Attention, Self-Employed Bosses! Here Are 4 Tips for Budgeting on a Variable Income

Money mindset is everything.

Photo: ColorJoy Stock

During my first month as an entrepreneur back in December of 2018, I made $226 as an administrative assistant. Fifteen months later, I would go on to quit my day job and make upwards of $5,000 a month as a freelance writer and content creator for Rosetta Stone.

While I had excitedly waited to get to this point, it was still hard for me to give up the financial security of my day job. Without corporate perks like PTO, health insurance, and automatically deducted taxes, I suddenly had to make sure I had enough to get through the expected—and unexpected—costs each month without the help of a regular paycheck.

As an entrepreneur or freelancer, it is completely normal to have an irregular income, but it can definitely make budgeting your money a little trickier. Luckily, after a lot of trial and error and some helpful advice from a top-notch financial coach, I can finally say I’ve figured out how to budget with a variable income. Since this is something I wish I had known years ago, I decided it was time to share with my fellow business owners!

1. Calculate Your Monthly Needs

Before taking control of my budget, I had no clue how much I really spent per month. Like most young business owners, in my first two years of business, I was pretty much taking whatever job I could get—mostly because I just needed to get my bills paid. Never really knowing how much to expect from month-to-month, I ignored my bank account completely.

Every month I would just cross my fingers and hope I wouldn’t get an “insufficient funds” notice from my bank. But, this method led to a lot of extra stress and negative emotions around money.

So, one day, I sat down and went through my last three months of bank and credit card statements and looked at how much I had been spending on necessities. This helped me figure out how much I really needed to be making each month to get by. Some common needs within a personal budget include things like:

Rent

Utilities

Groceries

Gas (only for required outings)

Debt repayments (minimum required payment)

Phone

Personal care (toiletries, medicine, etc.)

Insurance (car, life, etc.)

Essential family expenses (childcare, clothing, etc.)

I also included the needs I had for my business. Some common business needs within a budget include things like:

Employee/contractual worker wages

Website hosting

Email hosting

Insurance (health, business, etc.)

Public relations

Marketing/advertising

Business-related debt repayment

Travel

Taxes

Business-related software (accounting, email management, website building, social media marketing, SEO, project management, CRM, communication/messaging, etc.)

Business-related hardware (computers, phones, printers, etc.)

And this isn’t just what I learned from personal experience. When I sat down with financial coach Yvonne Tran for one of my podcast episodes, she echoed this sentiment as well. “If you have variable income my biggest tip would be to know how much you need to pay every month for expenses or bills and make that a goal to bring in every month in your business,” Yvonne shared.

2. Reset Your Money Mindset

Like it or not, we all have certain ideas about money. Whether you grew up hearing “money is the root of all evil,” “a penny saved is a penny earned,” or any other common money-related beliefs, our society has a lot of positive and negative associations with money.

Having grown up in a family of entrepreneurs, money struggles—and the negative money mindset that comes with them—were no stranger to me. For a long time, money was something that I considered stressful and even dirty. It wasn’t until I learned to see money as a tool and something to be grateful for that the money really started flowing.

“Money mindset is definitely really important because if you view money as so stressful, super complicated, and intimidating then I can show you all the ways that you can fix your financial situation, but if your mindset is telling you ‘no’ then it’s not going to work out in the end,” Yvonne told me.

A few ways you can reset your money mindset are:

Using positive affirmations around money (and putting them everywhere!)

Learning to give money away without fear

Evaluating your beliefs around money

Actively fighting off any negative thoughts about money

Fostering gratitude in every transaction

3. Cultivate Healthy Money Habits

Creating a strong budget and resetting your mindset creates a strong foundation for making good financial decisions, but keeping up with those good financial decisions means you have to cultivate healthy money habits too. Some healthy money habits that could help keep your budget on track are:

Downloading a money-tracking app like Mint

Spending with gratitude, not fear by using affirmations like, “I am grateful for all that money brings me,” or “I am grateful that I can contribute my money to the economy/this cause/this person,” when spending money

Setting financial goals each quarter

Waiting 24 hours before buying “wants” to avoid impulse purchases

Saving 20% of your income for the unexpected

Yvonne is a big proponent of saving, especially when you have a variable income. “If you happen to have a short month one month and not bring in as much as you need then hopefully you’ll have that extra savings already set aside,” she shared. “That way, that can come in to fill the gap for that month, and then you’ll just work harder next month to bring in more money.”

4. Re-Evaluate Your Budget Each Month

If you have a variable income it is best to evaluate your budget pretty frequently. By re-evaluating your budget more often, you’ll have a better handle on your money as your income changes.

Since I can usually predict my income for the next few months, I tend to re-evaluate my budget each quarter, but monthly works great too. Here’s the method I use: first, I calculate how much I’ll be making over the next three months. Then, I divide that up to give myself a general monthly budget. Finally, I calculate all of those personal and business needs we talked about earlier.

Next, I subtract my needs from my income and I use that final number as my budget for the month. I’ll usually take out a percentage for savings, but the rest I let myself spend freely. Some people prefer to take their savings directly out of their income, but it makes me feel better knowing everything else is taken care of first. This works well for me because on good months I can splurge on certain items, whereas on not-so-good months I have to reign myself in a little bit. But either way, it gives me a concrete number to focus on each month.

There are hundreds of ways to budget your money, but the best budget is the budget that works best for you. I tried a lot of budgeting methods before I found one that really worked for me, so don’t get discouraged if you struggle a little bit. For me, once I changed my mindset around money everything changed, so I would definitely suggest digging into your own stories around money before getting started. Happy money-making!

“There are hundreds of ways to budget your money, but the best budget is the budget that works best for you.”

—Calli Zarpas, Founder of the Do Well Department

About the Author: Calli Zarpas is the founder of the Do Well Department, a holistic business program created to help overwhelmed business owners cultivate a business and life they love. When Calli isn’t running her community, she’s writing her weekly newsletter and hosting her podcast called Unstrictly Business, all about how successful business owners foster success in both their business and personal lives (Yvonne’s episode is an awesome place to start!).

Love this story? Pin the below graphic to your Pinterest board.

MORE ON THE BLOG

4 Important Things to Know Before Becoming a Freelancer

Shift your mindset from employee to CEO.

Photo: ColorJoy Stock

Starting a freelance career sounds like the ultimate dream: working independently, whenever and wherever you want, as well as choosing who you work with. If this appeals to you and you want to quit your full-time job to take that big leap, becoming a freelancer is a great idea. I know, it sounds scary! But like any other challenge in life, it will require you to create a new mindset, be persistent, and use your creativity in ways you’ve never imagined.

Once you’re on track, the benefits are extremely satisfying. Being a freelancer can be difficult at times, and it’s not everyone’s cup of tea. But for me, however, freelance work has been an incredibly rewarding journey. I have more flexibility, I pick my own clients (and also fire the bad ones), and I can choose my own assignments. And honestly, you will be the best boss you ever had.

So if you’re like me, grab a hot cup of tea, relax, and follow my four pieces of advice to someone who is about to start a career as a full-time freelancer.

#1 Get comfortable with inconsistency.

One important step in the process of becoming a freelancer is to shout it from the rooftops! Yes, let everyone know that you have transitioned to independence and are ready for business. Go ahead and do as much networking as you can, gain confidence by selling yourself, showcase your portfolio, and have a marketing plan ready. Building your personal brand is essential to gain recognition and make people want to hire you.

Another thing to keep in mind is that you will encounter clients who just can’t seem to pay on time. You can be the best, most trusted freelancer in the world, completing projects on time, and keeping track of invoices, but unfortunately, that doesn't mean your clients will do the same. It's important that you are financially prepared for hiccups like these and save enough funds to cover until you get paid.

#2 Adopt a CEO mindset.

When you transition from full-time employee to full-time freelancer, a shift takes place from thinking like an employee to thinking like a business owner. As a freelancer, you are your own boss, bookkeeper, business developer, HR department, and project manager all in one. As I became a more experienced freelancer, I started to think of myself as a CEO. I began to act more professionally, which resulted in attracting better clients. I also hired a lawyer who could help me with contracts, and doing this made me feel more confident controlling my business.

Freelancing is a way of working that offers you a lot of freedom. You could be a freelancer who prefers to do smaller projects for many different clients. Others like to work on long-term projects for one client for a number of months. It all depends on what you’re comfortable with. Most importantly, as an entrepreneur, you want to develop the skills you need to lead and work with efficiency and focus, and to set your priorities for your projects.

#3 Keep up with taxes and paying your own benefits.

Ask any freelancer about self-employment taxes and you will surely hear a big sigh. Many freelance business owners consider keeping up with taxes to be one of the most daunting and important parts of being self-employed. But don’t worry, after a while, it will become routine. Paying your taxes on time can also have a positive impact on your credit score.

Keep track of your business expenses (from furniture, to travel and lunch with clients) so you can write these off at the end of the year. Efficiently monitoring your finances, invoices, expenses, and taxes will give you peace of mind. There are also many useful tools to help you complete these tasks, such as Quickbooks.

#4 Know the importance of networking and building a portfolio.

It is essential to build a good network of people who appreciate you, potential customers, and people who can connect you with others. Find where your customers are moving. I advise you to do your research on Google, LinkedIn, Facebook, Instagram, professional associations, etc. Networking takes time, and if you are consistent and gain confidence selling yourself, sooner or later, you will start to make meaningful and authentic connections with people you admire and trust, and someone may end up referring you or even hiring you.

“When you transition from full-time employee to full-time freelancer, a shift takes place from thinking like an employee to thinking like a business owner.”

—Silvia Cantu, Art Director and Visual Artist

About the Author: Silvia Cantu is a Los Angeles-based multidisciplinary art director and visual artist. She is always looking for new stimuli, whether it is for work or style. Passionate about beauty in all its forms, Silvia is an all-around designer. She’s made a full-time job from her obsession and now she’s an eclectic artist with a strong eye for digital design. Silvia graduated with a degree in fashion design from Nuova Accademia di Belle Arti in Milan where she cultivated her talent for design and art direction. After university, she started working freelance with national and international clients in London, Sydney, Los Angeles, and Toronto in the fields of fashion and beauty. Her clients include big names such as Nike, ELLE Magazine, For Love and Lemons, Casio, and Dr. Roebuck’s.

Love this story? Pin the below graphic to your Pinterest board.

MORE ON THE BLOG

How to Price Yourself in the Freelance Market

It’s a balancing act.

Photo: Christina Jones Photography

Unless you’re positive you’re going to win the Powerball (which, may the grace of good fortune be on your side), you are going to have to hustle this year. That means knowing how to price yourself in the freelance market, which is, unfortunately, as tricky as you think it is.

It’s a balancing act. Aim too high, and the client might offer the job to someone else. Price yourself too low, and you’ll end up resenting the high workload and low payout. Read on for a few tips on how to know your worth and how to navigate tricky money situations with clients.

1. Don't suggest an hourly rate.

Think of your work as value-based. If you are helping a brand grow its online presence, you shouldn't price yourself based on the amount of time you are going to spend on the job. You should price yourself based on the value you are going to add and your level of expertise. The better you get at something, the faster you work (usually), but that doesn't mean you shouldn't be paid for your skill level.

2. Dealing with the "we don't have a big budget," pickle.

It might be true, it might not be, but when a client says this to you it's often a red flag that they aren't going to want to pay. It's also a way to undermine your confidence from the gate. Telling you there is no budget will make you question what you're worth—don't let it. If you have a set rate, stick to it, and if they can't pay that, then it's up to you to decide if the ends justify the means. If you think it's a relationship that will pay in the long run, that's a decision only you can make.

3. Compare and contrast, but don't undersell yourself based on the market.

Look into what other people are being offered for the same service, but if you think it's too low for you, don't fall to market pressure. A simple way to find your number is to divide the high-average yearly salary of someone in your position who works full time by the number of months you'll be collaborating with a client. You want to start on the high end because most of the time you will get a counter-offer.

4. Quote yourself confidently.

Don't be afraid of that big number. Looking at it as a whole can seem intimidating, but sending a confident proposal that shows a client that you believe in your worth and your work, may instill the same confidence in them.

5. Offer your services in tiers.

Be explicit about what services you can provide for different prices. The more specific you can be about deliverables for price points, the more likely a client is to sign on. Tiers also give you wiggle room for negotiation. For example, if the client is into "tier 2" with one additional service you're offering in "tier 1," you can come back and say, "I'm willing to add in X service for X extra."

6. Asking point-blank if there is a budget.

If you don't know where to start, you can put the initial price point on the potential client. There's really only one way to do this: directly. "How much are you willing to spend?" will send the wrong message. Asking if there is a budget, will not.

7. There is no ax+b=c formula.

There’s no right answer to price yourself. At the end of the day, everyone has had different kinds of experience put on their résumé, has different skills, and all have worked for different rates in the industry. If you’re confident in your price, have compared your rate based on average market pricing, and have considered all of your skills, experience, and value, you’ll be able to come up with a rate that will make sense to you. If it doesn’t make sense to a potential client, oh well. Like Tinder and Bumble, you’ll eventually find a perfect match that will understand your self-worth and value.

Love this story? Pin the below graphic to your Pinterest board.

This story was originally published on February 28, 2019, and has since been updated.

MORE ON THE BLOG

Pro Tip: How to Convince Your Boss to Let You Go Freelance

Loving WFH?

Photo: Karolina Grabowska from Pexels

If you’ve been putting together a plan for leaving your 9-to-5 job and venturing into the brave new world of freelance, there’s a potential client I bet you haven’t stopped to consider yet: your current employer.

When I started my freelance career, my first client was the same PR agency I’d been working for over the last two years. There were things outside of work I needed to be able to dedicate my time to but I was committed to my job and team. I loved what I was doing, but I also craved the freedom of flexibility and autonomy.

If this sounds like you, keep reading because in today’s Pro Tip I’m going to share my step-by-step process for how to convince your boss to let you go freelance.

Pinpoint Your Value

The most important factor in convincing your current employer to let you switch from full-time to freelance is to pinpoint the unique value you bring to their business.

For me, it was my knowledge of and connections within the video game and esports industries. Beyond my expertise, my proven loyalty and track record for being a high performer also helped contribute to my cause. I had just been promoted about six months prior and worked well with my team and clients.

Once you have your unique value identified, gather important milestones you’ve hit throughout your time with the company. I like to focus on quantifiable milestones because numbers are the best way to communicate results to your boss. For my situation, this was the amount of new business I helped secure for the company, additional retainers I negotiated with existing clients, high-profile news hits I secured for product launches, etc.

Do Your Research

Freelancing is far from a new concept, but nowadays, more and more businesses are embracing this change in the workforce. Before you approach your boss with your freelance plan, do your research to make sure that freelancing is actually something you can afford to take on.

When you’re a freelancer, you’re forfeiting your company-provided benefits like healthcare, 401K matching, and paid vacation days. So take time to do some research and make sure that you’re ready for the change.

You also want to make sure that the jump from full-time to freelance is sustainable within the company you’re working for. Meaning to say, that you can continue to not only show your value but identify areas where you can continue to pick up additional work when projects end.

If you’re looking for more guidance on things to take into consideration before starting your freelance career, get your hands on my freelancer starter kit.

Create a Plan

The last thing you want to do is pitch the idea of freelancing to your boss without a plan in place. You’re asking for a significant change and in order to get the best outcome, you’ll need to prove that going freelance is the best route for not only you but your employer’s business goals.

Start by looking at the next six to twelve months and identify key moments where you regularly play a significant part in the business. For me, this was around client conferences and product launches. Once you have those key moments in place, think of the value you add to those occasions and the amount of time it typically takes to complete the necessary work-related tasks.

Freelancing is about hourly rates. Even if you negotiate a monthly retainer, you want to make sure you’re being compensated for the amount of work you agreed to for the amount of time estimated so you don’t fall back into what could feel like a 9-to-5 grind.

After you identify your value and key business moments, list the types of tasks you want to do as a freelancer to help support them. Then look at what you’ve written out to determine if it’s too little or too much work to support your freelance goals. From there, adjust where you need to and start to imagine how you’d like to bring this up to your boss.

The Pitch

Let’s recap before you schedule a time to sit down and pitch the idea of freelancing to your boss you want to have the following:

A clear understanding of the unique value you bring to their business.

Confidence through the research you’ve done that you’re ready for freelance life.

A plan of action for how you will transition to and execute freelancing so effortlessly, they’ll hardly notice the difference.

Once you have these three factors in place, ask your boss to schedule a time for a one-on-one conversation. It’s important this meeting be scheduled for a time with minimum distractions. For example, if you know your boss is particularly busy in the mornings, aim for the afternoon.

Start the conversation with confidence. This is a proposal you’re pitching, not a favor. Switching to freelance is a business-related request so don’t go into the meeting thinking that you’re going to appear weak or less-than for asking for something that you want.

Start with something like this:

“I would like to discuss the opportunity of transitioning to a freelance employee with you today. I’ve created a plan of action that I’d like to share for how I can continue to add value to your business in this new capacity. I enjoy working with you and hope this is something you will take into consideration.”

This messaging is clear, to-the-point, and friendly. From here, share your plan and ask for feedback along the way.

Be prepared to answer questions like:

Why do you want to switch to freelance?

What hourly rate are you expecting?

How many hours a week can you commit to?

Are you willing to come into the office?

How long do you want to freelance for?

Every individual’s answers will be different so it’s important to think of what you want from the setup. Be prepared for where you’re willing to compromise and where you are firm. Having clear answers will make the decision-making process much easier for you and your boss.

About the Author: Audrey Adair is a seasoned freelance communications professional and founder of The Scope, a platform providing resources and community to freelancers and the self-employed. Connect with The Scope on Instagram and join the email list to receive your free resource, The Freelancer Starter Kit.

This post was published on March 19, 2019, and has since been updated.

Love this story? Pin the below graphic to your Pinterest board.

MORE ON THE BLOG

Pro Tip: The Free Tools I Use Every Day as a Freelancer

Freelance isn’t free, but that doesn’t mean we don’t appreciate a free resource.

Photo: Create & Cultivate

Freelance isn’t free, but that doesn’t mean we don’t appreciate a free resource as much as the next person—especially when you consider that, when you’re a freelancer, you become financially responsible for all of your business expenses. We’re talking about your tech (your hardware and your software), your office space, your health insurance, your advertising and marketing—everything.

Ahead, Audrey Adair, a seasoned freelance communications professional and founder of The Scope, breaks down the free resources that she continues to use on a daily basis. From a free email service that’s so much more than just email to a stock image database that offers high-quality photography without a premium price tag, scroll on for free resources that’ll help you get the job done.

Gmail

Where would I be without Gmail?

More than just email, Gmail also provides access to 15 GB of cloud data storage, a calendar, a suite of office resources like Google Docs and Sheets, and the ability to converse with friends and colleagues through Hangouts.

My favorite tools are Google Docs and Sheets because they save updates in real-time and I don’t have to worry about whether or not I packed my drive with me when I travel because it’s all saved on the cloud. It’s also great for collaborating with others and allows you the capability to work on a single document in real-time through the internet.

Upgrade Options: $6 / $12 / $25 per month payment options give you access to even more storage space and the option to have a personalized email address.

Canva

I don’t know about you, but I could just never figure out Adobe Photoshop. I tried and tried, but never used it enough to remember all that goes into it. I’m also much better at creating with words than I’ve ever been at art.

Enter: Canva.

Canva is a free online graphic creating platform that provides you with access to thousands of templates and design ideas for anything you could possibly think of.

I’ve used it for YouTube thumbnails, Instagram posts and IGTV cover photos.

There are some features that are pay per use, meaning you can more than likely find a free option but if you want to use a specific art file you may need to pay for it. But most files I’ve seen are $1 to use so it’s still an incredibly affordable option and SO easy to use.

Upgrade Options: $12.95 per month per team member makes Canva a collaborative space for coworkers and unlocks access to artwork and customization features.

Planoly

I use Planoly to help plan and schedule my Instagram posts and absolutely love it.

It helps save so much time and hassle being able to save all of my IG content in a single place, write out the captions and schedule when content will go live.

I’ll spend an hour or so planning content in the app and then voila, it’s done and I can go about my business for the rest of the week.

Upgrade Options: Planoly has several payment options starting as low as $7 per month that covers management of multiple accounts and the capability to upload unlimited photos to your planning grid.

Mailchimp

I didn’t understand the importance and value of a solid email list until I started The Scope and Mailchimp is an awesome tool for anyone looking to grow and manage their list.

Free up to your first 2,000 email subscribers, Mailchimp grants access to different email templates and analytics like open/click rates and demographics.

Upgrade Options: Mailchimp offers two different payment plans: Grow and Pro. The Grow plan starts at $9.99 per month and increases as your list and needs for the platform grow.

Social Media

Facebook, Instagram, Twitter, Pinterest, LinkedIn and YouTube.

These are the five primary social media platforms I use on a daily basis to help promote my businesses and stay connected with fellow freelancers, entrepreneurs and potential readers and the best part - using them is absolutely free.

While we have all felt the woes of algorithm and home feed changes on these platforms over the years, we have to remember that they’re all free and it’s up to us to either adapt with the changes or find our audiences elsewhere.

Burst

There are so many stock image databases out there but Burst is the one I return to time and time again.

I don’t always have visuals to back the content I like to cover on The Scope, and Burst is easy to navigate and usually has exactly what I’m looking for. It’s also great to pull from for new client proposals or social media posts.

I also like that they provide photographer information on photos so you can opt to see more of their personal work.

About the author: Audrey Adair is a seasoned freelance communications professional and founder of The Scope, a platform providing resources and community to freelancers and the self-employed. Connect with The Scope on Instagram and join their email list to receive your free resource, The Freelancer Starter Kit.

This post was originally published on May 7, 2019, and has since been updated.

MORE ON THE BLOG

Pro Tip: How to Get the Most out of a Slow Season

Don’t panic—get productive.

It’s no secret that being a freelancer is a lot like riding a rollercoaster. Some days are fast and fun while others feel like a punch to the gut while you cascade down into a dark, unknown tunnel as you inch along wondering which turn will happen next. For freelancers, this is what we typically refer to as a slow season. While this part of the rollercoaster can vary from field to field, for most of us it does happen.

For me, it's usually around the holidays. For others, it's the summer. No matter when it happens for you, the best thing you can do is be prepared for it and don't let it get you down. It's inevitable when you’re freelancing and when you find yourself in a slump, so in today’s Pro Tip, we’re sharing a few ways to get the most out of your slow season.

Learn A New Skill

Professional development is something we freelancers have to hold ourselves accountable for. Use the slow season to learn a new skill via an online class or even summer courses at a local university. For videographers it may be learning a new editing platform or getting your drone pilot's license. For copywriters, taking a class to learn better SEO/SEM writing habits. Whatever your trade, there's always something to learn and who knows? What you learn during your slow season may be what helps secure your next client.

Research New Business

It's my personal belief that twenty-five percent of your time as a freelancer should always be spent on networking and new business so that you hopefully never run into a slow season. If you do experience a slump in business, use this time to research and outreach to clients you see a potential working with. Identify a need for your services, find the right person to contact and secure an introductory call.

If you want additional guidance for creating an effective pitch letter, download my Freelancer Starter Kit.

Work For Fun

When was the last time you used your skills for fun? You more than likely started freelancing in your field because it's something you're not only good at, but you enjoy doing. Be your own client for a change and use your slow season to work on something that makes you happy.

Develop Your Brand

Chances are you've spent so much time working with your clients lately that you haven't updated your LinkedIn in a year or created those case studies you wanted to show off on your website or any other you-related task that's been pushed to the bottom of your to-do list. Spend your down time to grow your personal brand. Maybe this is a social media refresh or researching potential speaking opportunities or going to a local networking event. Whatever it is, do it!

Start Your Side Hustle

We should always be side hustling and if you're short for cash during your slow season, this is the time to do it. Mine is going through my closet and selling things on Poshmark. For others, it might be hitting up yard sales and flipping things on eBay (thanks, Gary Vee), signing up as an Uber and Lyft driver or selling personal designs on Society6 and Etsy. There are so many ways to make extra cash these days and what's great about most of these is that they can be done on your own schedule so once your slow season comes to an end, you can keep the side hustle going.

Indulge in Some Self-Care

I can't speak for everyone but when it comes to me and the freelancers I know, we are not the best at putting ourselves first. Use your slow season to work on YOU. Get a massage, read a book, spend your mornings meditating, go for a hike, do whatever makes you happy and helps clear your mind. This can also be a good time to look at the year ahead and start setting goals so when a slow season happens to you again, you’ll be prepared.

About the author: Audrey Adair is a seasoned freelance communications professional and founder of ‘The Scope’ - a platform providing resources and community to freelancers and the self-employed. Connect with The Scope on Instagram and join their email list to receive your free resource, The Freelancer Starter Kit.

MORE ON THE BLOG

Solopreneur Tax Tips: The Freelancer

“Dreams are wonderful, but they only come true if you work your ass off.”

Making your own schedule, choosing your clients, and sweet, sweet freedom—these are just a few of the many perks of freelancing. But with that freedom comes great responsibility…including being on the hook for filing self-employment taxes. Above, content creator Grasie Mercedes—who splits her time between acting, writing, directing, and blogging—sits down with Lisa Greene-Lewis, TurboTax CPA, to learn how TurboTax Self-Employed can help freelancers stay on top of their tax obligations throughout the year. Read on to learn a little more about Grasie and see how TurboTax can help you find deductions, file confidently, and keep more of your hard-earned money in your pocket. Plus, we're gifting 30 readers with a FREE TurboTax Live Self-Employed product code (valued at $169.99) below—so you can file for free this season!

To quote your Instagram bio, you “do a lot.” You’re an actor, writer, director, and blogger—what do you like most about working on so many different projects?

I love to keep busy and I love everything entertainment, so for me, it just makes sense. Now, more than ever, actors "do it all": they direct episodes of the shows they're on, they create their own series, and they continue to act in everything from commercials to TV to major motion pictures. I think it's wonderful and exciting! Blogging is something I started over eight years ago as a creative outlet to supplement my then-styling career, which was supplementing my acting endeavors. From there, I turned it into a brand/business that I can have forever (or as long as I want)! Having so many things to work on and work toward is so special to me...I never get bored "working" and that's a dream. I'm so grateful to be able to do what I love, every single day.

What’s your biggest challenge in having so many different business ventures on your plate? The biggest reward?

The biggest challenge is when the various ventures start to interfere with one another. Acting is a crazy business with an unpredictable schedule so there have been plenty of times where I have to miss an event, trip or opportunity because I have to be in town for pilot season or for a callback, etc. When that happens, I just have to weigh my options and then deal with serious FOMO when I see what I missed on social media. The biggest reward is hitting new goals in any given venture. I just signed with an amazing talent agent for writing, I'm developing my first pilot with a great production company, and my first film is still getting accepted into major film festivals! Those are all huge wins for my writing and directing careers, which I started less than two years ago!

We polled our C&C community and found that many freelancers share the same concerns as Grasie—conflicting schedules and deadlines can make solopreneurship difficult. Luckily TurboTax Self-Employed makes it easy for freelancers to track and file quarterly estimated payments, so you can focus your efforts on your work and your clients.

What advice would you give to someone who wants to go freelance but is worried about how they’ll make a stable living?

This is a tough question. I think you have to weigh your options and responsibilities. When I decided to quit my day job and move to LA to be an actress/creative, I was in my late 20s with zero obligations. It was easy to just go for it because it was just me. No kids, no mortgage...not even a pet! If you have that freedom, then just GO FOR IT full throttle! Do whatever it takes to pay the bills (legal things only, of course). Wait tables, get a temp job, be a barista...all the while, make sure you are working on your creative endeavor daily. If you're responsible for more than just yourself, I would say keep your day job as long as possible, save money where you can and again work on your creative endeavor daily until it's bringing you enough money to quit your day job. The only difference between these paths are that the first one usually gives you more time and freedom to pursue your dream. But regardless of which path you take, the most important thing is to WORK HARD and WORK EVERY DAY on whatever it is that you want to be doing! Dreams are wonderful, but they only come true if you work your ass off.

What are you most excited about for your business in 2019?

Excited to revamp my blog and to work as a writer and director more! Acting will always be "my first born" and something I'll never stop doing, but creating my own work (TV shows/films) is my number one priority at the moment.

Want more tips for tax time? Check out our guides for side hustlers and C corp entrepreneurs! or Or you can dive into TurboTax Self-Employed here—and enter to win a free TurboTax Live Self-Employed code below!

Our friends at TurboTax were nice enough to share a giveaway with Create & Cultivate readers so you can file your taxes for FREE this season!

30 readers will receive a FREE TurboTax Live Self-Employed product code (valued at $169.99). Simply fill out the form below to enter to win. The winner will be chosen randomly and contacted via email. Good luck!

Not quite a full-time freelancer?

If you’ve got a side hustle and need help with filing taxes, be sure to check out last week’s guide. Stay tuned for next week’s post for more solopreneur tax tips—and enter to win a free TurboTax Live Self-Employed code below!

This post is sponsored by TurboTax.

5 Ways to Prepare for Self-Employment

But first, do the homework.

Nowadays the term “entrepreneur” is part of our normal vocabulary, but no one striking out on their own becomes an overnight success. If you’re thinking about pursuing self-employment and running your own company, here are five ways to properly prepare yourself for setting out on your own.

DO YOUR HOMEWORK

Self-employment is not for the faint of heart. If you are committed to pursuing the pros of working for yourself, you also have to be hyper-aware of the cons. As you contemplate leaving the financial stability of your corporate job, begin to evaluate the added stresses that come with being a company that is a party of one. For example, I thought critically about having to pay a very expensive health insurance bill every month where previously health insurance had somewhat silently been deducted from every paycheck.

"Self-employment is not for the faint of heart."

Tweet this.

I determined that the stress of that monthly payment would be more worthwhile than the stress I was feeling from my corporate gig where I was feeling unchallenged and unfulfilled. I also looked at what I would be doing from a day-to-day basis that couldn’t be covered by a team. I’d be offering clients my services from the ground up and they’d all be handled by me - no delegating up or down on a team. By thoroughly researching what your new normal will look like, you’ll be in for less of a shock when you become accountable only to yourself.

NETWORK

By far the most valuable thing I did in preparing for self-employment was tapping into my network. I began seeding to my friends, family and acquaintances that I was planning to leave my job to consult and one by one my network grew.

Everyone wanted to put me in touch with someone who’d had the courage to do what I was planning to do. I began speaking to loads of other freelancers and consultants and I came prepared to every meeting with a list of questions. Every encounter held a powerful and helpful takeaway and the more people I spoke with, the more my network expanded and the more business leads I started to pull in. Those I spoke with also were incredibly valuable when it came to setting the costs for my services, determining what tools I’d need to invest in and helping to provide guidance on how to successfully manage my business.

GET ORGANIZED OPERATIONALLY

There’s a lot that goes into operating your own business and some of the things may even surprise you. Before you leave your job for the land of self-employment, I recommend starting to get the pieces of the operational puzzle in place. One of the first steps I took was finding a lawyer who could incorporate my business. Then I set up a business banking account so I had a checking and a savings account for the company and also a credit card for all expenses. I got set up on Quickbooks to run the financial side of my business and also built a forecast so I was setting goals for myself to meet from a revenue standpoint.

"Before you leave your job for the land of self-employment get the pieces of the operational puzzle in place."

Tweet this.

Next came working with my lawyer to draft contracts and other necessary paperwork I would need to run my business from a client services perspective. I also developed a capabilities deck I could send to prospective clients, built a website, ordered business cards and developed a list of companies I was interested in speaking with. Once everything was done prior to leaving my job, it was easy to hit the ground running pursuing business because I had prepared all of my operational to-dos.

PLAN FINANCIALLY

Before you commence self-employment, you have to first accept that you won’t know from where your next paycheck is coming. Which translates to having to prepare financially for those inevitable times that you won’t have steady pay coming in. Knowing I lived in the most expensive city in the world, I put pen to paper to determine what living in New York was really costing me every month in regards to expenses. I signed up for a Mint.com account to build out a budget and for two months tracked my expenses. Once I had an idea of averages in particular categories, I built out an expense worksheet for myself that included rent, health insurance, groceries, travel, utilities, etc. I knew I wanted to have whatever that number was per month times six saved before I pulled the plug on my corporate job so that when the time came to dip into savings, I felt OK doing so.

"Do the math and start saving accordingly before you up and leave your job."

Tweet this.

Do the math and start saving accordingly before you up and leave your job. You’ll be far better off down the line for having done so.

THINK LONG TERM

When you begin working for yourself you’ll feel like you need to say yes to whatever initial projects come your way because you fear the unknown. But when you accept projects or clients that you don’t feel passionate about, you’re defeating one of the best perks of being your own boss: the ability to say no. While you certainly need to pay your bills, you shouldn’t take on work that you don’t feel capable of delivering on or for people or brands that don’t make you feel invested in the work. If you begin to take on projects you’re not jazzed about, you are limiting the hours you have a month to pursue and accept jobs that will not only give you income but also fulfillment.

Meghan Donovan is the founder of mmd communications, a public relations and influencer marketing agency in New York City helping to elevate lifestyle brands with dynamic, meaningful ideas. In addition to her decade of experience in the marketing industry for major brands like Procter & Gamble and Virgin America, she also pens the popular life + style site, wit & whimsy. You can read more about her journey to self-employment here.

MORE FROM OUR BLOG

Considering Going Freelance? Here's What You Should Know

One is (sometimes) the loneliest number.

FREELANCING IS KIND OF LIKE BEING YOUR OWN BOSS. But it's not rainbows and butterflies. You need to hustle and you're constantly at the whim of clients.

HERE’S WHAT YOU NEED TO KNOW BEFORE MAKING THE SWITCH TO A FREELANCE LIFESTYLE.

If you’re thinking of ditching the 9-5 and working independently you’re not alone. According to a survey by Freelancers Union and Upwork, one in three Americans are now freelancing, and 50% say they wouldn’t trade their freelance career for a more traditional job even if it paid more.

Of course, it’s not all that surprising considering that freelancing allows workers to choose when and where they want to work and build their career around their lifestyle.

The independence freelancing provides means it’s often an ideal choice for women who are juggling the demands of a career and motherhood, and research shows that the majority of full-time freelancers (53%) are now women.

Flexible doesn’t necessarily equal easy, though, and going freelance also means taking on a lot of additional responsibility. So whether you’re a writer, photographer or web designer, here’s what you need to know before taking the plunge.

1. YOU MUST CREATE A STRONG PERSONAL BRAND

Having a strong personal brand is important for any professional, but even more so when you’re a freelancer and are essentially marketing yourself.

If you’d like to start freelancing full-time, spend some time thinking about your marketable skills and qualifications as well as what sets you apart from the competition. Once you know what sort of image you want to project, you can start building your personal brand using social media, blogs or your own personal website.

2. NETWORKING IS ESSENTIAL

As a freelancer, the wider your network, the easier it will be to find jobs. One study that looked at how freelancers get gigs found that 81% of freelancers refer work to fellow freelancers and 37% trade or barter services.

Fortunately, 65% of freelancers also say technology has made it easier to find jobs. Before you leave your current job behind, start building up your network by joining relevant groups and online forums, connecting with like-minded professionals through sites like LinkedIn and Twitter, and attending conferences and industry events.

3. YOU’LL BE ABLE TO SET YOUR OWN RATES

As a freelancer you’ll have the freedom to set your own rates, but you’ll also be responsible for handling everything from your taxes and insurance to your pension plan, so when deciding how much to charge, you should consider both your budget and your time.

Of course when you’re just starting out it can be difficult to accurately estimate how long a project will take to complete, so time-tracking tools like Harvest can be useful for figuring out how long each task actually takes you and how much you should be charging.

4. SPREAD YOUR RISK AND HAVE AN EMERGENCY FUND

The Freelancer Union report shows that 87% of freelancers earn their income from more than one source in a given month. Why? As a freelancer you never want to put all your eggs in one basket, because if your main source of income dries up unexpectedly, you’ll be in a very difficult position.

With that said, having more than one client also means sending out multiple invoices and chasing more than one person for money at the end of each month, so it’s important to have an emergency fund to cover any unexpected expenses and stay afloat when clients don’t pay on time.

5. YOU SHOULD HAVE A DEDICATED WORKSPACE

Although freelancing means you can work anywhere from your local coffee shop to the living room sofa, it’s still important to have a dedicated workspace where you know you won’t be distracted by kids, visitors, non-work-related phone calls or household tasks. Having your own office will also help you separate your work responsibilities from your personal life.

This could mean designating a room in your home for work, renovating a garage or even looking for a coworking space in your area, which is an increasingly popular option for freelancers.

6. SETTING BOUNDARIES IS IMPORTANT

When you’re freelancing it can be harder to draw a line between work hours and leisure time, but answering emails at all hours of the day or taking on extra work without being adequately compensated can quickly lead to burnout.

Set some boundaries with your clients early on by letting them know when you will be available to discuss projects and then sticking to those hours. Also, before starting on a new project, make sure both you and the client are clear on what will be included so you can charge for any unforeseen extras and avoid working for free.

7. FREELANCING CAN SOMETIMES BE LONELY

Although freelancing does give you enormous independence, it can sometimes be a bit lonely too. If you’re working from home, you’ll probably end up spending the better part of your days alone, and meeting up with colleagues for a quick drink after work will require more planning than it once did.

With this in mind, you should consider whether working in a less social environment would suit you. Of course, there are plenty of ways to socialize outside of work, from volunteering to taking up new hobbies to scheduling lunch dates, but you will need to make more of an effort to stay social and connected once you start working for yourself full-time.

* * *

Are you a full-time freelancer? What tricks do you use to stay organized, motivated and connected? Let us know in the comments.

An original version of this article appeared on Career Contessa.

MORE FROM OUR BLOG

You're a Freelancer and You Lost a Client, Now What?

4 steps to stay in the game (and pay your rent).

The freelance world is full of competition. (Read up as to why we think a little competition among women is more than OK.)

Sometimes you’re competing against other freelancers and sometimes you’re competing against yourself. Like when a steady client all of the sudden PULLS the PLUG and you’re left scrambling to cover your monthly nut. (Click here for key financial rules to follow at any age.)

When it’s you against your bank account, we want you to come out on top.

Because it doesn’t matter how great you are at your job or how well you interface with clients, it happens to the best of us. Directions and budgets change. The people who hired you leave positions and bring on a new person. Sometimes the relationship has simply expired.

Here are four ways that will keep you from getting lanced by the roller coaster world of working for yourself.

WORK IT OUT WITH UPWORK

Great people can be hard to find, so make yourself findable with the world’s largest online workplace. Upwork has over 5 million registered clients who post over 3 million jobs annually. The site also boasts over a billion dollars worth of work done annually. That’s money going into other pockets.

You apply, create a profile that focusses on your very niche (and very impressive) skills, and start hunting. Browse jobs in over ten different fields, from writing to design and creative. There’s a new job out there for you, so go find it.

2. BE AS COLD AS ICE

Sometimes jobs find us but most freelancers have to find the job. It's called a hustle.

So you lost one job? Use it as a reason to find two more. Build a list of one hundred clients that you want to work for and reach out. The most successful “cold” emails offer a service instead of asking a question.

"The most successful cold emails offer a service instead of asking a question."

Tweet this.

Don’t ask if someone is hiring, show them with data and specific examples of what you can do for them. Karin Eldor, self-employed copywriter and social media strategist says this of cold contacting: “Hit up the job boards of the brands you love most to see if there are any postings for your skill-set, and fire off those applications and emails.

She adds, “Set a goal of reaching out to four contacts per day -- the wider your net, the more likely you'll get some bites. The key to cold emailing and increasing the chance of a reply is making your email short and to the point: start with flattery, then hit 'em up with your expertise in a short tagline about yourself. You need to intro what you do, what your specialty is, and how you can help them.”

3. FOCUS ON WHAT’S WORKING, TO MAKE SURE YOU KEEP WORKING

“Losing a steady client can shake you to the core,” says Karin. But all freelancers agree that going negative is as bad as going dark.

Jane Helpern, writer, copywriter, and editorial director living in LA, says it's “Easier said than done but try not to take it personally. Don't waste your time wondering what went wrong, or if it's something you did. It's endlessly more productive to focus on improving one aspect of your professional package, whether it's refreshing your website, tightening up your social media presence, or tricking out your desk setup. It's kind of like a revenge body, but for your career.”

"Focus on improving one aspect of your professional package. It's kind of like a revenge body, but for your career.”

Tweet this.

4. SIGN UP FOR NEWSLETTERS

Unsubscribe from everything that's wasting your time and sign up for everything that will advance your finances. From our Create & Cultivate Classifieds to ilovecreatives job boards.

Karin says, “sign up for newsletters from freelance-oriented websites and make sure to visit job boards that list contractual gigs, on the daily -- it's a freelance world, and we're just living in it. We have big love for ilovecreatives lately, as they send weekly digital classifieds for creatives.”

MORE FROM OUR BLOG

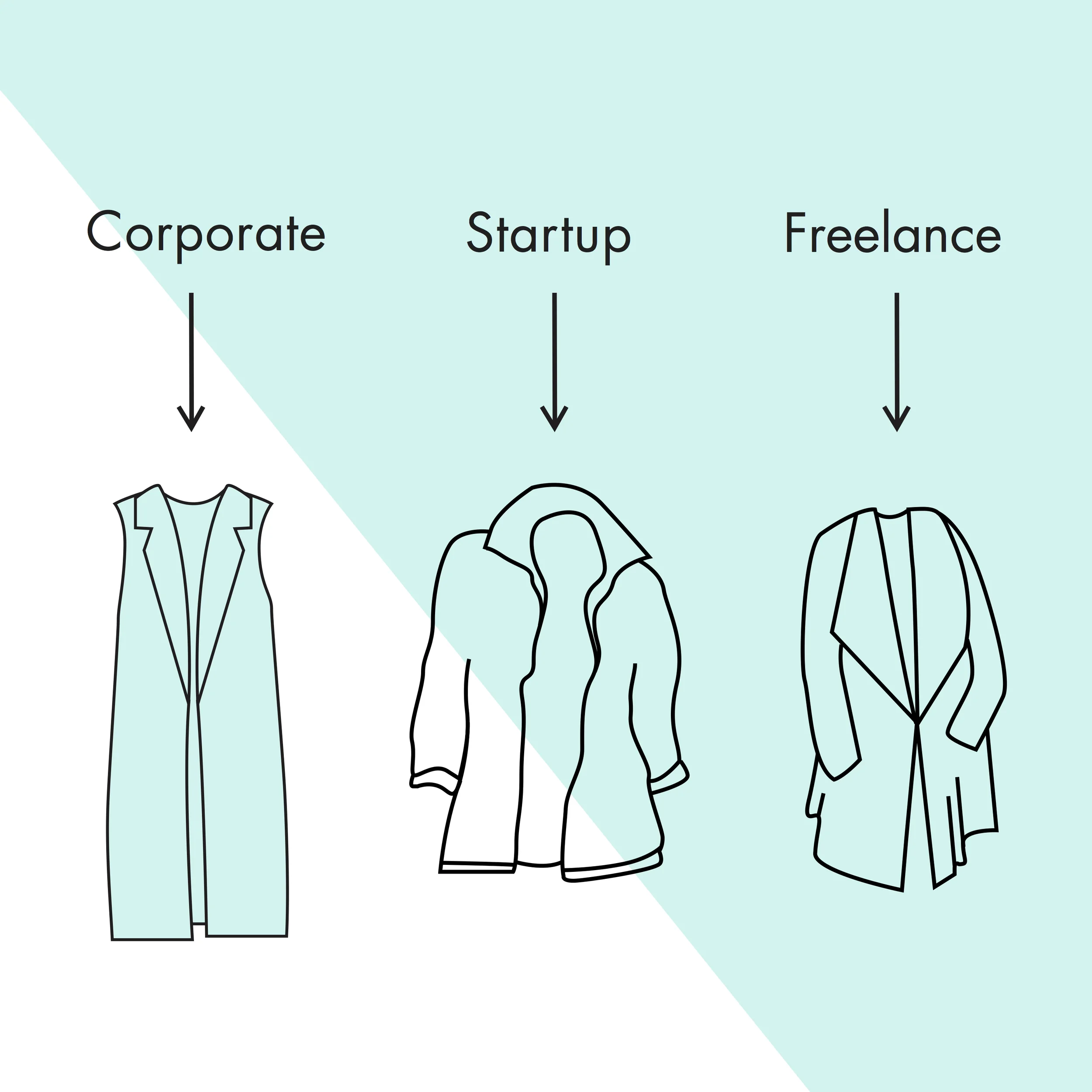

Dress The Part: Corporate, Startup, or Freelance?

If you're going to work the part, you should also dress the part.

Office culture has changed a lot of the years, and it’s left some of us a tad bit stumped on how to dress. #help. Just when does one wear a power suit? And what’s the deal with casual Fridays, when jeans have become an every day part of the work week? You’ve got enough to worry about in the morning without getting held up by your closet.

So, we asked for a little help from Bar III, the fashion-foward line from Macy’s, to figure out how to get dressed (and out the door in time) in the AM. With modern pieces that fit into any office environment, you’ll look oh-so-profressional— whether you work in a corporate environment, spend days and nights at a start-up, or you’re on that freelance hustle.

Start with a basic pair of black pants and top from their line, and follow the below to figure out the office culture style that fits your personality best. It’s a no-fuss solution to setting the bar higher.