Diem Co-Founder Emma Bates on Human-Centered Technology and The Power of Female Communication

ABOUT THE EPISODE

In today's episode of WorkParty, Jaclyn is joined by Emma Bates, founder & CEO of Diem. If you attended Create & Cultivate's Austin Pop-Up event earlier this year, you might've already heard from Emma on one of our panels where she spoke about women paving the way with blockchain technology.

If you're not familiar with Diem, it's a community-powered search engine designed for women. Diem is a Techstars NYC portfolio brand backed by leading investors like Flybridge, Acrew, & Sellation. By trade, Emma is a marketer and a community builder. Her entry into marketing was somewhat untraditional–in that she started out by growing her personal blog to 100K+ readers at age 19, and later transitioned into corporate marketing roles at some of the fastest-growing consumer brands in NYC and the UK. Prior to founding Diem, she worked as the Head of Global Marketing at the direct-to-consumer luggage brand, Away, where she found her passion for connecting with consumers through brand partnerships.

When she's not sidestepping her way into another entrepreneurial endeavor, she works to create social change as a lifelong advocate for gender equality. Emma has also been featured in Forbes, HuffPost, Entrepreneur, and The Cut for her unique approach to marketing, community building, and partnerships.

In this episode, she shares the importance of adding a human element to technology and product design, the power of female communication, and how she's working to bring inclusive, reliable information to people all over the world.

LISTEN TO THE FULL EPISODE

RESOURCES

To connect with Emma Bates click here

To connect with Jaclyn Johnson click here

To sign up for the Diem newsletter click here

To follow along with Create & Cultivate click here

To submit your questions call the WorkParty Hotline: 1-(833)-57-PARTY (577-2789)

SHOW OUR SPONSORS SOME LOVE

Printfresh | Head to printfresh.com/WORKPARTY or use code PARTY at checkout for 15% off your first order.

OTHER EPISODES YOU MIGHT LIKE . . .

How One Woman Used TikTok To Land a Job Promotion

This Black-Owned Company’s CEO Is Disrupting The Beauty Industry

Pietra COO, Tala Akhavan on Balancing Work, Motherhood, and Access to Female Entrepreneurship

Using Technology to Drive Social Impact with AllVoices Founder, Claire Schmidt

Where To Find The Right Investors That’ll Take Your Deck From Pitch To Closing

As an entrepreneur, I’ve had to present my ideas in front of many key decision makers. From closing sponsorship deals to recruiting executives, I’ve lost count of how many pitches I’ve given over the years—but I’ll never forget my first pitch to raise my fund New Money Ventures. Raising money is one of the most challenging and rewarding experiences but as we know women are at a disadvantage with only 2% of VC funding going to women owned businesses.

According to the Bank of America® 2022 Women & Minority Business Owner Spotlight, 79% of women business owners plan to obtain funding in the next year; however 75% of women business owners still wish they were more knowledgeable about small business financing. This is a big reason why I am so passionate about lending my experience and expertise to up-and-coming entrepreneurs—and why I launched a venture fund focused on money and mentorship. Here, I want to give four things to think about that will help you find the right investors at the start of your business.

1. Know Your Business Inside and Out

It sounds simple enough but understanding every aspect of your business before launching requires substantial research and deep reflection. Why does your product or service need to exist? Why will consumers be excited to spend their money with you? And why are you the one to create it?

You must also understand your position in the market, what your competitors are doing, and how you stack up against them. Think: audience demographics, industry trends, and hard data that will not only back up your business proposition but also solidify your standing as a dedicated, success-oriented entrepreneur. Then, compile your findings in a robust pitch deck to share with your potential future investors.

FYI: If you're looking for a guide to building the perfect pitch deck, check out the episode of Launch House that I shot earlier this year for tips, tricks, and a free presentation template to get started.

2. Pinpoint the right source of funding

Once you have a handle on your numbers, it's time to pinpoint the funding source that's right for your stage of business. The right choice might be friends and family who believe in your dream; a small business loan to cover initial costs like inventory or equipment; an angel investor in your niche; or a venture capital firm dedicated to helping you scale. My advice is to consider your immediate needs. If you secure funding, which option will help your business reach the next level with the least debt? There's a lot to consider, so give this point some good, hard thought before you jump in.

3. Prepare to answer the hard questions

Now that you have your target, take time to prepare for questions that everyone from venture capitalists to small business loan lenders will likely ask about your and your business.

What are you using these funds for?

Why are you valuing your company the way you are?

Where are your competitors sitting?

What data do you have to back up?

What is your metric for success?

This is also an opportunity to prepare questions for your investors, too!

What do they look for in investments?

How much do they typically invest?

Do they have any funding mandates?

How will they support you?

If you're looking into a loan, ask if they lend to other businesses in your industry.

How long is the application process and what do they consider?

Ask for testimonials and feedback from current or past customers.

4. Don't go it alone

Lastly, don't feel like you have to go through this process alone. I suggest working with your accountant or small business advisor to prepare documents, run numbers, and help you look at your business from a lender's perspective. Don't have a business accountant yet? That's ok! Banks like Bank of America offer Small Business Bankers that provide advice and guidance on everything from loans and lines of credit to alternative routes to access capital.

The best investor is much more than cash in your pocket. In my experience, having someone experienced and knowledgeable enough to support and help grow my business in my corner is more valuable than any dollar amount. For this reason, I became a Bank of America business card holder and never looked back!

Outdoor Voices & Try Your Best Founder Ty Haney Shares How to Leverage Web3 to Build Powerful Communities

ABOUT THE EPISODE

Live from our 2022 Small Business Summit event, Ty Haney joins Jaclyn Johnson for a keynote conversation about building community in Web3. If you're listening to this episode it's because you believe in doing things. Big things. And Ty Haney is on the same page. Haney founded Outdoor Voices–a vibrant, fun-first athleticwear brand back in 2014.

During Haney's time with Outdoor Voices, the brand became synonymous with IRL events that brought shoppers together to celebrate movement. And today, she's here to talk about how to bring that same IRL magic online with the next wave of community-driven technology.

Haney's new brand TYB, which stands for Try Your Best, makes Web3 community-powered growth tools that allow brands and fans to directly link, come together, build, and win together. And if you don't know what that means, it's okay! By the end of this episode, you'll be a pro.

LISTEN TO THE FULL EPISODE

RESOURCES

To connect with Jaclyn Johnson click here

To follow along with Outdoor Voices click here

To follow along with Try Your Best click here

To follow along with Create & Cultivate click here

To submit your questions call the WorkParty Hotline: 1-(833)-57-PARTY (577-2789)

SHOW OUR SPONSORS SOME LOVE

Printfresh | Head to printfresh.com/WORKPARTY or use code PARTY at checkout for 15% off your first order.

OTHER EPISODES YOU MIGHT LIKE . . .

How One Woman Used TikTok To Land a Job Promotion

This Black-Owned Company’s CEO Is Disrupting The Beauty Industry

Pietra COO, Tala Akhavan on Balancing Work, Motherhood, and Access to Female Entrepreneurship

Using Technology to Drive Social Impact with AllVoices Founder, Claire Schmidt

How to Build a Portfolio Career With CEO and Selling Sunset Star, Emma Hernan

ABOUT THE EPISODE

Live from our 2022 Small Business Summit event, CEO and Selling Sunset star Emma Hernan joins Bunita Sawhney Executive Vice President of US Financial Institutions at Mastercard for a fireside chat about what it takes to build a portfolio career. While you may know her from the hit Netflix show, you may not realize that Emma Hernan is someone whose business savvy goes far beyond what's depicted on the silver screen. As a self-made multimillionaire, Emma is not only a realtor at one of Los Angeles' top agencies, The Oppenheim Group, but she's also an entrepreneur and CEO of Emma Leigh & Co, as well as an angel investor. In other words, her plate is very full.

It's clear that she loves the work she does, and her drive and passion to help other female entrepreneurs grow and succeed is evident from the moment you meet her. We're lucky that she's here today to share tips on how to vary the types of work that you're doing, what investors are looking for, and how to persist with founding a business even when you come up against obstacles. (Plus, she might even spill a little Selling Sunset tea!)

LISTEN TO THE FULL EPISODE

RESOURCES

To connect with Emma Hernan click here

To connect with Jaclyn Johnson click here

To start bingeing Selling Sunset click here

To follow along with The Oppenheim Group click here

To follow along with Emma Leigh & Co. click here

To follow along with Create & Cultivate click here

To submit your questions call the WorkParty Hotline: 1-(833)-57-PARTY (577-2789)

OTHER EPISODES YOU MIGHT LIKE . . .

How One Woman Used TikTok To Land a Job Promotion

This Black-Owned Company’s CEO Is Disrupting The Beauty Industry

Pietra COO, Tala Akhavan on Balancing Work, Motherhood, and Access to Female Entrepreneurship

Using Technology to Drive Social Impact with AllVoices Founder, Claire Schmidt

Why It's Important To Have a Strong Relationship With Your Bank

For a new entrepreneur, the role of a bank can help further the growth and development of your business. Managing your money and your accounts properly is essential to making or breaking your small business, so it's important to build a lasting relationship with a bank that will take care of you. However, given that banking institutions constantly offer different incentives (and, at times, varying interest rates), should you break away from having multiple accounts and trust just one to handle your financial needs?

Committing to a single bank may not only build a trusting relationship between a banker and customer, but it may also open the door to growing your business and reaping the benefits of rewards and resources. As a banker, “it is important to meet with your clients regularly, and it is recommended to connect with them at least twice a year,” says Erick Silva, VP at Bank of America. “Banking products and services are always evolving, especially in digital technology. It’s important for our clients to have a good understanding of our products and services so they can fully take advantage of the essential and innovative benefits that come from having their banking relationship with us.”

Silva goes on to share that Bank of America alone goes above and beyond by offering a Small Business Resources site that provides helpful tools and information for business owners. Here are five benefits to committing to a single bank, sure to have you making a trip to the bank this week.

Building credit

When you’re a new small business owner, you are in the early stages of building business credit. Things like your credit score can be an indicator of how’ll handle a credit card. “A business credit card can be a powerful financial tool for your business. By using it wisely, you can keep personal and business transactions separate for accounting and tax purposes, stretch your cash flow, and build your business credit,” Silva says.

Sustaining responsible growth

Knowing how to business forecast and to manage cash flow is an essential trait for all business owners so that you can be prepared for your next big purchases. “It’s especially important for small businesses, which often operate on a very lean budget,” Silva says. According to an Intuit study of 3,500 companies, by Intuit and Wakefield Research, 60% of small businesses say they regularly struggle with cash flow issues, and 40% have restricted business growth because of it.

“In other words, it is important to maintain a healthy cash flow. We provide a visual example to illustrate this idea to our client by using our robust technology such as Bank of America’s Cash Flow Monitor. That’s one example of a tool that can track your business’s performance, identifying potential shortfalls in advance,” Silva adds.

A banker on your side

The more a banker knows about your situation, the more they can help you with specifics. Your banker may help analyze trends, discuss the current market, and prepare you for the future. “Ultimately, our goal [as bankers] is to provide our clients the tools and resources to make them competitive in the market and allow them to concentrate on doing what they do best and that’s focusing on their business,” Silva shared. Here’s how knowing your bank well helps:

Assists you in determining how much credit you need based on your goals and priorities and offers solutions to support you

Identifies areas for business growth and offers guidance on how to achieve the next steps, considering the stage of your business

Uncovers causes of cash-flow problems and helps streamline your business by providing solutions that will help with managing your cash flow

Connects you with payroll providers and subject matter experts with the knowledge to guide you

Introduces you to new clients and vendors and shares ideas for growth that businesses in the same industry have been able to execute successfully

Learning from wisdom

“As we’ve helped our clients along the way, we’ve learned from them along the process. I was able to help one of my customers, the owner of Mikko Sushi Mia Davis, find stability with her new business after years of falling short,” Silva says.

“Mia came to the United States when she was 20 years old and worked nights and weekends as a server to support her family as a single mother. She not only returned to school to understand the financial side of the business after ‘failing miserably,’ but also had to learn how to use social media after opening her restaurant right before the pandemic,” Silva adds. She ultimately credits her Small Business Administration (SBA) loan with making her “American dream come true.”

Making access to capital easier

Lastly, banks connect entrepreneurs in the U.S. to affordable loans. Access to funding can sometimes be the biggest challenge in building a business. A relationship with Bank of America may connect women entrepreneurs with resources to gain access to affordable loans. The Tory Burch Foundation is one of them, which provides three options for funding:

Bank of America Loan Program: Provides women entrepreneurs the opportunity to access affordable loans through Community Lenders.

Grants for Women of Color: Gives grants to businesses through a partnership with Fearless Fund and The Cru.

Fellows Program: A year-long program that provides entrepreneurs with a $5,000 grant for business education, access to $0 interest loans, and a premier network of founders and advisors.

Two Founders Share The Process They Took To Raise Funding For Their Apparel Business

It seems as though women-founded businesses have been underfunded since (what feels like) the beginning of time. According to Crunchbase, only 2.3 percent of venture capital went to women-led startups in 2020, a drop from previous years. For two women who started a braless clothing company, and where we mostly pitched to men, it was clear why the process was hard.

We’ve gone through the search for capital multiple times, throughout the lifecycle of our company. We had no choice but to start by self-funding our business, Frankly, out of our personal accounts. We then moved from bootstrapping to raising different forms of capital after about six months of being self-funded. Having broken the million dollar raised mark, and despite being in the “difficult to fund” apparel industry, our experiences gave us insight into the tricky world of business. Here's what we've learned along the way, and what has helped us raise funding and lead our brand to success.

1. Understand what you have working for and against you, and go for it anyway.

Starting a company is fundamentally contrarian. There will be people who think you or your idea is crazy, but a product would already exist if it were a universally good idea. Start by making sure you have a clear idea of what funding in your sector looks like for your company. Have some early revenue? Go on Crunchbase and see who has raised a pre-seed or seed recently, and see what type of traction those companies have.

Earlier rounds are less likely to be documented, but finding a network of entrepreneurs can help you get an idea of what the funding environment is like in your sector, or an adjacent sector. For the two of us, it was tapping into our business school and undergraduate networks. With one of us being Asian-American, we also found Gold House which has a community of founders willing to help one another. We knew that being an apparel company was working against us, so we had to get creative on funding.

2. Funding may look different depending on your vision and stage.

We figured out what we needed at every stage, to get to the next milestone, and we raised enough to get there. Kickstarter is non-dilutive, so when we were looking for proof that people wanted the product, we knew that was our best option. If it went well, the Kickstarter funds would cover the inventory. And if it went poorly, we would take it as a sign that the company would not be a full-time venture for us. Luckily it went really well and we were able to cover our first runs of inventory with it.

We then raised a friend and family round, and a year and a half later raised a pre-seed from two institutions. The friends and family round was raised to set up the company, run experiments, and figure out exactly who our customer was. The pre-seed was to refine our focus and take the business to the next level. We thought a lot on if institutional capital would be a fit, and the answer is that it depends on what type of business you want to build. There’s an argument to be made about bootstrapping to profitability, then raising an institutional round if needed for specific reasons. The question to ask yourself here is: are you willing to give up more of your company to someone else, to build a bigger business? That tradeoff makes institutional capital not worth it for some founders. There are also pitch competitions, grants, and other ways to find capital for your business.

3. Be able to point at concrete proof.

Lots of people raise ideas, but all of them have some sort of proof point that they gathered during needfinding. For every type of company, you need to have an indicator that people are going to pay for that product. Whether it’s crowdfunding, a social media proof point, or revenue, it’s much easier when you can point at concrete metrics.

For consumer businesses already bringing in revenue, metrics like repeat customer rate, returned item rate, and AOV is important. With a B2B company, you want some kind of pilot or letter of intent with your target type of consumer. As women raising for a women-centric product, we needed more proof for Frankly – especially when talking to male investors. We needed to show that bras were a pain point, so we asked investors to go home and ask the women in their lives if they hated their bras. They were often surprised by the answer, though we weren’t!

4. Practice pitching with a variety of personalities.

We practiced our pitch at least 15 times with different people (investor friends, friendly faces, and friends of friends). This helped us ensure our deck was telling the story we wanted to tell. There are friendlier investors, people who ask pointed questions, and others who are obsessed with numbers. You never really know who you’re going to get when pitching, so make sure you’re ready for every personality.

Some investors are just harder to read than others, and that’s okay. Everyone will have different reactions to your deck but you’ll start to see patterns, then you can adjust accordingly before you go out to the market. Docsend, which we used to send out our deck, has a piece on what every deck needs. Our advice from what we’ve seen is to keep your deck under 12 slides. People have short attention spans.

5. Know that it’s going to be an emotional process, even if it goes well.

Even the most successful businesses have had trouble raising in the beginning. The example that we always think about is John Foley, the founder of Peloton. "Foley raised $400k at a $2M post-money valuation from eight angels. From 2011 to 2014, he pitched to 3,000 angels and 400 firms. Almost everyone said no. Eventually, he raised $10M from 100 angels," Joe Vennare shares on Twitter.

Even if you raise successfully, you'll still likely have to hear at least 30-40 no’s through the process. There are a ton of reasons why people don’t invest, and it doesn’t mean your company won’t do well. The self-belief that you’re building a business that is going to make a difference in the world will keep you going throughout all of it.

About the Authors: Heather Eaton and Jane Dong are the co-founders of Frankly Apparel, an inclusive clothing brand that designs bra-less essentials for women of all sizes. Before starting Frankly, the two of them worked at Deloitte, Goldman Sachs, Uber, and Rothy’s. The duo met at Stanford Graduate School of Business, where most of their classmates were starting tech companies. They felt so strongly about making the bra-less trend more accessible to all cup sizes, that they started Frankly anyway.

How To Utilize Community Listening To Develop A Product Your Customers Can’t Resist

If there’s one thing business owners have noticed this year, it’s how rapidly the world is changing. Since the start of the COVID-19 pandemic, we’ve been running businesses with so much uncertainty. One way that I’ve found it easier to know how to adapt is by listening to my community, who frequently tells me what types of changes they’d like to see and what’s really working for them. This community-listening model has allowed me to take data-backed leaps of faith that have, in large part, paid off.

Presently, I serve as the CEO of Novel Education Group, a private homeschooling service that I started after private tutoring in Los Angeles. Through my experiences working in private tutoring, I saw the need for schooling services to a community of kids who wanted to get an education while also pursuing their dreams and goals. Although this was the stepping stone for me to build an education business model that catered to them, it was hard in the beginning to find this kind of community and support when I was solely working one-on-one with clients and in education. You don’t have that sense of community like you would in an in-person school because it’s a very unique and specific niche business. It’s definitely a field where sometimes it’s hard to find relatability.

When I started, there was so much stigma around homeschooling that I knew I’d have to break to gain clients. From the start, I implemented a community-listening model that allowed me to understand the needs and concerns of my clients. Largely, I learned that the word “homeschool” is essentially unregulated, and for many clients, this uncertainty made them question whether it was right for them. For example, the knowledge level of a child in high school who’s 14 years old and has been homeschooled may be a high-school freshman or they may not. In the typical homeschooling system there’s no way to tell where they are, what they studied, if they’re on par with their peers, or if they’re on track to go to university.

Because I heard this feedback, it was incredibly important for my business to be regulated. We’ve partnered with an online private school and students have a teacher to guide them daily. On top of that, we have graders for each class that are constantly checking the work that the tutors do with the students. This has allowed me to break down the stigma and get people to understand that online schooling, homeschooling, and virtual schooling are trends for the future. It is highly accredited and a highly standard form of education.

We’ve also continued to see a growing trend of families who live in communities such as Los Angeles or London, where they didn’t want to be in one place for an entire school year. For them, our partnership with private schooling and implementation of their curriculum allows a student, who let’s say had to travel for two months out of the year, to continue their education path as remote learning.

All that to say I am proud of my entrepreneurial journey and it all happened because I was ready and willing to adapt to change or pivot. Today, I have a full-time staff who gets health benefits, and I’m also able to watch students graduate and accomplish their goals. Although change can be difficult mentally and emotionally, you just need to take it one step at a time and understand that things that are happening for the benefit of your business and its customers.

Here’s some pointers that helped me stay on track and continue to grow my business:

1. Do not make changes unless it adds value to your business. There is a right time to pivot your business, and it has to be organic and filling a need.

2. Take some time to reevaluate your customer base and pay attention to their changing needs.

3. Always think of the most efficient and cost-effective way to operate. I work with a Small Business Banker at Bank of America who has helped me gain insight into business loans, and which ones are right for me. They also have a Small Business Resources site that provides helpful tools and information for business owners, such as, which benefit options are right for employees.

4. If you find you are missing out on business because of a road block, try and change it or work around it.

5. Be patient and conserve funds. You know what they say. Good things come to those who wait.

About the author: Tiffany Sorya founded Novel Education Group in 2014. She is a renowned influencer and thought leader in the education industry, widely recognized for spearheading a fundamental change in the way young people engage with education in the digital age.

This Founder Evaluates Her Business Every 6 Months To Maximize Growth

In life, you have to plan and account for unknown elements and circumstances that can’t always be planned for, as they’re unknown. The best way to do this in business is to make sure everything that can be planned, is. Most businesses, particularly small businesses, like to use org charts for budgeting, staffing, responsibilities, and chains of command, among other things. While they are an excellent tool to utilize, they aren’t the only way to plan and organize your business to maximize growth.

Jasmine Morris runs a multifaceted PR agency and likes to refer to herself as a digital storyteller. She opts not to use an org chart for her agency, “Not because [she] doesn’t believe in them,” but because she takes the untraditional route and invests in business strategists. “Focus on the overall vision of the company,” she advices, adding that she assesses her business quarterly. By doing so, she has proudly scaled her agency to not require hiring many people, and found a way to replace humans for a system that has generated multi-six figures to seven figures.

Wondering how she did it? We were too, so we got her to spill her secrets. Here's 4 steps she has taken to successfully scale her agency to success:

1. Clarity

The most important thing for Morris was to know what she wanted internally and externally for her agency. She continues to refine her strategy by coming back to those questions mid way through the year. “We've gotten super clear on our dream client, and we've created a system where we only promote internally, to our clients, as a referral system to keep business flowing in,” Morris says. For example, she made the decision not to invest in social media marketing for her agency, which guides her company in a clear direction and has financial benefits. “Not focusing on social media marketing has allowed us to not hire a social media manager and eliminate any additional cost at this time.”

She also sets up her week for clarity and efficiency to accomplish their goals for the week. “We have specific days for specific tasks. For example, Mondays are CEO days where it gives me, as the CEO, a chance to check in with the financial goals, marketing for the week, branding, etc. We only schedule company calls Tuesdays through Thursdays, which eliminates having calls throughout the week as well.”

2. Continue to invest in yourself

Morris abides by the adage, “If you don’t invest in yourself, who will?” Despite her success, she continues to invest yearly in high-level business coaches to continue her agency’s growth in reach and profits, and every six months invest in their systems and team to ensure it's improving. This approach helped her invest her first $10,000 right back into the company. “To surpass our first six-figures years ago, we invested our first 10k to identify what our messaging should be and how we should present our sales pages, and got super clear on our signature services. We found that only having three signature services is key to scaling and having a strong ROI every month. The fewer services, the better the ROI (in our opinion).” She continues, “We've invested almost 10k+ each year in business development and we've always seen a 10x return on it.”

3. Eliminate roadblocks

Morris found that for her company to run smoothly and successfully, the agency must be aware of and combat roadblocks on a more frequent basis. “Every week, we are focused on eliminating roadblocks for the company,” she explains. “We keep a database of 'opportunities' that we need to address whether it's financial, with whom we may need to hire, or processes that we have in place that we need to change. Having this database is a game changer.”

By combating issues every month, Morris and her team are set up easily to progress forward and plan for major changes every half-year.

4. Untraditional hiring

As Morris previously stated, she likes to take the untraditional route. That’s particularly true when it comes to her hiring practices⎯more so her hesitation to hire non-essential employees. “Unlike most agencies, we didn't hire the traditional way by hiring a VA, project manager, marketing manager, etc,” Morris says. “What has allowed us to grow strategically, authentically, and to multi-six figures is to invest in experts and focus on growing from the inside out. Many female CEOs get stuck on hiring, but until you know what you need, you cannot scale properly so invest in someone who can assist.”

She isn’t advocating for any business to nix basic hires for operating, but some of the non-essential positions can be outsourced to apps and systems that help save an agency or company money while scaling. “Of course, there are basic hires that you should identify before operating. But as you operate, you learn what gaps you need to fill. After identifying what needs to be accomplished to run our agency, we've replaced a lot of those people with systems and strategies that allow us to serve our clients easily.”

Morris adds that she also relies on Asana (a work management platform designed to organize, track, and manage a team’s work) and Dubsado (a suite of business tools including template creation, scheduling, and invoicing among other things). “We have a project overview within Asana that allows each team member to know what the project they are assigned to is about and what their specific tasks are,” she shares of the software. The versatility and range of both systems help her “eliminate hiring a ton of people,” again saving money that can be re-invested for further growth.

Written by: Abby Stern

How Female Entrepreneurs Are Leading The Way Out Of The Pandemic

There’s no denying that post-pandemic, female-owned businesses are on the rise. In fact, in 2021, women started 49% of businesses, up from 28% in 2019. That shouldn't come as a surprise when you think about the way women do business. Men tend to be very transactional when it comes to business. They focus on data and analytics, and place more emphasis on whether a product or service is a top seller over feelings. Most women are the opposite of that. We are relational and want to create a business that's purposeful, mission-driven, and that we’re passionate about.

When the pandemic hit and we were all isolated in our homes, we experienced a sudden loss of connection with people worldwide. During this time, people realized how important that connection was. We all craved to intereact with people again, not only with our loved ones but also with the people and companies we buy from. This was when many women stepped up and said, “I'm not just going to sell it to you, I'm also going to connect with you too."

Women are meeting the changing needs of consumers as we come out of the pandemic. Here's how:

1. Women Are Selling Differently

During the early days of the pandemic, so many of us turned to the online world to connect in one of the only ways we could. We watched videos, joined online groups, and took online courses. We turned to the internet for entertainment and information.

Many female entrepreneurs stepped into this space and filled that need for connection. As the owner of two businesses, Framed by Sarah and Launch Your Box, I was able to serve and sell online. I spent time cultivating relationships with our online audiences and shared my passions with them. So many of us experienced growth in our businesses as a result.

The pandemic changed us and our buying habits. More than ever, people want to be part of something bigger than themselves. They want to feel good about where they spend their money. Yes, we all appreciate Amazon’s ability to deliver what we need quickly and conveniently. But we also want to support the artisans and female founders who are passionate about what they do, and spend time sharing that passion and building relationships with their customers.

2. Women Are Creating Flexible Work Environments

Women have a way of looking at things differently as business owners. That perspective helps us in building teams and hiring employees. For example, during the pandemic, my number one goal was to figure out a way to keep the women I employed. During that time, many women across the country had to choose between homeschooling their children and keeping a job. The experience reframed our idea of work-life balance. Now, post-pandemic, many female leaders continue to adjust their companies for their employees, rather than the other way around.

Many women business owners are prioritizing positive work environments and cultivating a culture where women can find balance. It's not a nine to five anymore. In my business, we’re working from home, working during school hours, and taking Fridays off. I’m proud to create an environment that allows each member of my team to feel good about being a mom AND having a career or job.

3. Women Are Natural Adapters

Women wear so many hats in their daily lives. This natural ability to multitask serves us well in our roles as entrepreneurs. We are several steps ahead, can plan for what’s next, and are able to manage multiple priorities at the same time. We are natural problem solvers.

In many families, women act as the “glue” of the family, keeping everyone and everything moving in the right direction. We bring those same skills to our businesses. So much has changed since the beginning of 2020 and the way we do business has changed, too. The structure of our workdays, the role social media plays in our businesses, and the way we sell our products and services have all changed. As women, and especially as mothers, we can adapt to changing priorities and unexpected challenges at home. That flexibility served us well during the pandemic and continues to be an asset as we adapt to doing business in a post-pandemic world.

While none of us can predict what the future will hold, I believe a day will come where female entrepreneurs have outnumbered men. I don't know how long that will take, but the shift will come. As women continue to lean into who we are and what we can bring to the table, we will get there.

About the author:

Sarah Williams is the CEO and Founder of two 7-figure businesses, Framed by Sarah and Launch Your Box, where Sarah has worked with thousands of subscription box owners and those wanting to start a subscription box, providing in-depth training that takes them through each step of starting, launching, and growing their business. She is also the host of Launch Your Box Podcast, which launched in February 2021. Connect with her on Facebook @subboxwithsarah.

Porn: How this Brand is Putting Women on Top

Ladies, are you ready to take your sexual journey into your own hands? No pun intended! Ethical porn may just be what you need to build confidence in your sexual wellness endeavors.

Sexual wellness and porn, you ask? Yes, porn! As with any taboo subject, there are many misconceptions around the word “porn” alone. There’s a negative stigma that floats around the idea of watching porn, and when you look into what the mainstream industry is consistently producing, those thoughts are often validated. However 90% of people watch porn, and porn was ranked the #1 resource to learn about sex, yet 60% of women remain dissatisfied with their sex lives. This means one thing: people are watching porn but it’s not helping them have great sex. Porn can be more than fantasy, but also a tool to learn from. That’s where afterglow wants to step in.

afterglow’s mission is simple: to help more people have great sex. Founder and CEO Lilly Sparks built the membership-based community and sexual educational website to merge porn and sexual wellness. Afterglow hosts a content library of videos, exercises, and articles that guide users into deeper intimacy with themselves or their partners. Sparks set out to create porn that showcases the sex she really wants to have. Which is hot, realistic and relatable.

✨ Exclusive! Activate a free 7-day trial membership to afterglow with code XOCREATE ✨

Sexual wellness is the fastest growing sector in the wellness category. Statista estimates the market size of the sexual wellness market to reach $37.2 billion dollars by 2023. “Watching porn is highly connected to self-love and orgasms, which have been proven to be good for our physical & mental health and to even make us better partners,” Sparks shares. But lack of information might just be the biggest barrier between people and their sexual wellness.

Women have been taught that the pursuit and exploration of pleasure is lewd. Certified sex coach Gigi Engle shares that the disconnect sits with society’s majority attitude towards human sexuality. We all have it, but there’s often nowhere to turn for proper education. We work with what we have access to, which is porn. That said, “we have to have conversations that speak to our ability to center safety and pleasure; and normalizing sex work as a consumer-driven industry where neither consumer nor provider should hold shame,” licensed clinical Psychotherapist and performer Jet Setting Jasmine chimes in.

Your relationship with porn is yours, but the first step of working toward self love is to learn about your body and understand what makes you feel good. Which is why afterglow’s mission goes beyond producing porn— they’ve built an incredible online universe where erotic films are made by women, for everyone's enjoyment. As afterglow puts it, “where experiencing guided masturbations and learning partner exercises are as normal as reading the morning paper.”

Their content stands out because it shows the reality of having sex. “[On afterglow] Watching porn can be a great way to explore fantasies, learn about what turns us on, and prioritizes our pleasure. It can even make us better partners, depending on how we consume it,” they encourage.

In order to do this though, Lilly and her team still have to face the challenges of running a porn company head on. As a disruptive brand builder, she’s helping shift the adult media paradigm by breaking down the unfair and taboo stigma and working through censorship (ever see the 🌽emoji on social media?).

“The porn industry has more female executives running the show than Fortune 500 companies do. The adult industry has seen a huge shift in the past 20 years with many old industry vets retiring or selling their companies and being replaced by young up-and-comers — many of whom are women. There’s Bree Mills, the Chief Creative Officer at AdultTime, Erika Lust, a pioneer of feminist porn, and Kelly Holland at Penthouse Global Media. There’s Shine Louise Houston at PinkLabel.tv,” Sparks adds. afterglow is following the lead with their mission to create a space that is both positive adult media and contributes to sexual wellness.

Convinced to ditch mainstream for content that’s made just for you? Sign up now for afterglow’s guided masturbations, partner exercises, and even behind-the-scenes content. You pay for what you want to watch and cater the content to your desires. Creating an account is easy as 1, 2, 3, with monthly fees at levels that work best for you. Content creators to the site also get a free month to make sure it is a space they feel comfortable contributing to. As for you, if you’re ready to log on, cozy up to an exciting evening of putting your wants and needs first. It’s afterglow’s hope that you’ll feel more confident in telling your partners what you want and need—and of course, loving yourself.

This Game-Changing Tool Is Helping Small Businesses Level Up Their Content

Take an exclusive 15% off your purchase at Replica Surfaces with code C&C15. Valid now through 7/26 at midnight.

With gorgeous visuals and impeccable design dominating our social media feeds, it’s impossible not to think about content as a small business.

Content is the lifeblood of any marketing effort and successful digital strategy. It can come in many forms—articles, videos, and photos—really any digital media that attracts, engages, and retains an audience. Whether you’re a service based business sharing your value prop through educational videos or ramping up your social media presence as a new CPG brand, content is the key to drawing in an audience and building brand loyalty.

Creating new, frequent and powerful content is a healthy and necessary practice of business in any industry. But, many choose to forgo dedicating time and resources to actual content creation. This is especially common when business owners don’t believe they have the inherent “skills'' of a viral content creator. But if we’ve learned anything about going viral, all it takes is a mixture of drive, persistence, authenticity, and access to a smartphone to strike a cord.

Holding off on content strategies means holding off on untapped potential. Here are 4 reasons why your company needs to kick its content game into high gear:

1. Establish and maintain a strong brand identity in the market.

With an expedited shift towards consuming all things digital, your customers are more aware than ever of their purchasing power. It’s your job to provide both new and existing customers with the information (and inspiration) they need to make smart buying decisions.

When done right, content marketing is a powerful tool to communicate brand identity, build trust, and form meaningful relationships. From there, brand awareness and loyalty are sure to follow. Just as the front desk associate is the face of your local gym, your content is the face of your brand identity. Inconsistency and inauthenticity aren’t ideal in either scenario. Consider asking yourself questions like: "What is my target audience?", "What is my unique value proposition?", "What is my brand's personality?" and "How do I want others to see my brand?"

2. There has never been an easier time to produce content than right now.

With the proliferation of social media and platforms to create and distribute new ideas, businesses are publishing content at an unprecedented rate. If you're not separating yourself from the competition (i.e. publishing the same stock photos that everyone else has access to), then standing out will be tough. The good news is, developing solid content doesn’t have to be as complicated as some folks make it out to be. You just need access to the tools that make content creation easy.

Enter Replica Surfaces: a photo solution helping even the most novice photographers and creators make advanced, revenue driving content.

Replica Surfaces meticulously designed hyper realistic photography surfaces that are stain resistant, lightweight, and ergonomic, allowing for seamless content batching within the same studio space.

The Replica Studio is the real game changer here though—it’s an innovative all-in-one mobile photo studio changing in-home photoshoots forever. Meticulously designed, the Studio allows creators to make instant Surface changes, hold light modifiers like a dream, and switch from eye level to flat lay angles in seconds. The days of floor photoshoots and cluttered dining room tables are gone.

Graphics and video should be the soul of your content. But, you don’t need to be a professional photographer to make stunning content. Replica Surfaces is an essential tool for anyone with a story to tell. Create & Cultivate approved! (Check out their Photo Formula Course while you’re browsing, and peep an exclusive offer below!)

3. Leverage content to convert leads into customers.

Great content doesn’t just help with awareness, it’s also a proven lead generation method. According to a B2B marketing research, 72% of business to business marketers say content marketing increases engagement and the number of leads generated.

Content marketing works across channels. A blog post making a case for your service will generate traffic and leads through search. Beautiful social media content will inspire and attract new audiences. The inclusion of compelling content in email marketing will drive direct conversions.

Regardless of how you choose to distribute your content, the same valuable assets can be used to fuel all of your efforts. And because all of those channels have different characteristics and capabilities—think SEO versus social media—you can customize content according to each channel to ensure it reaches its potential.

With the right content marketing strategy and the right content, you can generate leads for your business online, no matter which channels you choose to use.

4. Content marketing is a long game.

Your first few pieces of content may be strong, but it’s not likely they’ll blow performance out of the water. This by no means your content is bad. It means you should focus on letting your expertise and unique value prop shine through consistent, quality content.

The sooner you create and publish content, the sooner you have data to analyze and inform your marketing strategies. There are a myriad of variables that could influence a successful piece of content. Reach, engagement, and conversion are all metrics to be considered, but it takes time to build benchmarks.

Patience is a tough sell in an “always on” digital world, but all it takes is one step forward to start seeing results.

Take an exclusive 15% off your purchase at Replica Surfaces with code C&C15. Valid now through 5/29!

How Dress Up Buttercup's Dede Raad Is Leveraging Social Media to Turn Followers Into Shoppers

ABOUT THE EPISODE

Turning followers into shoppers is no easy feat.

The savvy social media crowd can spot a disingenuous post from a mile away, so monetizing your account with sponsored posts takes honesty, authenticity, and plenty of creativity.

Which is something Dede Raad, the founder of Dress Up Buttercup, knows a thing or two about.

The blogger works with major brands like Nordstrom and Amazon to sell products to her 1M Instagram followers—and she recently launched her own collection of denim jackets that sold out in minutes.

She was also named one of Fortune’s Top 25 Creators, along with Lil Nas X, Addison Rae, and Benny Drama, a formal recognition of her ability to monetize her platform in interesting ways.

I can’t wait to chat with Dede about how she’s turned her followers into shoppers, including her go-to KPIs for measuring success and her tips for cultivating an engaged audience.

EPISODE TOPICS

The most important KPIs when analyzing content performance and making major business decisions

How to leave the comment, likes, and view chase behind

Specific strategies to convert followers and readers into shoppers

How to diversify your business by launching a product line

The data that really matters when launching new content

RESOURCES

To connect with Jaclyn Johnson click HERE

To learn more about Dress Up Buttercup click HERE

To follow along with Create & Cultivate click HERE

To submit your questions call the WorkParty Hotline: 1-(833)-57-PARTY (577-2789)

LISTEN TO THE EPISODE

OTHER EPISODES YOU MIGHT LIKE . . .

How Paige Mycoskie Took Aviator Nation’s E-Comm Sales from $25,000 to $1.5 Million in Just 24 Hours

How MaryRuth Ghiyam Went From Owing $700K to Building a $100 Million Wellness Empire

Grow On: How to Double Your Revenue With Elyce Arons, Co-Founder and CEO of Frances Valentine

How CeCe Olisa Pivoted From Fashion Founder to Beauty Entrepreneur

Ashley Tisdale on Her Experience with Anxiety and Depression, Launching Freshe, and More

THIS EPISODE IS BROUGHT TO YOU BY . . .

OneSkin • Visit oneskin.co/party and use code PARTY for 15% off your first purchase.

Shopify • Go to shopify.com/party for a FREE 14-day trial and get full access to Shopify’s entire suite of features.

Should You DIY Your Website or Hire a Pro Designer?

If you’ve been in the business world for any amount of time, you've probably noticed the impact a well-designed, conversion-focused website can have on your business. Not only does it help position you to look like the professional you are and build your ever-important “know, like, trust” factor, but a powerful website can also be a major boost to your marketing efforts.

But figuring out when it’s the right time to invest your time in DIYing your site or invest your hard-earned money in a professional designer can be a minefield. Here are five questions to ask yourself to help you decide if you should DIY your website or take the leap and hire a professional designer to create one for you.

1. What stage of business are you at?

When just starting out, and during those first few growth months, it can seem daunting to tackle creating a website from scratch, but it is usually a good idea to DIY your website at first.

Not only because you’ll be able to save your investment in a professional designer for other, arguably more critical, parts of your business but also because you’ll likely see many shifts in your brand and business as you evolve over the next few months, so investing a large portion of your income into a professional site might not give you the returns you’d like to see for your investment.

Once you are bringing in a consistent income and you feel relatively settled into your brand, it can be a great time to start talking to website designers to see how creating a polished, strategically designed, and aligned website could support your growth.

2. How do you feel about tech?

The exception to the above is if the idea of all of the tech that comes along with websites sets you off in a panic. If you know you need a website but you also know that if you do it yourself you’ll leave it on your to-do list forever because you’re dreading working on it, then it could be more effective to invest in hiring a web designer to set it up for you.

Another great option could also be to find a well-designed template that you can take and tweak to your specifications and save yourself a lot of technical heartaches.

3. Do you have an eye for design?

While your website doesn’t need to be, and shouldn’t be, overdesigned, if you don’t feel comfortable picking out appropriate colors, fonts, and layouts that make sense for your business and represent you as an expert, then bringing in a professional designer could be a great idea.

A strong brand is key to creating a successful website, so starting with a brand template or semi-custom brand could be a great starting point to help you feel empowered to then tackle the layout and graphic design. If, on the other hand, website layouts leave you scratching your head, opting for a strategically designed website template could be a great way to empower you to create your website yourself.

4. Do you have a strategy for how your website needs to work to serve your business?

The whole point of your website is to bolster your marketing efforts, warm up leads, and make sales, but every business has slightly different needs, so how all of this needs to come together on your website will be unique to your business and your goals.

When DIYing your website, you’ll be either mapping out this strategy yourself or following a template. When working with a designer, they’ll help figure this out with you and offer their expert advice on how to best optimize your website for your goals.

Have an honest conversation with yourself (or someone else if you prefer) about which option makes the most sense for you and your business at this point.

5. What’s your budget?

The last key thing to consider when deciding if you want to DIY your website or hire a designer is what your budget looks like.

If money is tight and you need a quick return on your investment, a professionally designed website might not be the best investment for you. That’s because websites often take time to truly pay off with increased traffic, more leads, and better conversions so they are a longer-term investment.

However, if you have a runway of a few months and can afford to put in the money upfront to see the return down the line, that can be a great sign that it’s time to put some fuel on the fire and invest in a professionally designed website.

"Have an honest conversation with yourself about which option makes the most sense for you and your business."

—Michelle Pontvert, Branding and Website Designer

About the author: Michelle Pontvert is a branding and website designer supporting her fellow moms and mums on a mission to scale up their service-based businesses without burnout so they can spend more time with their families and doing what they love. Grab her free training on creating a website that converts on her website and say hi over on Instagram @michellepontvert.

Featured image: Color Joy Stock

Grow On: How to Double Your Revenue With Elyce Arons, Co-Founder and CEO of Frances Valentine

ABOUT THE EPISODE

Doubling your revenue is no easy task.

You need to set well-defined goals, create meaningful connections with your customers, and discover new distribution channels and marketing opportunities.

Which is something that Elyce Arons knows a thing or two about.

In the midst of a pandemic that has pummeled the fashion industry, the former Co-founder of Kate Spade has led the luxury lifestyle brand Frances Valentine to double (!) its revenue.

Needless to say, I can’t wait to chat with Elyce about how she’s grown the brand exponentially, including the old-school marketing strategy she tapped into to increase the brand’s sales by 40% (!).

EPISODE TOPICS

Her Second Act: Building Frances Valentine

Adapting to the New Online Retail Space

Why She Recommends a Mix of DTC, Wholesale & Retail

Why Pop-Ups Are the Best Way to Test New Markets

The Importance of Regional Retail Spaces

How She Doubled Her Revenue During the Pandemic

Where She Puts The Majority of Her Marketing Dollars

What She Pulls Inspiration From In The Design Process

Her Predictions on Major Fashion Industry Shifts

RESOURCES

To connect with Elyce Arons click HERE

To connect with Jaclyn Johnson click HERE

To learn more about Frances Valentine click HERE

To follow along with Create & Cultivate click HERE

To submit your questions call the WorkParty Hotline: 1-(833)-57-PARTY (577-2789)

LISTEN TO THE EPISODE

OTHER EPISODES YOU MIGHT LIKE . . .

THIS EPISODE IS BROUGHT TO YOU BY . . .

CDC Vaccine • Visit the CDC website CDC.gov for additional information you can trust about how COVID-19 vaccines can protect your entire family.

Shopify • Go to shopify.com/party for a FREE 14-day trial and get full access to Shopify’s entire suite of features.

This Tech Founder Has Raised Over $3.5 Million in Venture Capital—Here's Her Best Fundraising Advice

You asked for more content around business finances, so we’re delivering. Welcome to Money Matters where we give you an inside look at the pocketbooks of CEOs and entrepreneurs. In this series, you’ll learn what successful women in business spend on office spaces and employee salaries, how they knew it was time to hire someone to manage their finances, and their best advice for talking about money. For this installment, we caught up with Kim Kaplan, founder and CEO of the video dating app Snack. Here, she shares the ah-ha moment that inspired her to launch a new kind of dating app, the reason she believes women should talk about money and business more openly, and the best advice she has for female founders currently seeking funding.

You were one of the earliest employees at Plenty of Fish, a dating site that eventually sold to Match Group for $575 million in 2015. What was the lightbulb moment for Snack and what inspired you to launch your business and pursue this path?

I was scrolling through TikTok one day and saw a video of a woman pointing to her name, age, location, and zodiac sign. I had this ah-ha moment and realized that she was trying to use TikTok to date. However, the platform wasn't built for it (there's no location, way to know who's single, what their age is, etc.). The song that went with that video trend had over 130,000 videos created that were all dating-related, and the hashtag single had over 13 billion views at the time—that was when I knew there was a massive opportunity.

You recently raised a $3.5M seed round from investors like Kindred Ventures, Coelius Capital, Golden Ventures, Garage Capital, Panache Ventures, and N49P—no doubt you’ve learned a lot along the way. What are three crucial elements everyone should include in a pitch deck when raising money and why?

A lot of emphasis is placed on the pitch deck when it comes to raising capital, I actually think the process for raising capital is just as important (if not more so). These are the three pieces of advice I would give:

1) Spend the time upfront to prepare a list of funds and partners at those funds that you want to speak to. Find which connections you have in common and see who can give you a warm introduction.

2) Think about what you can learn from the process, whether it’s the advice you're hearing from investors on how you can better frame your pitch or what you should change in the next pitch to pre-empt some of the questions you’re getting.

3) This is more COVID-19 related, but find a place where you feel the most comfortable. One benefit of pitching over Zoom is that you’re not racing from one location or office to another. Instead, you get to pick where you pitch from. I chose to pitch from my couch, inviting investors into my den instead of going into theirs.

What advice can you share for entrepreneurs on partnering with the right investors? What do investors need to bring to the table other than just money?

There are numerous investment options out there, but the three primary routes for startups are venture capitalist firms, private equity, and angel investors. By understanding your needs, you can narrow down which type of investment would suit your company.

My personal experience at Snack has been with venture capitalist firms and angel investors. From that experience, my number one tip would be to do your reference checks and talk to founders of other companies they’ve invested in to understand what they’re like to work with and what their expectations are. This will help you ensure you’re aligned with their values.

Women-led startups received just 2.3% of VC funding in 2020. Why do you think there is still so much inequality in the venture capital world, and what advice can you share for women entrepreneurs who are currently seeking funding?

I think part of the issue is approaching investors with confidence and the ways in which women present themselves. I was told to act overconfident when I was pitching. It wasn’t so much that I wasn’t confident in myself or my idea, but I need to exude that confidence in a way that I think is a lot more natural for men.

Where do you think is the most important area for a business owner to focus their financial energy on and why?

Time is your biggest resource, so how do you make sure you're directing it to the right parts of the business? It’s important to hire (if possible) to fill the areas that need attention but are not your areas of expertise. For example, I immediately hired an accountant to help with bookkeeping as I knew it would take an exorbitant amount of time and someone could do it better and more efficiently than I could.

What are your largest expenses every month?

Salaries. We want to make sure we have great people around the table and as such it’s definitely the largest expense.

Legal fees. We’re still in the process of fundraising and completing the company setup (such as trademarks) so there are lots of legal fees.

Do you pay yourself, and if so, how did you know what to pay yourself?

This is a hard question to answer because every founder is in a different financial situation; there’s no one size fits all. What I can say is, if you can afford to pay yourself less, you’ll be able to scale faster.

Do you think women should talk about money and business more?

Yes!!! Men have more open conversations with other men about money; how much they make, what they are investing in, and about new opportunities. These types of conversations not only help people learn about their financial worth but also open up opportunities. Additionally, I believe these conversations boost a person’s confidence to jump into the unknown and take a risk. Take startup investing or crypto as an example, there are fewer women in these industries so there are fewer people to go to discuss shared experiences, ask questions or simply learn.

Not only do we need men to be transparent about their finances, but women need to be speaking openly with each other as well. The more we engage each other in financial and business conversations, the more confidence we will collectively gain. Quite simply, we all need to talk about money and business more openly.

What money mistakes have you made and learned from along the way?

Oftentimes at the start of a business, it makes sense to bring on a contractor when you don’t have enough work or capital for a full-time hire. I hired a contractor that simply wasn’t delivering as expected. Looking back, I should have checked in with them more often, set very clear deadlines for deliverables, and cut ties much sooner.

What is your best piece of financial advice for new entrepreneurs?

For founders that are seeking investment, I would remind them that people invest in you as much as your idea. Communicate your passion and confidence in your business and think about how to build a relationship with your potential investors. Investors provide value beyond finances; it’s important to find ones that you connect with.

Featured image: Courtesy of Kim Kaplan

4 Digital Strategies To Watch If You're a Small Business Looking for Big Growth

E-commerce has undergone a significant transformation in recent years, with the rise of more personalized, convenient, and engaging ways of shopping. eMarketer estimates that e-commerce sales will reach $6.39 trillion by 2024. However, the question remains: What's next for online retail innovation?

To get some answers, we turned to Karen Behnke, beauty industry veteran, expert in sustainability, and founder of Juice Beauty. In a recent interview on WorkParty, Behnke shared her insights on the future of e-commerce, and why she see’s it as one that's driven by personalized experiences and technology that enhances the customer journey.

Ahead, she highlights four emerging strategies that she believes will be game-changers for small businesses looking to drive growth.

1. Live shopping

Live shopping combines the power of video with the engagement of a live event to build deeper connections with customers and drive sales in competitive marketplaces. It's also a great way to build excitement while assessing interest and taking feedback in real time.

Recently Juice Beauty dipped its toe into live shopping by partnerning with Reach TV, the largest in-airport TV network, to launch a new shoppable video series titled Beauty on the Fly and featuring guests like Kate Hudson. "The early results look good," Behnke says. "It is driving traffic, and it's only been running for barely a month."

2. Artificial intelligence

AI-powered tools can help personalize the customer experience, automate repetitive tasks, and help business owners gain valuable insights into customer behavior. Juice Beauty recently upgraded to Shopify 2.0 to start working with new technologies like AI. "It was a big deal for us and our digital team,” says Behnke. “The capabilities for our customers are so much more rich.”

3. Video

Behkne also sees video as a tool that should be used across all channels to make content more engaging and informative. She believes video is the best way to showcase products and brand personality in ways that text or images can't do alone.

4. Digital partnerships

Juice Beauty launched 17 years ago as a retail-only brand focused on in-store activations. Today, its products are available on Amazon Luxury, Ulta.com, as well as Sephora.ca. And Behkne says brand partnerships like these with retail stores that have strong digital capabilities proved to be a smart way to expand reach and tap into new markets.

"Juice Beauty has been a [brick-and-mortar] retail brand from inception, so it was a little bit harder," says Behnke. "But, we're talking with our major retail partners about everything digital. Our team is doing a great job of moving more and more into the space."

Discover more small business technology solutions and digital beauty marketing tips by tuning into this week's episode of WorkParty.

RESOURCES

To connect with Karen Behnke click here

To follow along with Juice Beauty click here

To connect with Jaclyn Johnson click here

To follow along with Create & Cultivate click here

To submit your questions call the WorkParty Hotline: 1-(833)-57-PARTY (577-2789)

OTHER EPISODES YOU MAY LIKE . . .

Taking a Concept and Building a Brand with Dr. Roshini Raj, Founder of TULA SKincare

LLC vs. S Corp: Which Is Best for Small Business Owners?

Picking the right one is essential.

Photo by Marcos Paulo Prado on Unsplash

As a small business owner, you’ve probably heard the words LLC and S Corp floating around. And you probably need to decide which one to form. And while legal structures aren’t the most exhilarating topic, picking the right one is essential for your business.

Deciding if you should go LLC or S Corp starts with knowing the differences between the two and how each one will impact your business. Read on to learn everything you need to know about LLCs and S Corps.

LLC vs. S corp: The basics

As a small business owner, the two legal structures you’ve probably heard the most about are single-member LLCs and S Corps. Before we talk about the difference, we got to get one technical thing straight.

Technically, an S corp isn’t a legal entity but a tax election. It’s confusing but bear with us.

The IRS assigns every business structure a default tax treatment...which is just a fancy way of saying that the IRS decides how each business structure is taxed.

Single-member LLCs are automatically taxed like sole proprietors unless they ask otherwise. That’s where the S corp election comes in.

You can ask the IRS to tax your single-member LLC as an S corp, which means that the IRS won't tax you under the rules of a sole proprietorship; they’ll tax you under the rules of an S Corp (which we'll talk about later).

To keep things simple in this article, we will be referring to:

Single-member LLC as an LLC

Single-member LLC electing to be taxed as an S Corp as an S Corp

Taxes

The biggest difference between an LLC and an S Corp is how you’re taxed.

An LLC and S Corp are both pass-through entities. That means that all the profits from the business are passed on to the owner’s tax return. Unlike a C Corp, which has to pay corporate taxes, your business doesn’t pay any taxes. Instead, you, the owner, do.

How LLC taxes work

The IRS automatically taxes an LLC like a sole proprietorship. Under this tax treatment, you’ll pay two types of taxes:

Self-employment tax - 15.3% of 92.35% of your profit. Self-employment tax goes towards your Social Security and Medicare.

Income tax - Varies based on your tax bracket.

You probably know that self-employment tax is a killer, and it’s why taxes feel so much higher when you’re a small business owner than an employee.

When you’re an employee, your employer pays for half of this 15.3% through payroll taxes, and you pay the other half, which is deducted from your paycheck.

When you’re a small business owner, you pay for all of it yourself.

How S Corp taxes work

When it comes to S Corps, there’s one major tax difference: S Corp owners don’t pay self-employment tax on the business’s profits. They only pay income tax on the profits.

It sounds great, we know. But there’s a catch. S Corp owners are required to pay themselves a reasonable compensation via payroll. And your employee wages are subject to FICA payroll taxes.

FICA payroll tax is 15.3% of your employee wages. Yes, that’s the same amount as self-employment tax. But, the difference is that your business pays half of that (7.65%) through employer payroll taxes, and you pay the other half (7.65%), which is deducted from your paycheck.

You pay the equivalent of self-employment tax, but only on your employee earnings.

There are a few other things to know about S Corp taxation:

Your payroll taxes and the salary you pay yourself are a tax write-off, which lowers your taxable profits.

There’s no federal guideline for reasonable compensation, and we recommend chatting with a tax professional about how much to pay yourself (p.s. Collective can help with this!).

You’ll also have federal and state income tax withheld from your paycheck.

Your income tax will include your employee wages and the profits from your S Corp.

Tax savings: LLC vs. S corp

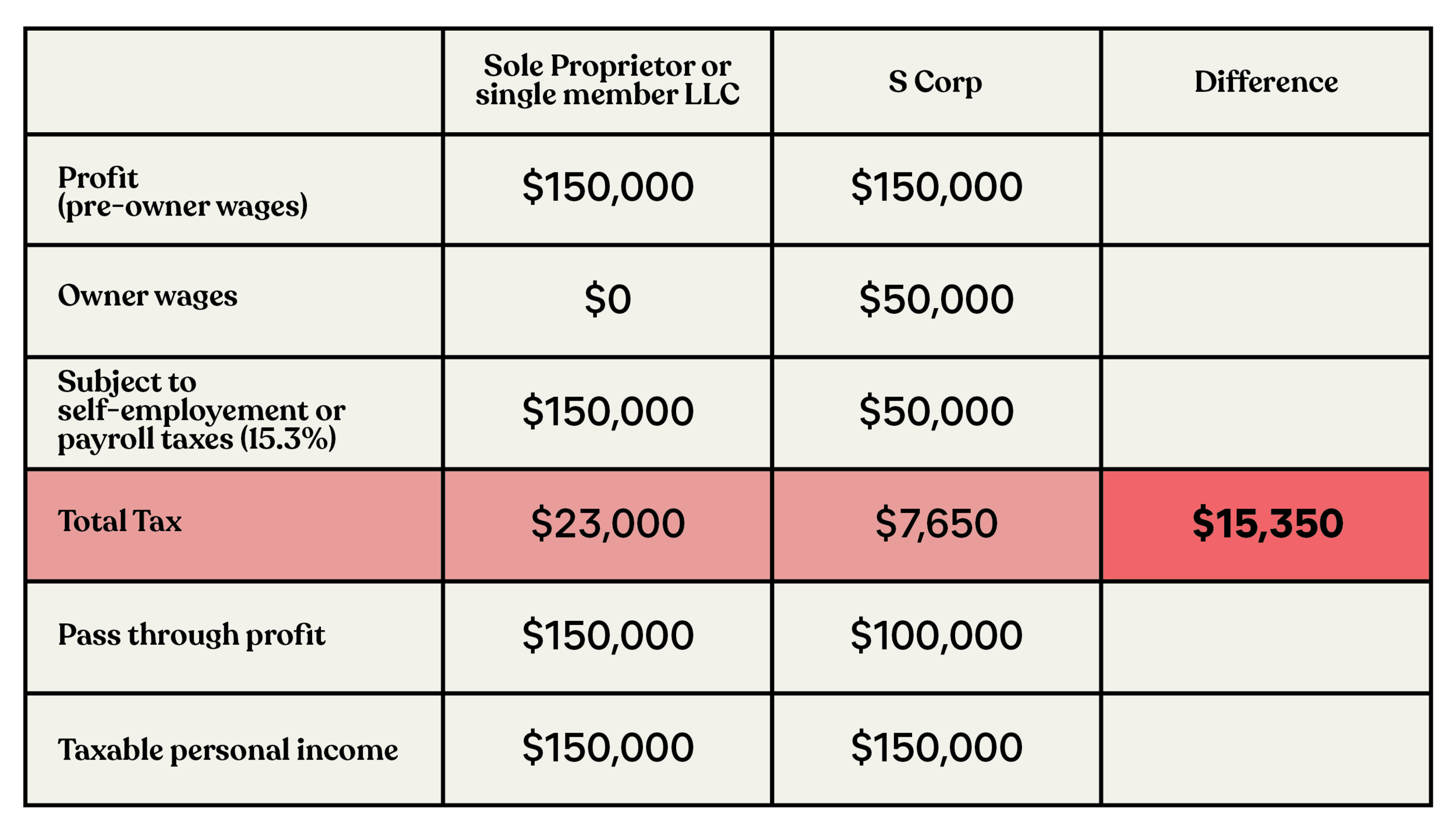

Let’s do an example to compare the taxes a small business owner would pay as an LLC and S Corp. We’re basing this example on a small business owner who earns $150,000 annually in profit and, who as an S Corp, pays themselves a $50,000 salary.

In this example, the business owner could save $15,350 by switching to an S Corp! Keep in mind that these tax numbers don’t include income taxes or state taxes, which will vary based on your tax situation.

If you want a personalized comparison of how much you could save with an S Corp, check out Collective’s tax savings calculator.

Additional costs

S Corps cost more money to run than an LLC. Here are some of the additional costs associated with an S Corp:

Payroll service fees

You 100% don’t want to do manual payroll yourself. Manual payroll involves many percentages, tax calculations, quarterly and annual forms, and ongoing payments to the IRS. If you calculate your payment wrong or miss a deadline, you’ll be subject to a penalty and pay interest on underpayments that you made.

Trust me. It’s way more work than you want to deal with. Instead, you can use a payroll service that runs payroll for you and takes care of all your tax payments and paperwork. Our favorite payroll service is Gusto, which is perfect for S Corp owners.

But like most magical things that do all the work for you, Gusto isn’t free. Gusto will cost you $45 a month to run payroll (unless you have a Collective membership, which includes a free subscription to Gusto).

Bookkeeping costs

The days of doing your bookkeeping via a shoebox full of receipts are over. As an S Corp, you’ll need to get serious about your bookkeeping and use a legit accounting program, like QuickBooks Online. The most basic QuickBooks Online subscription will cost $20 per month (Collective members also receive a free subscription to QuickBooks Online).

Tax preparation fees

When you’re an LLC, you report your business’s income and expenses on your personal tax return, and you only file one tax return.

As an S Corp, you’ll file your personal tax return plus a corporate return called the 1120-S, U.S. Income Tax Return for an S Corporation. Filing this extra return will set you back several hundred dollars.

Annual state registration fees

Depending on where you live, you might have to pay a yearly registration fee for your LLC and S Corp. Fees range from $20- $800 per year.

Cash Flow

S Corps require steady cash flow.

Cash flow is the money that comes in and goes out of your business in a given period. While cash flow includes your income and expenses, it also includes transferring money to your personal account, debt payments, and savings.

Sometimes, businesses are profitable but don’t have enough cash flow to sustain their operations because too much money is going out to cover debt, taxes, or owner pay.

With an S Corp, every time you run payroll, you pay a portion of your taxes in real-time, both as the employer and employee. This means you need to have the money available for your salary and payroll taxes every month.

Liability protection

The good news is when it comes to liability protection S Corps and LLCs offer the same level of limited liability protection to their owners. That’s because an S Corp is an LLC taxed under the rules of an S Corp.

Limited liability means that if your business is sued or can’t pay its debt, creditors and claimants can’t go after your personal assets, like your house or car. While there are some exceptions to this rule, generally, this is the case.

Which one is best for you?

The truth is, the less you earn, the less beneficial an S Corp will be for your taxes. Even if you have some tax savings, the additional costs might eat up all your tax savings. Then you just have more work to do with no payoff.

Our general rule of thumb is that you will benefit from an S Corp if:

You’re earning more than $80,000 in profit each year

You can pay for the additional costs of running an S Corp

You have the cash flow to make regular payroll runs

Now that you have all the deets about LLCs and S Corps, you can make an intentional decision about which entity to form. Still not sure if an S Corp is right for you? Check out Collective’s tax savings calculator and see how much you could save with an S Corp.

C&C readers can enjoy 2 months of a Collective Membership at 50% off with this exclusive sign-up link.

About the Author: Andi Smiles is head of content at Collective. She started her career as a small business financial consultant, teaching businesses-of-one to take control of their finances to build more authentic and sustainable businesses. She’s helped thousands of self-employed folx organize and understand their business finances while also uncovering their emotional relationship with money.

MORE ON THE BLOG

How to Perfect Your Pitch and Attract Investors with Venture Capitalist Visionary Arlan Hamilton

The best storyteller wins.

Photo by RF._.studio from Pexels

In 2020, venture capital funding boomed—but women’s share shrank. Startups, overall, raised 13% more from venture capitalists in 2020 than in 2019, but female-founded companies raised a staggering $190M less in 2020 than in 2019.

As the founder and managing partner of Backstage Capital, Arlan Hamilton aims to turn these discouraging stats around. Her mission is to minimize venture capital funding disparities by investing in minority founders.

Since she founded the firm in 2015, Backstage Capital has raised more than $15 million (!) and invested in more than 180 startup companies.