countries and has been featured in the top 10 of Fiction on Apple Podcasts and Spotify.

Before starting Meet Cute, she was a member of the investment team at Union Square Ventures, a technology venture capital firm in New York, where she spent most of her time talking to companies in the consumer and well-being space. Prior to that, she was a macro equities trader at Goldman Sachs and studied mechanical engineering and human biology at Stanford University.

MORE ON THE BLOG

Psst... This Could Be Why You Didn’t Get the Job

Reason #1: You didn’t sell yourself.

Photo: Create & Cultivate

Behold, the dreaded email that just rudely cannonballed into your inbox:

“We’ve reviewed your background and experience and have decided to proceed with another candidate who meets our needs more closely at this time.”

The disappointment can crash over you like a wave upon reading these words. Professional rejection is one of the worst feelings a person can experience while job hunting, and yet we have all been there at one point or another. And likely, the first rejection won’t be the last.

Once the initial blow has settled, you will probably start to wonder what it is that these “other candidates” have that you don’t. At the risk of sounding annoyingly optimistic in this unfortunate, but unavoidable, situation, taking time to consider the reasons behind your rejection offers an opportunity to better prepare yourself for the next position you apply for. It is also entirely possible that this is an “it’s not you, it’s me” situation, and you really did nail the job interview, but outside factors got in the way of sealing the deal.

Let’s explore some of the reasons why a company might decide not to move forward with you.

Reason #1: You didn’t sell yourself.

In professional situations, being confident is the key to success. Nerves are to be expected when interviewing for a job, but if you allow them to take over and mask the great experience and professional accomplishments you’ve made, your potential employer will take note.

If things didn’t go as well as you’d hoped during your interview, remember that even the most seasoned professionals can get flustered in these situations. You may have made a common error that made the difference between the hiring manager moving forward with you. Did you dress appropriately? Were you on time and polite to everyone you met? Did you do your research on the company beforehand? Proper preparation, body language, and confidence are key to nailing the interview. And above all, don’t forget to send a follow-up email or letter shortly after the interview.

The art of talking yourself up without coming off as cocky or above-it-all is one worth working on for future interviews—if there was ever a time to show off your skills and accomplishments, this is it! You can bet that the candidate who does end up landing the position will present themselves confidently and graciously.

Reason #2: You’re not qualified.

You could be an excellent culture fit with a positive attitude and a dynamite work ethic, but at the end of the day, if you do not meet the job’s qualifications, you are probably not going to be hired for the position. If this is the case, there’s no need to beat yourself up—it’s nothing personal, there are simply other candidates that could better perform the job. If you’ve lost out on your dream job, take this as an opportunity to work on building up your skills and experience so that next time there is an opening, you meet the qualifications.

Reason #3: You didn’t tailor your résumé and cover letter to the specific role.

You don’t have to redo your entire résumé and cover letter every time you apply for a job, but it is vital to make sure you are targeting your application materials to the specific skills and job description provided for the position you’re applying for. To be seriously considered or (hopefully) hired in a new position, you need to showcase all of the concrete reasons you would be the right fit for the role.

Keeping your skills and experience too general, won’t be enough to “wow” a hiring manager, so it’s well worth it to take some time to adjust your language and ensure you are highlighting your most relevant skills and experience. For more advice on this, check out our useful guide on resume dos and don’ts.

Reason #4: Your salary requirements are too high.

It can be tricky to navigate how to answer when a job application or hiring manager asks what your salary requirements are for a role. List a number too low, and you may undersell yourself and set yourself up for compensation frustration. Go too high, and your application may be quickly tossed into the “no” pile—listing a salary outside the range of what the company is hoping to provide may have been the factor that took you out of the running.

The best way to approach a salary requirement question is to make sure you have done your research on your market value and the salaries of similar roles ahead of time. This way, you can go in with a justifiable number or range already in mind. Don’t let fear convince you to put a number lower than what you feel you are worth. It’s a good idea to write something like “flexible” next to the number so that even if it is higher than what the company is willing to spend, they know there is room for negotiation.

Reason #5: The company decided to hold off on hiring.

This one really takes you off the hook, because there’s probably nothing you could have done to avoid it. Sometimes, due to budget or internal organizational shifts, companies will decide not to move forward with hiring for a role. While unfortunate, it happens. Try not to get discouraged.

It’s important to give yourself some time to feel the disappointment of not getting a job you wanted—after all, this is a difficult experience that can be a blow to your self-esteem, but, don’t let this situation be for nothing. Consider all aspects of the job application process to figure out where you could improve for next time, from pressing send on your initial application to nailing your interview and post-interview follow-up.

This story was submitted by Career Group Companies.

Love this story? Pin the below graphic to your Pinterest board.

This story was originally published on December 14, 2019, and has since been updated.

MORE ON THE BLOG

How to Gracefully Exit Your Current Job

Burning bridges is never a good idea.

Photo: ColorJoy Stock

Leaving a job is never simple, especially when you want to stay on good terms with your boss, which is always a good idea. Burning bridges over the course of your career will only burn you. And chances are, you will quit a job at some point in your career.

In fact, people are quitting their jobs at record rates right now. Nearly 4 million Americans left their jobs this April, according to data from the Bureau of Labor Statistics, pushing the quitting rate to 24% higher than it was before the pandemic.

So we’re answering your big questions about how to gracefully exit, prima ballerina style.

Give Plenty of Notice

The hiring process is long, arduous, and complicated. Finding the right person to fit into a well-oiled machine is notably one of the hardest parts of running a company. And when a team member leaves, a major wrench is thrown into that machine, no matter how well executed it is.

If you work at a corporate job, two weeks is a standard amount of time to give. However, if you work at a small startup, where your team members will be scrambling to cover your work and tasks, you should plan to give a month. That way, no one on the team is forced to work even longer hours than they already do.

Most employers admit that hiring into a small team takes a finer-toothed comb. And at startups, there aren’t temp employees or people working beneath you who already know your job. 30 days may seem like a lot, but it shows your soon-to-be former boss and colleagues that you respect them. It also gives you enough time to potentially train your replacement.

You don't want to simply leave on good terms, you want to leave a good memory in the minds of your work peers. And what they are required to do post-exit, will color that memory for better or worse.

Let Clients Know You’re Leaving (the Right Way)

Often, especially at larger companies, it is upper management’s responsibility to notify clients of your exit, as they are considered company property. No matter what, you should ask before making contact of any kind.

That said, everything should be brief but positive. If you are resigning and already know your replacement, it is a good idea to introduce clients to the new team member. That way they know the transition is smooth, not messy, and they are still in good hands. The reality is: a client or work colleague’s number one concern isn’t where you’re heading next, but how their account will be handled.

If however, you resign without a replacement, sending a mass email to your client list looks bad and it makes the company look bad. It looks like balls are getting dropped. Even if you’re leaving on good terms, it’s a surefire way to make your boss question your motives.

So, how do you handle leaving if you don’t have someone primed and ready to take over?

Make sure you have a conversation first. Every boss is different, but taking the time to ask them how they would like you to handle, is a professional courtesy that will be appreciated.

If you are unwilling to ask, you should wait two weeks to announce your departure. Hopefully, in that time, the company has found your replacement and assured a smooth transition.

Send the email from your personal, not work email.

Do not discuss the “why” of your exit in depth. Bringing any kind of drama into a mass email is unprofessional, and it doesn't make the company look bad, it makes you look bad.

Define Your Duties Thoroughly

Beyond creating a document that outlines all of your duties, you should also create a document of what you’re currently working on and where those things stand. Your boss will thank you (because you’re saving them the massive headache of sorting through what’s falling through the cracks), but so will the person who follows you. And you never know where that person might end up.

People tend to think of exiting as it applies to the team they already know. But the truth is, the person who fills your job knows EXACTLY what kind of worker you are/were. Use that to your benefit. They see previous correspondence, how you interface with clients, and what you left hanging. If you want to make a good impression, make their transition smooth. You never know where they will end up either.

This story was originally published on January 4, 2019, and has since been updated.

MORE ON THE BLOG

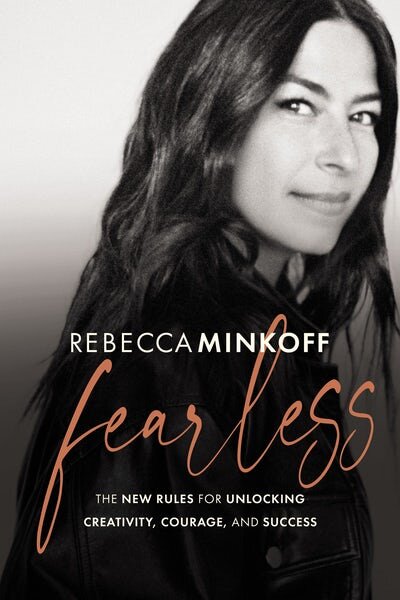

Rebecca Minkoff Doesn’t Believe in Asking for Permission—and Neither Should You

An excerpt from the designer's new book, "Fearless."

“Really, the only person you need permission from is yourself. Not your parents. Not your friends. Not society.”

—Rebeca Minkoff, Co-Founder and Creative Director of Rebecca Minkoff

At Create & Cultivate’s Money Moves Summit, Rebecca Minkoff opened up about her slow-burn success, working hard and never giving up, and leading a company through tough times. In her new book, “Fearless: The New Rules for Unlocking Creativity, Courage, and Success,” she shares even more learnings from her decades-long career. Below is an excerpt from her new book in which she shares one of the most valuable career (and life) lessons she’s learned so far:

The first dress I ever designed for myself was for my bat mitzvah. A few years before, I had seen a polka-dot dress in a store window and became obsessed. It was just a simple A-line shift dress, but to me it was the coolest dress I had ever seen in my life. Even though I couldn’t touch it, in my mind, I knew it was made with the softest cotton I’d ever felt. The sleeves had just enough pouf to be stylish without feeling kooky or too kiddie. I knew it would land right above my knee if I ever had a chance to try it on. Like most kids, I begged my mom to buy it for me. And, unlike most moms, my mother said, “I’m not going to buy this for you, but I’ll buy you fabric and you can make it.” That was a real light bulb moment for me. I had been crafting and making cutesy, fun things like aprons and pot holders, and I’d been using puffy paint and sewing patches on my jean jackets, but this felt like a revelation. If I designed something fashionable, did that make me a fashion designer? That sounded really cool.

Asking my mom for things and having her turn me down was pretty much par for the course. But the truth is, she just wanted to teach me how to figure things out for myself. She didn’t buy me that dress, but she guided me as we made one—and I thought it was even cooler than the one I had seen. Now, I was twelve, and between the idea of becoming a “woman” for my bat mitzvah and having a size AA training “bra” (think: stretchy cropped undershirt), I very much felt like I needed a dress that would highlight and showcase my chest. (Why, you ask, was my focus on my chest instead of on my Torah portion? Tweens aren’t exactly known for their impeccable priorities.) This became my first design challenge. I decided on an empire waist with a square neck and a little princess puff sleeve, and I made it out of white matte silk. I made it just above my knees so that you could see my gams when I sat on the bima (that’s Hebrew for the stage). My mom wouldn’t buy me new shoes for just one night, so a family friend lent me her cream-colored pumps that matched the color of my dress exactly. I wore them with pride even though they were a half size too small. (But I did spend most of the time up on the bima worried that I was losing circulation in my feet.)