“Take Smart Money”—How Annie Lawless Scaled Lawless Beauty Into a Wildly Successful Second Business

This week, on WorkParty.

Photo: Courtesy of Annie Lawless

Listen to the full episode here.

Starting a business is no easy feat. According to the Bureau of Labor Statistics, 20% of businesses fail by the first year, and 50% close by the fifth. So the odds of starting one successful business—let alone two—are stacked against you. But defying the odds is something that today’s WorkParty guest, Annie Lawless, knows a thing or two about.

In 2012, Annie launched her first company, the cold-pressed juice brand Suja Juice, which she scaled into such a success that Coca-Cola and Goldman Sachs each bought multi-million-dollar stakes (!). And now her second business, the clean beauty brand Lawless Beauty, is on a similar trajectory. The band doubled its sales as of October 2020 and is on track to double its overall sales in 2021.

In this episode of WorkParty, Jaclyn chats with Annie all about how she started her wildly successful second business, how she formulated a strategic exit strategy from her first company, and so much more! Scroll on to tune into the full episode and get a sneak peek of just a few of the many, many highlights.

Subscribe to WorkParty and never miss an episode.

On launching a business…

“Starting a business is the most time and work-intensive endeavor you can undertake.”

On bringing in capital from outside investors…

“Once you start bringing capital in from outside investors, you also start bringing in a lot of other viewpoints, perspective, control.”

“You can get money from a lot of places, but you really want someone to understand your business and bring you the tools and resources to help take it to the next level beyond just the capital.”

On the importance of making strategic new hires…

“Finding those key great people is one of the hardest things about having and scaling a business.”

On the challenges of being an entrepreneur…

“There are going to be some really high highs and really low lows of being an entrepreneur, so you need to trust that everything is going to work.”

On pushing through the hard times…

“On the other side of the hard times is going to be such a big reward for what you've created if you really weather the storms.”

On the best career advice she’s ever received…

“Don't sit on the sidelines of life. You have to get off the bench and play in order to potentially win.”

Keep the WorkParty Going By

Supporting Our Sponsors

MZ Wallace is offering WorkParty listeners 15% off your first purchase.

Coors Pure is the perfect beer to celebrate the wins of everyday life. So, when you want to enjoy a beer, reach for Coors Pure. It’s organic, but chill about it.

Joybird is offering WorkParty listeners 30% off your purchase! Time to give your space a refresh with so many custom furniture and home decor pieces right at your finger tips!

MORE ON THE BLOG

5 Numbers to Consider When Launching a Coaching Business

Set yourself up for success.

Photo: ColorJoy Stock

The coaching industry is one of the fastest-growing sectors with the market size predicted to surpass $20 billion by 2022. (Calendar check, it’s already August.) And while this has left many frustrated and floundering in an overcrowded market, it has also jump-started thousands of budding entrepreneurs’ coaching careers.

And as with any new career trend, along with all the commotion, there is a lot of information (and misinformation) floating around the internet. While click-bait Facebook ads often depict building a coaching business to look like a walk in the park and endless traveling, the reality can often look a bit different.

Rather than sitting on a beach, spicy margarita in hand, glancing down at your phone while yet another effortless sale hits your bank account, new coaches and coaching side-hustlers are often found drowning amongst a sea of other coaching connoisseurs, endless freebies, masterclasses, and promo threads.

If you are coaching curious, a coaching side-hustler, or looking to launch (or re-launch) a new coaching business, here are five numbers to consider to ensure that you’re setting yourself up for success, and profit, from the get-go (so that dream of sitting on the beach is a much closer reality.)

Number 1: Your Net Income

How much do you want to make per year?

Have you ever taken the time to really think through the income that would sustain and fund your ideal lifestyle? If not, now’s the time!

This number will largely differ based on where in the world you live, and what constitutes a dream lifestyle for you. For some, it encompasses travel. For others, it’s as simple as being able to afford childcare. Either way, the first number to get clear on, is how much money you need in your bank account in order to thrive.

Example: I need $75,000 a year in my personal bank account to live my dream lifestyle.

Quick definition from Investopedia: Net income (NI), also called net earnings, is calculated as sales minus cost of goods sold, selling, general and administrative expenses, operating expenses, depreciation, interest, taxes, and other expenses.

Number 2: Your Total Cost of Doing Business

What will your expenses and taxes look like?

How much does it cost to run your business? If you have no idea what these numbers are, it’s time to PAUSE and do a little research. For business expenses, outline one-off costs, such as building a website build, and reoccurring costs like accounting software.

For taxes, it’s going to largely depend on the type of business you file and what state you live in. However, for example, expect around 30% of your profits to go to the government. So, multiply your desired net income by .30 to get this number.

Once you know your one-off costs, your recurring expenses, and your estimated tax payouts, you can add them together to get to an estimated “total cost of doing business.”

Example:

One-off costs: $4,000

Recurring monthly costs: $2,000 ($24,000 annually)

30% of 75,000 (net income): $22,500 (taxes)

Total cost of business annually: $50,500

Number 3: Gross Annual Sales

How much does your business need to make?

Now that you have your goal net income, and your estimated total cost of doing business annually, we can add them together to determine what your business needs to generate in gross sales annually in order to support your net income.

Example:

Total Cost of Business ($50,500) + Net Income ( $75,000) = $125,500 = Gross Sales

Quick Definition from Investopedia: Gross sales is a metric for the total sales of a company, unadjusted for the costs related to generating those sales. The gross sales formula is calculated by totaling all sale invoices or related revenue transactions. However, gross sales do not include the operating expenses, tax expenses, or other charges—all of these are deducted to calculate net sales.

Number 4: Gross Monthly Sales

How much do you need to gross per month?

If you were to work for a company, there are generally 52 pay periods in a given year. When you own your own company, you can either payroll yourself OR pay yourself out via owner’s draws. For “Number 4,” you can either divide your total annual gross sales by 12 months OR by 52 pay periods.

When you’re starting out, let’s say as an LLC or sole proprietor, it’s more common to look at your expenses and sales monthly, thus we’re going to use 12 for this example. You want to know how much your company needs to gross monthly in order to deliver you your desired net income. So, simply divide your gross annual sales by 12 to learn what you need to gross monthly.

Example:

Gross Annual Sales Needed = $125,500.00 / 12 = $10,458.33

$10,458.33 = Gross Monthly Sales Needed

Number 5 (Option 1): Total Client Load

How many clients do you need to take on to hit your income goal?

There are two different numbers you can choose to act as your key fifth number (a.k.a. Number 5). The first is your total client load. In this scenario, ask yourself, how many clients do you want to work with at any one given moment? Do you want to only work with three clients annually? Or do you want to work with 30 new clients a month via a group program? You might not immediately know, but pick a number to start out.

From here, you will be able to determine how much you need to charge per client per. For example, if you identified you only want to work with three clients annually, then that means those three clients need to produce $10,458.33 of gross monthly sales for you. That means each client needs to be on a $3,486.11 monthly retainer.

On the flip side, if you have identified you want to go after a volume model, and you’ve identified you want to work with 30 clients a month every month, each client will need to pay $348.61 monthly in order to hit your gross monthly sales goal ($10,458.33 / 30 clients a month = $348.61). However, also consider that this means you need to sign a total of 360 clients annually (30 clients monthly x 12 months).

Number 5 (Option 2): Pricing First

How much should you charge for your services?

If you already know that you’re looking to create a very specific product at a pre-identified price point, then you can back your way into knowing exactly how many clients you need in order to hit your gross sales goals. For example, if you want to sell a $100 online course, then take your total needed gross sales and divide that by $100. This will indicate that you need to sell 104.16 (round it up to 105) courses a month to hit your sales goals.

The Bottom Line

Ultimately, these five numbers are what you need to know in order to identify your ideal business model. Numbers 1-4 inform us of what we need in order to “play around with” Number 5. If you’re feeling stuck between high volume or high ticket, consider asking yourself this, which business model and workload is most conducive to your dream lifestyle? If you need a little more help breaking this down, check out our free masterclass here.

We’ll leave you with this, “living your dream life shouldn’t be just a dream.”

About the authors: Lexie Smith (pictured left), named “Brilliant PR Expert” and “Trailblazer Women Leaders in 2021,” is a PR coach, host of the “Pitchin’ and Sippin’ Podcast,” co-founder of Ready Set Coach, and the founder of THEPRBAR inc., an online coaching brand that empowers entrepreneurs to increase their influence, impact, and revenue through relationship-driven marketing and PR.

Emily Merrell (pictured right), as featured in Refinery29, Girlboss, Forbes, and Huffington Post, is the founder and community curator of Six Degrees Society, a professional speaker, host of the “Sixth Degree Podcast” business coach, and co-founder of Ready Set Coach.

MORE ON THE BLOG

How to Professionally “Break Up” With a Client

Cutting ties is tough, but worth it.

Photo: ColorJoy Stock

As a business owner, your natural inclination may be to please clients, and it can be tempting to fall into the trap of taking any client that wants to work with you. The hustle is addictive. And the thought of saying “no” is scary, especially when faced with the uncertainty of when your next client will be locked down. But while cultivating and growing your clientele, your list of frustrations might follow suit.

PSA: There will likely come a time when you’ll want to cut ties with some clients. It might be something you’ve been considering for a while now as a result of clients behaving badly (hello, unpaid invoices), or maybe you’ve simply become too busy and need to edit your client base (high five, boss). Whatever the reason, it’s uncomfortable AF. And considering your reputation is on the line, you’ll need to finesse this difficult convo.

So to help you manage your business relationships and determine which clients are giving you good vibes and which ones deserve “goodbyes,” we spoke with Andrea Crisp, a life coach, host of "The Couragecast," and author of “Designed With Purpose.”

Is it time to break up with a client?

According to Crisp, here are six signs you are subconsciously done with a client:

1. You feel completely drained after having a conversation with them because you rehash the same thing over and over.

2. You work overtime trying to please them when it becomes apparent no one can satisfy them.

3. You find yourself watching the clock every time you have a meeting with them.

4. You believe there is no amount of money in the world that makes working with them worthwhile.

5. You contemplate going back to your 9-to-5, just to escape this client’s requests.

6. You stop billing them in the hopes that they don’t contact you again.

And here are six signs that a client is giving you life:

1. You are willing to put aside time to work on a project; in fact, you look forward to it, even on weekends or at 3 a.m.

2. You feel compelled by the cause and are passionate about the impact it is making.

3. You are fueled by every conversation. Every time you speak with the client you are motivated and energized and feel even more creative.

4. You think of ways to help them, even during your “me” time.

5. You are on the same wavelength and kinda want to be their BFF.

6. You are willing to go the extra mile for them, even though it’s not part of your mandate.

How do you break up with a client (and prevent it from happening in the first place)?

If you’re starting to feel the “cons” outweighing the “pros,” it’s time to release these clients—and release yourself in the process.

Here are some ways to do so:

Set boundaries right from the start

This not only helps you as an entrepreneur, but also gives clear guidelines to your clients as to when they can expect work to be done, and when they can expect you to respond to their emails, texts, and calls. So you avoid receiving emails on weekends (if that’s not part of your mandate) and avoid anxiety-inducing emails with subject lines that read: “Urgent: need this ASAP.”

“At the beginning of every client relationship, I outline a clear coaching expectation so that my clients are aware of how this relationship will work,” explains Crisp. “It has served me in so many ways. And, I have to constantly remind myself that even if I don’t think a client needs to hear my expectations, I need to say them. It keeps me in check and accountable to my clients, and allows them the freedom to ask the right questions.”

Know your niche

Your dream clients are ideal because you’re passionate about helping them, and your expertise matches their needs and vision. As soon as you take on clients outside of your niche, you have to work harder than ever to figure out what they may need. This becomes super frustrating, as there starts to be a disconnect between your “dream clients” and your “dreaded clients.”

Release yourself from the pressure

Crisp puts it clearly: “Release yourself from the pressure that you need to be everything to everyone. As entrepreneurs, we may want to have all the answers, have the biggest client roster, and have a strong social media following, but in the end, that does not produce results and only pushes us closer to burnout and fatigue. The biggest obstacle that stands in our way of making an impact as female entrepreneurs is ourselves.” Boom.

Give yourself a break, allow yourself to have a day off, turn off your phone. The world will not end. Trust.

Look at your numbers

If you know you simply can’t even with this client anymore, look at your upcoming projects and revenue. Can you afford to let this client go? If this customer is draining you of all your energy and not allowing you to perform at your best, then it sounds like letting them go will help open the window for other awesome clients. And, after all, good clients lead to other good clients. If the client is mistreating you, then you’re better off without them.

Have the difficult conversation

Don’t procrastinate; the longer you put off the inevitable, the harder it will become to have “the talk.” After all, there are times in every relationship, like with your squad, team, or clients that you have to tell the hard truth. This may involve being honest and vulnerable, which can be very difficult.

Face it head-on, take a deep breath and stand tall—you’ve got this.

Don’t look back

Once you make your decision and fire your client, don’t look back. See the situation as a key learning for the future. Upwards and onwards. Trust the process.

When is enough, enough?

The moment you start to believe that you need to fill your calendar with clients out of your niche is the moment you have to work double-time to accommodate their needs.

Don’t go there.

When trying to determine “the last straw,” you have already passed the point of no return. This may sound counterintuitive, but the real question you need to be asking is: “Do you have the confidence and assurance you need to only take clients you want?’

TBH, it really is more about you than them. Ask yourself these tough questions and don’t become addicted to the hustle by taking clients that drain your energy and creative flow.

Another key point is that as you grow, your focus might narrow, which can lead to some clients no longer matching your brand. Recognize when this happens, too, no matter how lovely the client might be.

Remember, a client-supplier relationship is a partnership. And if you’re no longer satisfied with your end of the deal, it might be time to say, “K, bye.”

About the author: Karin Eldor is a coffee-addicted copywriter with a long-time love for all things pop culture, fashion, and tech. Ever since she got her first issues of “YM” (remember that one?) and “Seventeen” in the mail, she was hooked on the world of editorial content. She's a contributor to Forbes, Coveteur, MyDomaine, and more.

This story was originally published on November 28, 2016, and has since been updated.

MORE ON THE BLOG

We Tapped 3 Foodies for Work-From-Home Meals to Whip Up With Pantry Staples

No sad desk salads here.

Photo: Courtesy of RASA

Working from home makes you miss things like chatting about “White Lotus” over lunch with your coworkers. But just because you’re WFH with no one to discuss the finale with doesn’t mean that you shouldn’t take that lunch break. Whip up something delicious with these easy recipes made with ingredients you probably already have at home.

We tapped Mia Rigden of RASA, Wendy Lopez and Jessica Jones of Food Heaven, and Gaby Dalkin of What’s Gaby Cooking and asked them to share their go-to work-from-home recipes—and it’s safe to say they did not disappoint. From everything-but-the-kitchen-sink soup to not-so-boring pasta, you’ll be eating well this week.

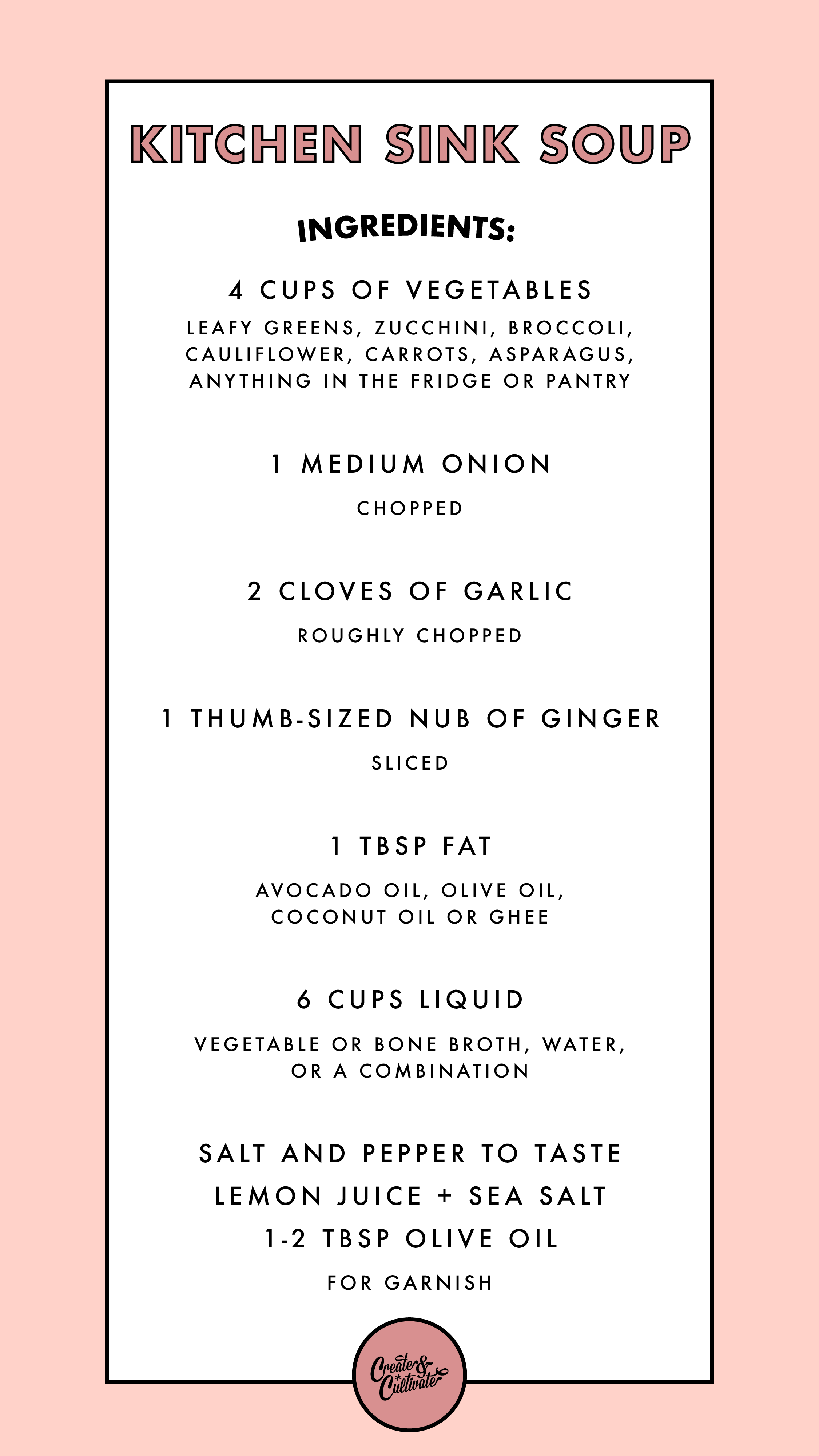

Kitchen Sink Soup

An excellent way to make the most of unused produced that’s sitting in your crisper drawer, this soup, courtesy of Mia Rigden, a nutritionist and the founder of RASA, is nutritious, flavorful, and a perfect way to reset. Make a big batch and freeze leftovers so you’ll always have a healthy meal on hand.

Instructions:

Heat coconut oil or ghee in a Dutch oven.

Add onions and garlic, stirring until fragrant, then add vegetables and stir for a minute or two longer.

Add broth then enough water to cover the vegetables (about two cups). Let simmer for 20-30 minutes and puree in a high-speed blender (or with a hand blender) until smooth.

Season as desired and serve with a squeeze of lemon, a splash of olive oil, and some sea salt

For a step-by-step tutorial, watch the Ask an Expert Live segment via Create & Cultivate’s Instagram here.

Nutritionist and founder of RASA

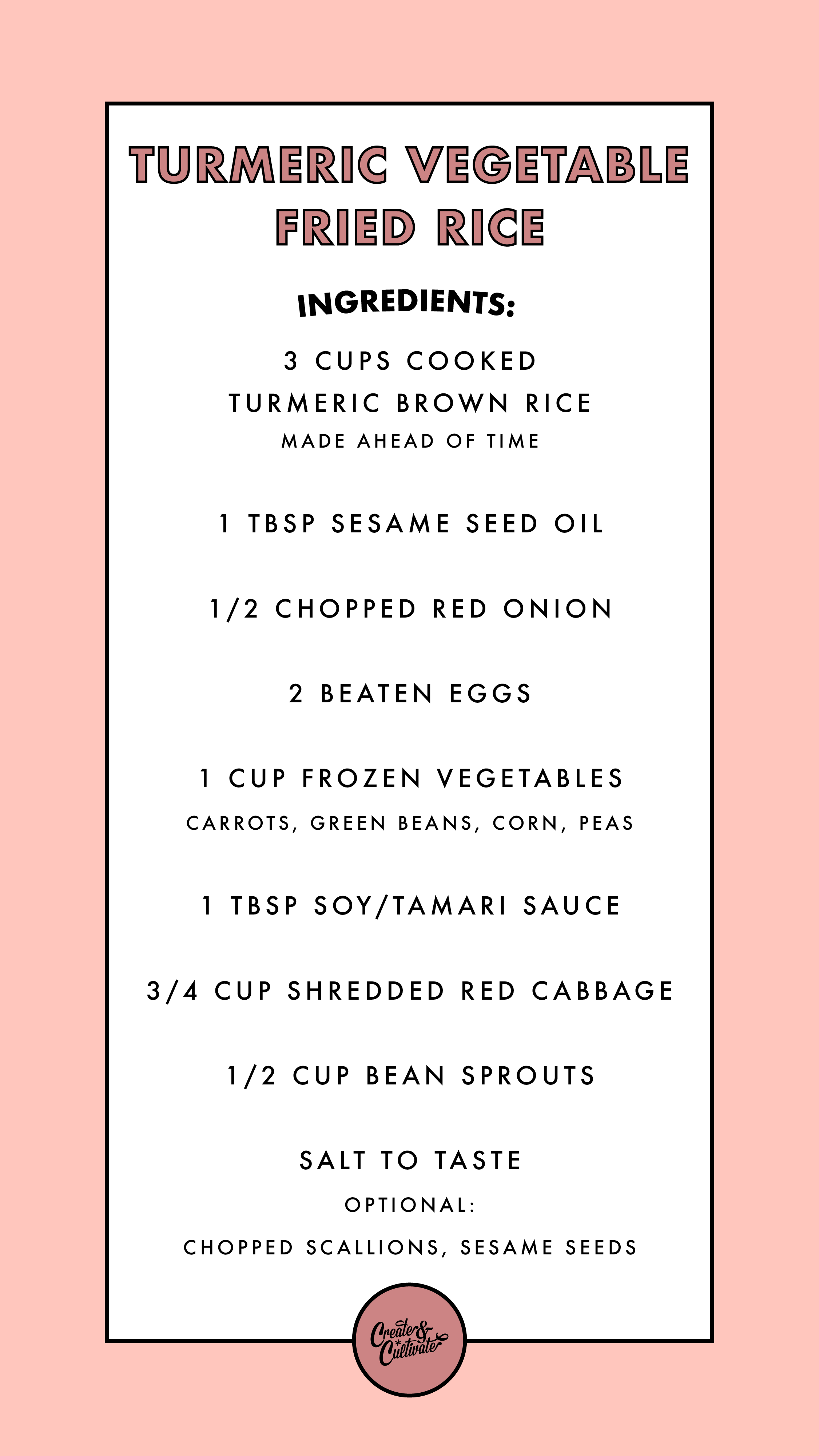

Turmeric Vegetable Fried Rice

This recipe puts a colorful spin on traditional fried rice with extra anti-inflammatory power! Wendy Lopez and Jessica Jones, registered dietitians, certified diabetes educators, and the founders of Food Heaven, bring us this easy and delicious way to make the most of super-spice turmeric!

When cooking your brown rice, add 1/2 tablespoon of turmeric to the boiling water, and cook as per package instructions. Set aside once done.

In a large pan, heat the sesame oil, and add the onions. Sauté for 1-2 minutes over medium heat.

Add in the eggs, and cook for 1-2 minutes.

Then add in the mixed vegetables, 2 cups of cooked turmeric rice, and the soy/tamari/aminos.

Cook over low heat for 4-5 minutes.

Turn off the heat, and mix in the cabbage and sprouts. Add salt, to taste, and top with scallions. Enjoy!

Recipe Note: The vegetables in this recipe are totally flexible and you can use whatever frozen/raw veggies you have stocked in the fridge.

Registered dietitians, certified diabetes educators, and founders of Food Heaven

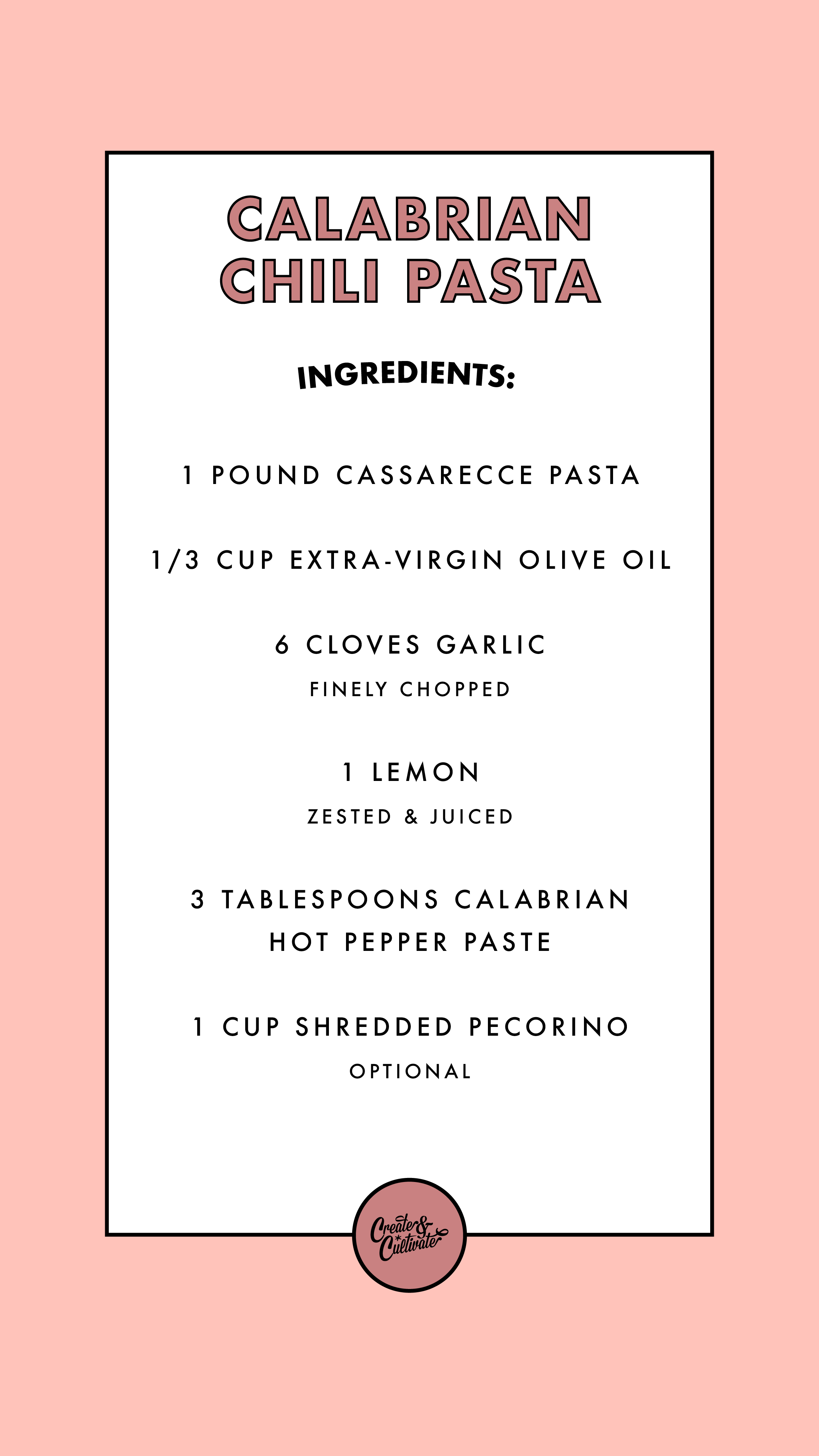

Calabrian Chili Pasta

Pasta, our fave go-to for easy dining, doesn’t have to be boring! Gaby Dalkin is a trained chef, recipe developer, entrepreneur, and the founder of What’s Gaby Cooking, shows us how to spice up the pasta you are probably eating for the millionth day in a row.

Fill a large pot with water and bring to a boil. Cook the Cassarecce according to the package directions. Once al dente, drain the pasta, reserving 1 cup of pasta water for future use and set aside.

In a large sauté pan, add the olive oil and heat over medium heat. Add the garlic and sauté for 30 seconds until fragrant. Add the lemon zest (saving the lemon juice for later) and sauté for 15 seconds. Add the Calabrian hot pepper paste and stir until everything is evenly incorporated.

Add the cooked pasta and stir to combine. If you need to add a few tablespoons of the reserved pasta water to thin it out, go ahead. Add the lemon juice and toss to combine. Season with salt to taste.

Sprinkle the pecorino over the pasta if desired and toss to coat and serve immediately.

Founder of What’s Gaby Cooking

This story was originally published on April 13, 2020, and has since been updated.

MORE ON THE BLOG

4 Organization Hacks to Help You Take Control of Your Life

We call it self-care.

Photo: Teona Swift from Pexels

When your home is cluttered and chaotic, it can be difficult to muster up the energy needed to tackle even the smallest of chores. The worse it gets, the harder it is to find both the time and strength to put things right. But all that disorder is actually doing you harm.

Research has shown that living and working in a clean, orderly environment is beneficial to both mental and physical health. Well-organized spaces lower stress levels, increase motivation, improve sleep, and even encourage healthier decision-making.

Organizing and cleaning a cluttered house may seem like a colossal task, but if you break it into smaller pieces, you’ll be amazed at what you can achieve. Here are four small(ish) organization hacks and decluttering tips to help you get started today.

Get Your Closets in Order

When your household closets are well organized, everything is so much easier to find. (In other words, you’ll never be late for an early morning meeting again!) No matter what kind of closet you’re looking to tackle, the following six steps should help you straighten things out:

Gather your materials. You’ll need some basic cleaning supplies and boxes for sorting. Empty the closet of all contents.

Wipe down the shelves and sweep/vacuum the closet floor.

Sort the contents of the closet into three piles: keep, donate, and trash/recycle. If you’re having trouble deciding whether something is worth keeping, ask yourself, “Have I worn/used this in the last year? If my home burned down and I lost everything, would I replace this?”

Assess your storage needs and make any adjustments necessary, such as installing shelves or making use of baskets and bins.

Organize the closet contents by grouping similar items together. Place the items you use most often in the most accessible area and seldom-used items toward the back of the closet or on a high shelf.

Once your closet is properly organized, keep it that way by maintaining it throughout the year.

Organize Your Files and Records

Whether you use your home office for work or for managing your household's most important documents, you can't get much done if your files are a cluttered mess. Fortunately, putting things in order isn’t difficult!

Tools you’ll need: A shredder, a scanner, and a recycle bin.

Start by coming up with a system to organize your files. It can be alphabetical, numerical, or whatever makes sense to you. Then, set up folders for each type of document being filed. For instance, you might have one folder for medical forms, one for tax documents, and one for household manuals. By constructing a clear and straightforward filing system, you’ll always know where to look for important documents.

Next, gather up everything in the house that needs to be filed. Make sure to grab any mail tucked away in various nooks and crannies, documents or manuals that were randomly pigeonholed, and odd papers strewn about on tables and counters. Sort the documents into four piles: urgent, file, shred and recycle.

Once your papers have been sorted:

Place your “urgent” documents (like high-priority bills) in an obvious spot on your desk. It may help to have a tray specifically for this purpose.

Digitize all documents you plan on keeping. There are many reasons to scan your records, but chief among them is that it’s far easier to back things up. Name the files appropriately and then move them to the applicable folder.

For physical copies, you need to hang onto (i.e. birth certificates), place documents in a flood/fireproof safe.

Collect all items for disposal. Shred anything containing account numbers, birth dates, maiden names, passwords, pins, signatures, or Social Security numbers. Recycle what’s left.

It’s paramount you back up all of your important files. Natural disasters and computer crashes seem to happen when we least expect them, and you don't want to lose anything you need. Backups can be kept on an external drive, in cloud storage, or in a safe.

Catalog Your Photos

Like your household documents, organizing your photos begins with gathering them all up into one central digital or physical location. As you do this, be sure to preserve any existing organizational structures—such as digital folders, paper envelopes, or albums—as these often provide information about a group of photographs. Then you can get to work!

For digital photos:

Review and edit: Delete duplicate, repetitive, and poor-quality shots. Edit what’s left by cropping and rotating, removing red-eye, and touching up exposure and contrast where needed.

Create folders: Choose a method for organizing your photos on your computer. You can do it chronologically, by theme, or even by person/pet.

Rename and file: Rename each photo and place it into the folders you created.

Backup: Back up each batch of photos as soon as they’ve been organized into folders using at least two of the following methods: an external drive, the cloud, an online storage service, or physical copies.

Delete: Erase the photos from your camera or phone to avoid accidentally downloading duplicates and to create space for your next photo opportunities.

Keep it up: At least once a month, download photos from your camera/phone to your computer to avoid them being lost.

For physical photos:

Be prepared: In order to properly organize your pictures, you will need to invest in a large set of photo albums as well as some photo boxes.

Sort: Arrange your prints into groups by year, event, or subject.

Record details: As you sort, write an identifying description on the back of each photo with an acid-free, photo-safe pen. You can record details such as the date or who's in the photo.

Cull: Throw away photos that are blurry, poorly exposed, or are of something you don’t feel the need to keep.

Digitize: Scan your prints and sort them into your digital folders. This will serve as a backup should anything tragic happen.

Display: Put your favorites into an album or frame!

Photographs need special care to survive the passing of time. Storing your photos properly is incredibly important to their longevity. Albums with acid-free plastic sleeves and specially designed photo boxes are the best way to keep them safe. Since temperature, humidity, and light can negatively affect photos, keep them stored in a cool, dry area—and avoid storing them in basements or attics.

Whip Your Garage Into Shape

If you've accumulated a gargantuan amount of clutter in your garage, you are not alone. Garages often become a dumping ground for all those items that we don’t know where to stash. If you’re ready to take on the giant project that is your garage, here’s how to go about it.

Tools you’ll need: Some heavy-duty trash bags, broom, shop vac, and plenty of storage bins.

As with your closets, you’ll need to start by purging the garage of its contents before you can start to organize. Arrange your bins, baskets, and trash bags beforehand. Lay everything out on your driveway and being to sort it into categories (e.g. car supplies, tools, sports equipment, lawn, and garden). Once you’ve done that, you can separate the items you wish to donate, sell, or throw away.

Clean your garage well, making sure to dust shelves, sweep out cobwebs, and wash the floor. Assess your garage storage needs and decide how you’d like to utilize your vertical space (pegboards, cabinets, shelving, etc.). Once everything is properly installed, you can move items back into the garage and store them in their proper homes. Place frequently used items closest to the garage door. If you have children in the house, make sure household chemicals and other dangerous items are stored in a locked cabinet.

Take It to the Next Level

As you get better at organizing, you can start creating “centers” around your home, such as a homework center or a recycling center. Sectioning your home in such a way can help you to keep clutter at bay and use your space to its fullest potential.

Organizing your house doesn’t have to be an overwhelming operation. By breaking big jobs into smaller tasks, you can squeeze a little bit of organization into a few hours of your time. And believe it or not, finishing even the smallest of these projects in a weekend will put you in a good mood for the rest of the week.

About the Author: Liz Greene is a feminist, makeup enthusiast, and anxiety-ridden realist from the beautiful city of trees, Boise, Idaho. When she’s not writing, she enjoys eating fancy cheeses, fantasizing about what life would be like if she had an Iron Man suit, and re-watching Venture Bros. episodes for the 100th time.

Love this story? Pin the below graphic to your Pinterest board.

This post was published on November 15, 2018, and has since been updated.

MORE ON THE BLOG

How Being Overdressed for an Interview Can Negatively Affect Your Chances of Landing the Job

Make a great first impression.

Photo: Create & Cultivate

Once you schedule an interview, these are just a few of the questions that might be swimming in your head: What if I show up and I’m overdressed? What if I’m underdressed? Will it even make that much of a difference? How bad is it really to be overdressed for an interview?

According to data released in the Job Interview Anxiety Survey, 92% of employed Americans get stressed out about job interviews, but it’s not just the actual interview that stresses people out. Figuring out what to wear for an interview can often become just as stress-inducing as wondering what questions they will ask you.

With the rise of startups and tech companies with laid-back company cultures, figuring out what to wear for your next interview has become more confusing than ever, but these tips will help you navigate the process with ease.

How bad is it to be overdressed for an interview?

Really bad.

If you’re interviewing at a company known for its laid-back dress code and company culture, showing up to your interview in a suit will show that you haven’t done your research on the company and the environment.

Even worse, showing up in a suit could mean that you did research the company and didn’t care about the dress code and rules.

What can you do to ensure that you’re properly dressed?

Research the company to figure out what the company culture is like. Company culture often dictates the dress code and how formal or casual people will dress. Use websites like Glassdoor to your advantage. These platforms allow users to rate and comment on companies, giving you inside knowledge about the company culture, and what it’s really like to work there. Often people will discuss dress code and the general vibe of the office.

Another option is to search for employees on LinkedIn. Observe what employees are wearing in their LinkedIn profile photos to get a better sense of the daily dress code.

Finally, if all else fails, pick up the phone and ask someone about the company’s dress code. This is something so simple, yet almost no one does this. If you want to make sure that you won’t be overdressed for an interview, simply pick up the phone and call the front desk or a recruiter that you’re working with.

If the dress code is really casual, stick with the guidelines, but ensure that you look put together and ready for work.

This is the most important thing to remember when you’re figuring out what to wear for an interview. I always suggest being a step above the dress code, but if you do decide that it would be in your best interest to come completely casual, just make sure that you look put together. Regardless of whether or not the dress code is super casual, you do not want to look like you just rolled out of bed. You’re still interviewing for a job.

If you do decide to go with jeans, make sure they are dark wash jeans without any rips or tears. Similarly, if you opt for a T-shirt, make sure that it is clean, plain without graphics or logos, and wrinkle-free. If you don’t like to iron, (I hate ironing!) invest in a mini steamer. It will change your life and make it super simple to get the wrinkles out of any of your clothes.

How bad is it to be overdressed for an interview? Depending on the company it could be detrimental and could be the reason why you don’t get the job. Showing up completely overdressed suggests that you didn’t research the company and have not paid any attention to the company culture.

Employers want to ensure that they hire employees who will fit in with the general office vibe, and showing up to an interview overdressed can be a major red flag. When you’re determining what to wear for your next interview, do some research on the company dress code and company culture, and dress accordingly. With the rise of business casual and completely casual dress codes, figuring out what to wear for your next interview can be tricky, however, if you follow these simple steps, you’ll be good to go.

Good luck!

About the author: A native San Franciscan, Michele Lando is a certified professional résumé writer and the founder of writestylesonline.com. She has a passion for helping others present the best version of themselves, both on paper and in person, and works to polish an individual’s application package and personal style. Aiming to help create a perfect personal branding package, Write Styles presents tips to enhance your résumé, style, and boost your confidence.

Love this story? Pin the below graphic to your Pinterest board.

This story was originally published on September 21, 2018, and has since been updated.

MORE ON THE BLOG

Everyday Humans Founder on WFH (From Hong Kong!) and Making It Work 12 Hours Ahead of EST

Asana is key.

Photo: Courtesy of Charlotte C. Pienaar

Welcome to our monthly editorial series A Day in the Life where we ask women we admire to share the daily minutiae of their professional lives, from the morning rituals that set them up for success to their evening wind-down routines. This month, we caught up with Charlotte C. Pienaar, the founder of Everyday Humans, to chat about what inspired her to launch an SPF-led skincare brand, why she’s working toward the goal of no screens before 8 a.m., and how she manages her time while working 12 hours ahead of EST.

Tell us a bit about Everyday Humans and what inspired you to launch your business. What whitespace did you see in the market, and what need did you want to fill?

We’re a newly launched DTC skincare brand that makes comfy, planet-friendly sunscreens for all. As a conscious founder who cares about the planet and cultural diversity, I’m passionate about sustainability and inclusivity and created Everyday Humans with the belief that sunscreen should be for all humans and the foundation of all skincare routines. I saw a whitespace in the market for SPF-led skincare products that combined multi-tasking formulas, good for the planet packaging at everyday prices.

Now, let’s talk about your workday routine! First, are you a night owl or a morning person? When do you do your most important work and why?

I’m physically a morning person so I schedule calls with the team and external parties and review my to-do list in the morning, then I do reactive work throughout the day, like approving things, responding to emails and requests, and general ops and coordination work. My brain only fully activates and the real magic happens in the after-hours when my creative side kicks in—deep-dive research, product ideas, campaigns concepts, marketing strategy—comes through at night.

What time does your alarm go off, and what’s the first thing you do upon waking?

I have two children so my alarm is my youngest who is one and a half years old and I get up before 6 a.m. on most days. The first thing I do is to get to the kitchen to make a bottle of milk for him. Nothing fun or glamorous, just good ol’ parenting.

What does your morning, pre-work routine look like?

This is the time when the entire family sits together for breakfast before work or school. I try to be as present as possible to spend quality time with my husband and kids. Sometimes, urgent emails and requests get in the way but I’m working towards no screens before 8 a.m.!

Take us through your morning skincare routine. How do you prepare your skin for the day?

I’m a really lazy skincare person so I like products that are multi-purpose and can combine steps. The first thing in the morning is to wash my face to get rid of excess oils that developed overnight. I’ve been really into face cleansers with a gentle exfoliant as it brightens and resurfaces my skin before I apply any skincare on so everything absorbs better. We’re in the midst of developing one so it’s extra awesome to try many brands and to test drive what works for me.

After that, it’s toning. I've recently been obsessed with Hada Labo’s lotion as it’s a toner, serum, lotion combo that helps my skin feel prepped and ready to go. My last and most important step is a multi-tasking serum and sunscreen, and of course, it would be my Resting Beach Face SPF30 sunscreen serum, which is a super lightweight organic SPF30 and hydrating serum all rolled up in one. It doubles up as skincare as it has moisture-boosting hyaluronic acid and pentavitin, antioxidant-rich spinach and green tea extract, and kopara extract that wards off urban pollutants and pollution. I rarely wear make-up so the bonus is it leaves a gorgeous lit-from-within finish that makes my skin look healthy, glowy, and well-rested.

Mark Twain said, “Eat a live frog first thing in the morning and nothing worse will happen to you the rest of the day.” What’s the first thing you do when you get to your desk?

The first thing I do in the morning is also the most important. I update my to-do list to make sure I have a bird’s eye view of what I have to work on for the day and schedule and prioritize accordingly.

What are you working on this week?

It’s been an interesting week as I’m on a 21-day quarantine and trying to balance work with two small children! We’ve just done a one-year review of the brand, putting together what we’ve achieved so far, what we’ve missed the mark, and how we’re going to improve in the future. It’s been challenging to work with kids in the background but I love doing big-picture and strategy work to align with all stakeholders so this has been a great week.

What’s been the most rewarding part of running your business? The most challenging?

Seeing customers happy and calling our sunscreens their holy grail. We have a Slack channel where we share mentions, reviews, and customer feedback to the entire team and it always makes me smile from the inside when we receive a positive note from a total stranger. The most challenging part is to always be one step ahead of the game. We’ve just celebrated our one-year anniversary and the landscape has changed so much since the inception of Everyday Humans. To be able to not lose sight of your mission while being able to innovate, plan ahead and execute flawlessly are all super hard but when you overcome obstacles and come out stronger and wiser, it’s incredibly rewarding.

Do you ever reach inbox zero? What tips can you share for handling the constant influx of inquiries and communication founders are so familiar with?

TBH I don’t think it was ever a goal, and friends are freaked out by the amount of unread messages I have! I love subscribing to newsletters so perhaps that doesn’t count?

What is your go-to work lunch?

I try to limit my carb and protein intake to keep my energy up. My go-to’s are a healthy helping of vegetables in various forms—steamed, stir-fried, grilled, raw—just as it is or as a warm or cold salad, my other go-to is brothy and vegetable-heavy soups that keep me full without feeling like I’ve overeaten (or else I’ll get sleepy!). I’ve always made my own lunches—even before the pandemic—so it’s extra awesome to see how other people put together theirs and take inspiration from them.

What advice do you have for balancing the minutiae of day-to-day tasks with big-picture planning?

By making it compulsory. We schedule monthly huddles, quarterly check-ins, bi-annual re-alignment, and annual planning.

What are some work habits that help you stay healthy, productive, and on track to reach your goals?

Taking time off every month to focus on your hobbies is compulsory at Everyday Humans. I try to encourage our team to share what we do outside of work and it’s been fun to learn about everyone’s interests. There’s something about sharing your intentions with a close group that encourages you to act on them. I’ve picked up some new hobbies that I never thought I would get into, like journaling, virtual workouts, and pottery because I spoke about it to my co-workers!

Any favorite apps you use regularly?

We run our entire company off project management software Asana so that’s my #1 favorite app.

What are you reading, watching, or listening to right now to help you wind down at the end of the day?

“Pop Culture Happy Hour” to keep me up to date as I’m so behind with gossip, lol. “Stuff You Should Know” is amazing and the good ol’ “How I Built This with Guy Raz.”

When do you go to bed? What’s your “optimal” number of sleep hours?

As I’m 12 hours ahead of EST, it’s hard to not stay up late for calls and emails till midnight or 1 a.m. The ideal is to be in bed before 10:30 p.m. and my optimal is 8 hours of uninterrupted sleep.

What’s the most rewarding part of your day?

Besides happy customers, seeing my team members grow makes me super happy. My job is to empower and equip my frontline staff to make better decisions than myself, so witnessing the fruits of my labor is incredibly rewarding.

MORE ON THE BLOG

Is Upstate New York the New Silicon Beach? 3 Founders on How Moving From the City to the Country Benefited Their Biz

Entrepreneurs are flocking to this incubator haven.

Upstate New York has always been a haven for creatives, and when COVID hit in 2020, many founders relocated from New York City to upstate out of necessity, desire, or both. Below are profiles of three entrepreneurs—Trinity Mouzon Wofford, the founder of Golde, Eliza Blank, the founder The Sill, and Hillary France, the founder of The Wylde—who made the move from the city to the country last year. Read on to discover how the change impacted these founders and their businesses.

Trinity Mouzon Wofford, Founder of Golde

Saratoga Springs, New York

During the summer of 2020, when COVID was surging, Trinity and her fiancé Issey, the cofounder of Golde, spent the summer in Saratoga Springs to gain some relief and safety from the intense situation in N.Y.C. They were going back and forth from Saratoga to Brooklyn, a three-and-a-half-hour ride each way, when Trinity had the realization that, for the time being, it made sense to return full-time to upstate New York to live and run their business.

On one ride down from Saratoga during late summer, she remembers thinking to herself that she needed to go back; that perhaps running her superfood health and beauty startup, Golde, and paying rent in Brooklyn for too little space was not benefiting the growth of her business nor her own personal growth. On top of these challenges, Trinity and Issey are in an interracial relationship and, in the city, tensions were becoming palpable during the summer of 2020 in response to the BLM movement and the upcoming election. In a way, she felt as though the systems of the city were starting to fail her and she needed to actively change her surroundings for the benefit of herself, her family, and her business.

Trinity grew up in Saratoga Springs. In fact, four generations of Trinity’s family have lived in the same house that she returned to, where her mother still lives. Returning to the house that her ancestors had lived in for generations felt very natural and provided a safe space to gain a fresh perspective. It’s allowed her to go deeper into outlets such as gardening and plant care, which, in her own words, have allowed for more creativity. Not surprisingly Golde has benefited from this positive energy and change.

During this past year, Golde has been lucky. The business hasn’t been negatively affected, and has, in fact, thrived. In January, Golde launched in Target, and one of the brand’s two new products scheduled for release in 2021, Shroom Shield, has launched. The team has always been remote so no adjustments were needed in order to keep the business running smoothly. The lack of pressure to be everywhere and do everything, something that anyone who lives in a big city can relate to, has allowed her to realize that she can’t predict the future. She can only think a few steps ahead, and for the first time, she is living in the moment and is fully enjoying it and the lack of pressure this brings.

Eliza Blank, Founder The Sill

Stone Ridge, New York

It’s a similar story for Eliza. Coincidentally, both she and her husband Steve grew up in more rural areas of Massachusetts, so the desire to feel the grass under their feet has always been there. She found herself at NYU for university, and although she loved the city, she always missed nature. It’s this love of nature that inspired her to start The Sill, an online plant nursery that delivers botanicals right to your doorstep. It also inspired her to buy her first home in Stone Ridge, situated in the Catskills, in 2015.

The paths to starting The Sill—as well as finding a house in upstate New York—were not straightforward ones. Eliza found raising money for The Sill to be challenging. Venture capitalists often want fast growth at all costs, and Eliza was committed to making sure her foundational economics worked, which, for her, meant slower growth with her eye on profitability from day one. After an arduous raise, she is confident they found the right investors for The Sill, and these investors have been by her side navigating the most difficult year yet. As was the case for most businesses, March 2020 was a very dark time. All five of The Sill’s stores were closed and the distribution center in California was forced to shut down. The bright spot is that sales didn’t suffer. As it turns out, people look to plants for emotional support, and since people could not be together, they found connection in giving small gifts of kindness in the form of plants to each other.

In 2015, when buying their house upstate, Eliza realized that their mortgage would be less expensive than their rent in the city. Little did they know that five years later this house would become their permanent residence, sanctuary, and office for over a year. The past 18 months have led her to question if the social convention of the office is necessary. Does the team even need a five-day workweek? Eliza has started to hire permanently remote team members as far away as Hawaii and the business’s headquarters are now fully remote. For Eliza, she firmly believes that the space and closeness to nature their home provided them mitigated the extreme pressure and stress she experienced during COVID as a leader and also as an Asian American woman. Her home upstate became an oasis from what the world had become, or perhaps further revealed, that we live during a time of extreme unrest and racism.

When asked what’s next for her and her business, Eliza responds that she wants to live a life well-lived. She wants her two-and-a-half-year-old daughter to have the space to play and become independent. For the business, she wants to further realize the broad ways in which nature can be infused into our homes and what the brand essence of The Sill is, and how it can evolve to fit into this new space that we have all found ourselves living in. For Eliza’s family, they will go back to the city for a year in the fall and see how it feels. For right now, the country has allowed her to have creative breakthroughs and reimagine how The Sill can further help us maintain our well-being within our home as we spend more time there than ever before.

Hillary France, Founder of The Wylde

Hudson, New York

Hillary had always thought she would make the gradual move from spending weekends in Hudson, New York to living there full time. What she could not have predicted was that this move would happen as abruptly as it did in March 2020. For seven years, through her company Brand Assembly, Hillary had been running trade events for some of the most enviable fashion brands. Her business had been thriving, and then, within the first month of COVID, the Brand Assembly’s trade show business was almost obliterated.

She saw an 80% drop in activity and she soon found herself in the position of having to reimagine her whole business model. She immediately gave up her office, attempted to pivot but was unable to make it work, and slowly drained her resources. She had to accept that perhaps this almost fully offline and in-person event business was not an operation that could survive a pandemic. Not surprisingly, for the last year, her trade show business has been on hiatus (and the good news is that they are set to return in October of 2021), however, the backend operations piece called The Faculty is still fully functioning. This situation could have fully devastated Hillary, but instead, it pushed her to finally pursue a dream she had always had: to create a space for brands and community to convene in one place in Hudson. At that point, she had nothing to lose so she packed her bags, gave up her N.Y.C. apartment, and moved to her weekend house in Hudson to create what is now called The Wylde.

Hillary had spent nine years going back and forth to Hudson and saw an opportunity for a retail annex in this quickly growing city. In fact, Hudson was recently ranked the #1 metro area in terms of the biggest change in net migration. With the influx of people to the area, she figured there was more of an opportunity than ever to create a space where people could feel a sense of community and continue to be inspired by fashion and conversation. On April 17, 2021, Hillary launched the Wylde’s first outdoor market Summer Saturdays with a selection of handpicked vendors across apparel, accessories, vintage, and apothecary. Local N.Y. brands like M.Patmos, Hudson Hemp, and Lail Design are featured within the market while the permanent retail store that opened on April 30th launched brands like Rachel Comey, Dôen, Mondo Mondo, and more.

Is The Wylde solely an upstate dream? In Hillary’s mind, it’s not. When taking the Amtrak train down to the city she has daydreams of opening The Wylde up in another emerging market if she finds success in Hudson. Rather than feeling consumed by the fashion space she feels excited about how fashion, culture and even coffee (a Wylde cafe is slated to open in August 2021) can bring people together to create community and meaning. This evolution of the business more truly reflects the changes she has felt personally this past year and the community that she had always sought to be a more permanent member of.

Melissa Grillo Aruz, Founder of Aruz Ventures

About the author: Melissa Grillo Aruz has been an active part of the New York startup ecosystem for the past 20 years having senior roles at Forerunner Ventures, Gilt Groupe, and more. She currently runs her own marketing and talent consulting business under www.aruzventures.net where she helps commerce companies scale their business. She currently splits her time between upstate New York and Brooklyn. Instagram and Twitter @melgrilloaruz.

MORE ON THE BLOG

7 Reasons You Should Declutter and Organize Your Desk Right Now

Do it for the endorphins.

Photo: ColorJoy Stock

It’s hard not to fall prey to the American drive to have more. We live in a consumer-driven culture. Case in point, one of the first idioms I learned was, “Keeping up with the Joneses.” But as we fritter away our hard-earned money on “stuff,” we start to accumulate more than we can actually handle. Before we know it, we’re drowning in the byproducts of capitalism.

Years and years of this “more” mentality has caused a subtle shift in our culture. Many of us are starting to seek a more simplified life. We’re looking to surround ourselves only with the things we either truly love or truly need.

However, actually obtaining (and maintaining) such a lifestyle means getting rid of a lot of possessions—and then organizing what’s left. Although this may seem like an insurmountable task, it’s ultimately worthwhile.

Why?

Because decluttering and organizing feels amazing.

It's a Rush

Did you know that decluttering and organizing releases endorphins? One of the main reasons why these tasks are so satisfying is because our brains are literally pouring on the feel-good chemicals. This leads to reduced stress and anxiety and improves our mood!

One way to really get those endorphins flowing is to take on a task that you perceive to be more difficult or challenging than others. For instance, consider organizing your digital photos. According to a survey by Everpresent, 83% of families have not consolidated their digital photos into a single library. Gathering all of your photos into one place, arranging and labeling them, and then uploading them to an online library or external hard drive can take many hours (or even days). That said, the rush you’ll get when the job is done and your precious memories are safe will be well worth it!

It Gives You a Sense of Accomplishment

So many of life’s little chores don’t leave you with an observable end product. You work and work and work, and… nothing. Decluttering and organizing, however, delivers results you can really see. And believe it or not, achieving these results can have positive effects in other areas of your life.

When you accomplish a goal—even a small one such as cleaning out the junk drawer—you gain confidence. You realize that you can succeed when you put your mind to something. The more of these tasks you accomplish, the more confidence you build. These repeated triumphs arm you with the courage you need to face all of life’s challenges.

It Gives You Control

Creating a clean desk space gives you a sense of control over your environment. Since we often feel a lack of control in other areas of our lives, having this control over our homes is incredibly comforting (even if it’s only on a subconscious level).

What’s more, there’s actually an evolutionary need for that control. Humans are wired to keep track of their surroundings at all times. We’re naturally drawn to uncluttered spaces that are easier to scan—and when we’re safely within them, we feel more relaxed.

It's Meditative

It’s a strange thing to say, but the mindlessness of cleaning is actually one of its biggest perks. The physical elements of housework are often simple, repetitive tasks. This makes the activity highly meditative. Whether you listen to music or podcasts while you clean or let the silence of the house take over, allowing your brain to take a break from everyday thoughts while you clean is the perfect way to meditate while staying active.

It Makes You Feel Better

Disorganization can have a terrible effect on your sense of self-worth. If your home is cluttered and dirty, it’s not hard to internalize. The more disordered and disheveled your environment becomes, the worse you end up feeling about yourself.

A 2010 study from the University of California revealed that women who described their homes as being cluttered or filled with unfinished projects were more likely to be depressed and fatigued than women who characterized their living spaces as being restful and restorative. They also found that women who lived in cluttered environments had higher levels of the stress hormone cortisol.

It’s a Stress-Buster

Speaking of stress, clutter is surprisingly hard on our brains. Your brain is constantly processing visual information, and too much clutter can make it hard for it to be efficient. Keeping your home decluttered and organized helps to reduce unnecessary stimuli and allows you to stay focused on your goals.

It Makes Life Easier

One of the greatest reasons to declutter (besides it feeling awesome) is as a segue into a minimalist lifestyle. Every item you get rid of is one less thing you have to find a place for, regularly clean, maintain, and repair. The fewer items you own, the less time and energy you have to spend on taking care of things. Instead of collecting stuff for the sake of having it, only purchase and hold onto the items that mean something to you or you genuinely need.

It Empowers You to Move Forward

Have you ever kept an item strictly because you felt obligated to? An invitation to a friend’s wedding or a ticket stub from a concert? Sometimes the only reason we save items is that we feel responsibility, nostalgia, or even guilt when we look at them. But, in the spirit of minimalism, if we don’t love or use something, there’s no reason to keep it. Getting rid of these items will help you stay focused on the present and the future, rather than burdened by the past.

More and more people are starting to realize that the decades-old crusade to accumulate as many worldly goods as possible doesn’t always lead to happiness. In fact, it’s quite the opposite—too much stuff can lead to added stress and anxiety. Taking time to declutter and organize your home is a surefire way to feel more relaxed, in control, and at peace. And that’s worth all the money in the world!

About the author: Liz Greene is a feminist, makeup enthusiast, and anxiety-ridden realist from the beautiful city of trees, Boise, Idaho. When she’s not writing, she enjoys eating fancy cheeses, fantasizing about what life would be like if she had an Iron Man suit, and re-watching Venture Bros. episodes for the 100th time.

This post was originally published on September 24, 2018, and has since been updated.

MORE ON THE BLOG

How Shenae Grimes and AnnaLynne McCord Balance Being BFFs and Biz Partners

This week on WorkParty, the co-hosts of "Unzipped" don't hold back.

Photo: Courtesy of Shenae Grimes & AnnaLynne McCord

Listen to the full episode here.

Going into business with a friend can be an incredible experience, but it can also be a real challenge. You need to ensure your values, goals, and work ethics align.

So, how do you make it work with your bestie? How do you maintain healthy boundaries between being friends and being business partners? How do you navigate creative differences and make sure both of your opinions are heard?

To talk about what it really takes to go into business with a friend, Jaclyn Johnson, founder and CEO of Create & Cultivate and host of the “WorkParty” podcast, chatted with Shenae Grimes and AnnaLynne McCord on this week’s episode of “WorkParty.”

Although Shenae and AnnaLynne played fictional best friends on the CW show “90210,” today, they’re real-life besties and co-hosts of the podcast “Unzipped” where they talk about everything from friendship and parenting to pop culture and social issues.

On the “WorkParty” podcast, Jaclyn asked these BFFs turned business partners what it’s like to navigate the friend-business-partner relationship, why they decided to launch a podcast, and so much more. Listen to the full episode here.

Subscribe to WorkParty and never miss an episode.

On starting a podcast together…

“We like people's stories. We like having in-depth conversations. We like questioning ourselves, we like questioning other people, and we're not afraid to quote-unquote go there.” — Shenae Grimes

On finding value outside of your career…

“You can be rich in life and not be the richest and most famous.” — Shenae Grimes

On being an advocate for children…

“I want to be a part of creating a world where we don't see the number of child suicides that we're seeing right now. For example, children as young as eight and nine years old, are killing themselves.” — AnnaLynne McCord

On prioritizing a career with work-life balance…

“Ultimately, what led me down wanting to get into the content creation thing and veer away from acting was the freedom to work from home, so that I could physically be present with my family instead of on a set for 16 hours a day.” — Shenae Grimes

On balancing friendship and business…

"This is business. If there's a decision that needs to be made, this is not about your heart or your feelings, this is about money." — AnnaLynne McCord

Keep the WorkParty Going By

Supporting Our Sponsors

MZ Wallace is offering WorkParty listeners 15% off your first purchase.

Level up your small business by going to JustWorks.

MORE ON THE BLOG

Why You Should Dress Up for a Phone Interview

It’s called power dressing for a reason.

Photo: ColorJoy Stock

You may be wondering how clothing affects your ability to communicate. It all starts with that first impression. First impressions mean a lot.

Think about how often we judge people almost immediately based on their appearance. Clothing is a tool that can help you take control of how people see you and manipulate their viewpoint. Do you want to appear as a strong, knowledgeable, and confident individual? Your clothing can help with that!

In Jennifer J. Baumgartner’s book, “You Are What You Wear: What Your Clothes Reveal About You,” she explains that, “Our closets are windows into our internal selves. Every one of us attempts to say or hide something in the way we wear our clothes.” Use your clothing to positively affect how you communicate by taking the opportunity to show people who you are and what kind of person you want to be.

Below are some tips to help you dress in a way that communicates authority and demands respect.

Dress for the Job You Want, Not the Job You Have

You’ve probably heard this before, but there’s a reason it keeps coming up. Work hard, be respectful of others, and dress as if you’re the boss. There’s something empowering about dressing "up." It changes your demeanor and studies have shown that it influences the way we think. I often tell clients to dress up for phone interviews because it makes a difference in how you think and how you speak.

We’re often able to think more clearly and efficiently when dressed in workwear because it differentiates us from a more laid-back and social environment in which one would wear casual clothing.

You Will Be Judged on Your Appearance, so Take Advantage of It

Whether or not it’s right, it’s human nature to judge others based on their clothing and appearance. Since this is a known fact (people with straight teeth are considered more successful), take advantage of what you can and dress to impress. This doesn’t mean that you need to spend a lot of money on designer clothing, however, you should be dressing in clothing that is flattering and appropriate.

If you’re going to a meeting, opt for a pair of fitted slacks instead of jeans. It’s a simple switch that will immediately make you appear more professional and more authoritative. Similarly, by switching out a sweater for a blazer, you will make your look more polished and command more respect.

Think About What Your Grandparents Would Say

This sounds silly at first, but when getting dressed for work-related events or meetings, think about how your grandparents would react to the outfit. Everything is a bit more casual (hello, startup life), but that doesn't mean you should be casual in attitude when it comes to your career. If grandma says something's not appropriate, chances are, it's not. You can still dress like yourself and bring individuality to any outfit, but listen to that inner voice. You don't have to dress for the most conservative person in the room but aim somewhere in the middle.

My grandmother has always lived by the motto that you can never be overdressed, and it’s almost always been right. Keep in mind that you want to remain appropriate, however, a suit will almost always be considered appropriate workwear. If you’re in a more casual environment, think of going with bold prints that feel less formal but also polished. Even if others are dressing casually, if you dress to impress, you will be able to communicate more effectively and command more respect than those in jeans and a T-shirt. Plus, studies have shown the dressing to impress enhances people’s ability to engage in abstract thinking.

When you’re wondering how clothing affects your ability to communicate, think about how you want people to see you, how you want to portray yourself to the world, and how efficient you want to be. If you want to be successful, dressing in a polished and professional manner will help you achieve your goal and communicate this objective to others.

About the author: A native San Franciscan, Michele Lando is a certified professional résumé writer and founder of writestylesonline.com. She has a passion for helping others present the best version of themselves, both on paper and in person, and works to polish an individual’s application package and personal style. Aiming to help create a perfect personal branding package, Write Styles presents tips to enhance your résumé, style, and boost your confidence.

Love this story? Pin the below graphic to your Pinterest board.

This story was originally published on October 5, 2016, and has since been updated.

MORE ON THE BLOG

When COVID Hit, She Had to Close Her Restaurant—Now Her Products Are Flying Off the Shelves at Whole Foods

And she hasn't taken any venture capital.

You asked for more content around business finances, so we’re delivering. Welcome to Money Matters where we give you an inside look at the pocketbooks of CEOs and entrepreneurs. In this series, you’ll learn what successful women in business spend on office spaces and employee salaries, how they knew it was time to hire someone to manage their finances, and their best advice for talking about money.

Photo: Courtesy of Ayeshah Abuelhiga

Ayeshah Abuelhiga was first inspired to open her own restaurant while working at local eateries in Washington, D.C. as an undergraduate at George Washington University. “It’s where I learned the value of a hard-earned dollar, where I learned Spanish, and where I saw people like me who didn’t necessarily have rich parents with white-collar jobs who paid their tuition,” explains Abuelhiga. “I saw the opportunity for restaurants to modernize, and ultimately, I knew that one day I wanted to own a restaurant." And after 14 years of climbing the corporate ladder, she did finally open the doors to her own restaurant, Mason Dixie, an authentic Southern comfort food hotspot, in D.C.

Although she had the make the difficult decision to close her restaurant after six years of serving the D.C. community due to COVID-19, she’s stumbled upon an even more impactful way to modernize the food industry. Like so many small business owners in 2020, she pivoted, identifying an opportunity to bring the wholesome biscuits that people would line up around the block for in D.C. into frozen food aisles across the county. Today, Mason Dixie has evolved into a clean frozen food company that makes biscuits and breakfast sandwiches that are available at over 6,000 stores, including Whole Foods, Target, Safeway, Costco, and more. And Abuelhiga is just getting started.

Below, the founder tells Create & Cultivate how she’s scaled her company sustainably, why she’s opted to raise funds from private investors (rather than through venture capital), and what major mistakes she’s made and learned from along the way.

You started Mason Dixie, in part, because you believe everyone should have access to affordable, wholesome food. Take us back to the beginning—What was the lightbulb moment for Mason Dixie and what inspired you to launch your business and pursue this path?

I grew up poor. I was raised in low-income housing in Baltimore up until I was 11, but my parents did their best to instill the values of home-cooked, wholesome meals. We shopped at farmer’s markets and bought produce that was bruised, but we ate very balanced meals. I notice now looking back that the kids I still remember that I grew up with in Section 8 that ate out of vending machines are still in the system today, and those who had better access to food, are in better places. You truly are what you eat and I have always believed we deserve better.

In that same vein, my immigrant parents owned a soul-food carry-out restaurant and convenience store when I was little and I got my taste for American cuisine from it. It was also a deciding cuisine when my Middle Eastern dad and Korean mother would disagree about whose cuisine would win out for dinner that night. I craved soul food even as I was coming of age in college, but I could never find homestyle, scratch-made comfort food, only fast food equivalents.

Fast forward to college. I was the first member of my family to attend college and since my parents didn’t make a lot of money, I had to work to pay for school, so I worked in restaurants throughout my years at George Washington University. It’s where I learned the value of a hard-earned dollar, where I learned Spanish, and where I saw people like me who didn’t necessarily have rich parents with white-collar jobs who paid their tuition. I saw the opportunity for restaurants to modernize, and ultimately, I knew that one day I wanted to own a restaurant.

So after working for 14 years in male-dominated industries, like tech and auto, and quickly climbing the corporate ladder, I realized I was an upper-level manager who was unfulfilled and had another 20 years to go before I could go after the only female C-level role that I didn’t even want. I was disenchanted and uninspired. So, I decided it was time to start my dream of owning a restaurant. So in 2014, I founded Mason Dixie. I saw a huge opportunity in the lack of comfort food options available in the growing, better-for-you food space, and an even bigger opportunity making biscuits the focal point since there were no real, scratch-made biscuits on the market. I also saw an opportunity to make scratch-made comfort food affordable and accessible to the masses versus just doing better-for-you food in the fine dining realm by looking at the fast-casual scale and ultimately, grocery, as an even better avenue to do just that.

You recently raised $6.3 million in Series A funding from investors—no doubt you’ve learned a lot along the way. What are three crucial elements everyone should include in a pitch deck when raising money and why?

1. Know the problem you are solving and how big the addressable market really is. Frequently I see founders who do not research the market space enough and show a $20M market opportunity. No investor gets excited about the opportunity to take up to 10% of a $20M market. If you make a seed oil and that segment is small, how big is the oil market in general? Sell the sizzle. It’s the opportunity size that gets early-stage investors going. But be realistic. Be able to defend the market size with real data.

2. Know your sales performance and gross margins inside and out; it is ultimately how investors judge your worth. I cannot tell you how many founders I talk to that don’t even know what goes into a gross margin calculation, or where their strongest sales are coming from. This is important stuff you should be able to spat out on command.

3. Know how you are going to use the funds. Don’t just say I need $1M. What is that $1M built from? Half to overhead/salaries, some to equipment, a third to working capital? Show in your projections how you get to that number. You will always be surprised after analyzing cash flow projections how much more you really need than you thought.

You decided to forgo venture capital and instead opted to raise funds from private investors, many of whom are women. What advice can you share for entrepreneurs, particularly WOC, on partnering with the right investors, and what do investors need to bring to the table other than just money?

I say this until my face turns blue and people still look at me like I have three heads but choosing investors is like choosing a husband. They are almost identical on legal paper. They own your assets, you share financial responsibilities with them, and ultimately your relationship will be what allows you to succeed or fail. They are not a bank or a cash lender; they are meant to be business partners.

You have to know the type of personalities you vibe with, what their values are, do you have the same humor even. It’s like dating. You have to ask yourself, “Could I be with these people forever? Are they my people? Do they really believe in me and what I am trying to achieve?” These are some of the top questions I ask of my investors when getting to know them and I highly recommend founders do the same when they go out to raise. This is why for WOC especially, it’s important to find your people. The check is secondary to shared values and work style.

You launched Mason Dixie in 2014, and now the brand is available at over 6,000 stores, including Whole Foods, Target, Safeway, Costco, and more. What has been the biggest challenge in scaling your business and what lessons have you learned along the way? What advice can you share on how to scale a business sustainably?

The hardest part about scaling a fast-paced growth business is predicting growth. There are times when you get it dead wrong and over-project, and there are times you go gangbusters and hit it out of the park. Both scenarios are challenging to plan for.

I think the way we have navigated our business growth best was by learning the hard way at first and then optimizing each year. At first, we sprinted and made some mistakes. We were lucky in that the sprint just qualified us for the next race, but we weren’t ready. We just happened to be the fastest runner in that first race. I would have preferred looking back to have trained and prepared for the second race.

So with each misstep, we corrected, learned, and analyzed our weak points and then went in more cautiously. We chose better retailers, improved our product mix, then accelerated. I would always make sure to be cautious. If I could do it again, I would win strategically big and focus on making those wins bigger before going wider. It helps mobilize the team better, focuses your assets, and then allows you to move stronger into new markets.

There are a lot of small business owners reading this interview who would love to have their products sold at major retailers like you. How can these founders follow in your footsteps? What advice can you share for getting a foot in the door with a big-name retailer?

Fair warning: the market has changed a LOT since we first got started. Anyone who started before a couple of years ago were the pioneers. You did a lot and asked for forgiveness later and people were more willing to grow/make mistakes with you.

Now, the world has changed. There is a lot more competition—a lot more products out there—and retailers are getting smarter. Before you go pitch to a big retailer, you have to really know if you are ready. Do you have the marketing and trade budget to support the account? Can you keep up with the volume? Can you afford slotting fees? Do you have a sales support team to monitor and manage the account?

Remember, these players have dealt with far more billion-dollar companies than they have thousand-dollar companies, so the rules are set for much bigger fish than you.

Get educated, get funded, then jump into those waters with caution. Surround yourself with skilled and experienced advisors who have worked in the category/product type you are developing. Ask other companies in those retailers about their experience—both their successes and their follies. Get informed before you pitch.

Where do you think is the most important area for a business owner to focus their financial energy on and why?